Mutual Funds 101 Investing for Dummies

Post on: 12 Июнь, 2015 No Comment

Easy Investing Basics for Dummies

Mutual funds for dummies is the smartest way to invest. Getty Images

Investing for dummies can’t get any smarter than investing with mutual funds. We’ll begin with a simple definition. then move on to the basics. Within a few minutes, you’ll be ready to begin building a portfolio of mutual funds.

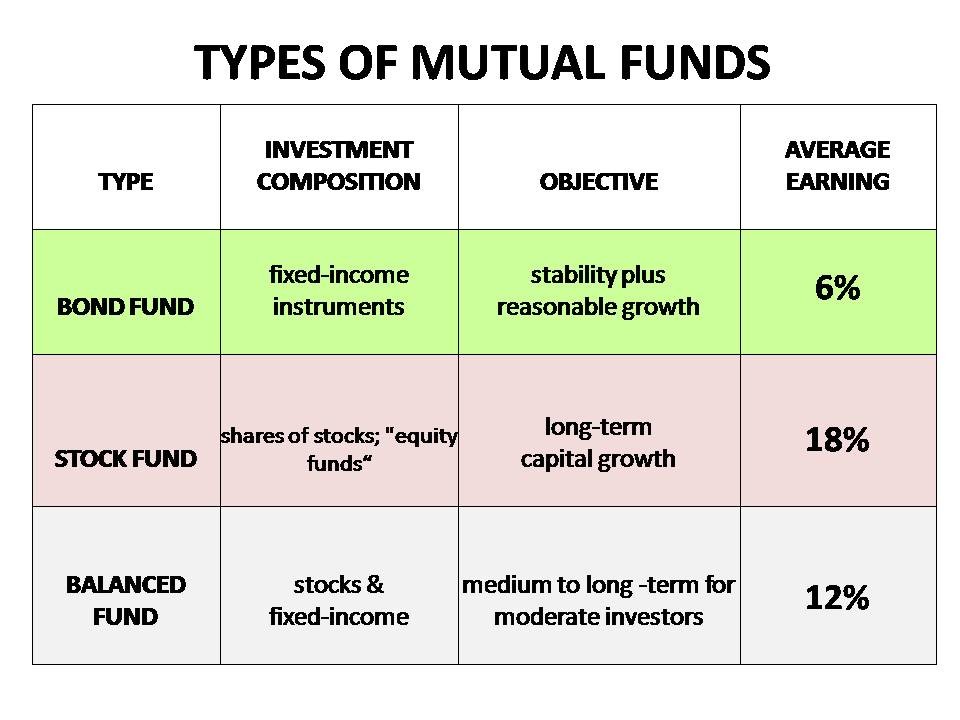

You are already aware that mutual funds are a type of investment or savings vehicle. But what are they? Are they like stocks or bonds? How do mutual funds work? A good way to understand mutual funds is to consider them a basket of investments. The reason is that one mutual fund often invests in dozens or hundreds of other investment securities, called holdings, such as stocks or bonds. Therefore, when you buy a mutual fund, you are not buying a particular stock or bond; you are buying a basket of stocks or bonds (or sometimes a combination of both).

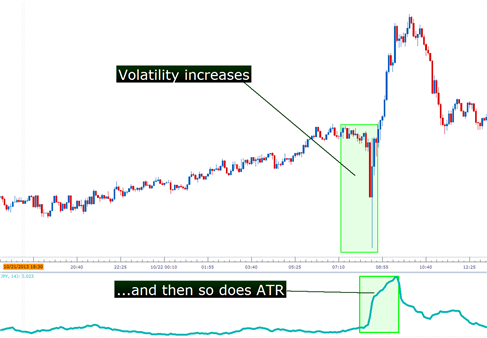

Stocks, bonds, and mutual funds all involve some level of market risk, the possibility of fluctuation in value or even the loss of principal. For example, you could invest $1,000 for 10 years and end up with $950. Although receiving a negative return like this over a 10-year period is extremely rare, it is possible. It is more reasonable to expect an average of return of somewhere between 7% and 10% for stock investments, including stock mutual funds, for periods of 10 years or more. However, there are short periods, such as 1 year, where your stock mutual fund can decline in value by as much as 30 of 40%. Similarly, you could have gains of more than 50% in one year.

Therefore, you need to have some reasonable expectations about how the stock market behaves but, more importantly, how you will react in the brief but inevitable extremes. Will you sell your mutual funds if they lose 10% in 3 months? You can get an idea of your risk tolerance, and thus the types of funds and the mix of those funds that is best for you, with tools such as the Vanguard Investor Questionnaire or Kiplinger’s Risk Tolerance Tool .

You may have heard the wise saying, Don’t put all of your eggs in one basket. This is good advice about something called diversification but investing does require money and beginners don’t always have enough money to cover the initial investment minimum (often $1,000 or higher) for more than one fund.

Fortunately, and as you already know from reading this article, mutual funds are like baskets that hold dozens or hundreds of other investment types and you need to find a fund or group of funds that is appropriate for your goals and risk tolerance. However you can find mutual funds that meet all of this criteria in just one fund; they are diversified portfolios in themselves. Examples include balanced funds and target-date funds. both of which can invest in a wide range of stocks and bonds. For this reason, these fund types can be best for beginners.

As a do-it-yourselfer, you may have already heard of Vanguard Investments. which is a mutual fund company best known for its index funds .

An index is not an investment but is better described as a statistical sampling or benchmark. For example, the S&P 500 Index is a sampling of approximately 500 large capitalization stocks of US companies. Many investors and portfolio managers compare the performance of their own investment portfolios against an index, with the hopes of outperforming it. However, an index mutual fund can be used to invest in an index. This is a kind of if you can’t beat ‘em, join ‘em philosophy because you can capture the returns of the overall market at a low cost, although you give up the chances of beating the market, which is not a good idea for most investors anyway.

You may also begin building your portfolio with one of the best S&P 500 Index funds or a total stock market index fund. However, when you decide to add more funds you can choose among dozens of different kinds of index funds that track other indexes such as the Russell 2000 (small-cap stocks ), the Barclays Aggregate Bond Index (bonds) or one of the MSCI Indices (foreign stocks ).

Before buying your first mutual fund. you may want to do some honest reflection and determine if an investment advisor is wise choice for you. Investing with mutual funds can be easy and you can find investing success after doing just a little homework. However, investing is not for everyone. If you don’t want to take time to research mutual funds or, equal and opposite, if you think you’ll spend too much time analyzing and worrying about the fluctuation of your account value, an advisor may be the best choice for you.

This is another reflective activity and personal choice. Chances are, if you are attracted to the simplicity and power of mutual funds, you may not be a market timer or interested in technical analysis but perhaps an investor who would grow into a tactical asset allocation style, which combines simple strategies with some of the prudent qualities of the buy and hold strategy .

Believe it or not, you already know enough to get started with mutual funds. However, it will help to gain a bit of foresight because you are the planning type. In different words, you can learn about more about building a portfolio so you’ll see more of the big picture before doing more building: Begin with the end in mind!

When you continue building your portfolio of mutual funds, you’ll want to learn more about the various categories of mutual funds. some of the basics about asset allocation. and how to understand the costs of owning a mutual fund by looking at its expense ratio .

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.