Mutual Fund Turnover Ratio What You Need to Know to Pick a Fund

Post on: 7 Июнь, 2015 No Comment

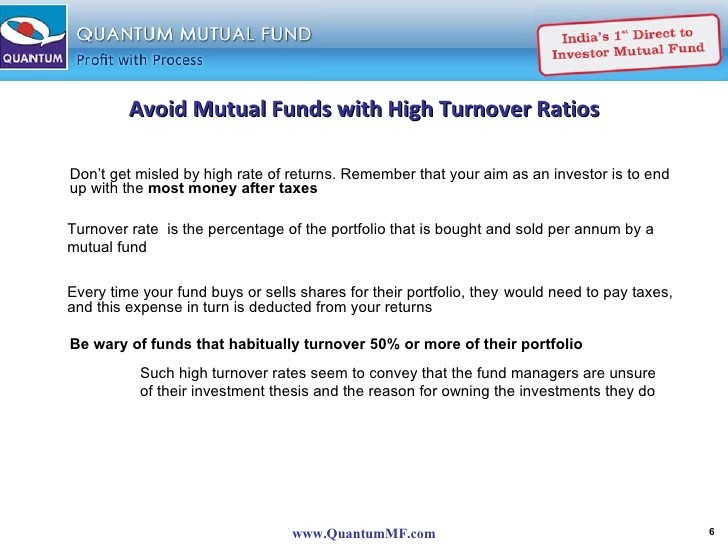

Another investing term that you need to get used to and understand (yes there are tons of them): Mutual fund turnover ratio. The turnover ratio is how often the fund is buying and selling stocks. It is a percentage of the assets that change over a specified time period, typically a year.

I like to use this as one of my criterion for selecting a mutual fund because it shows you if the managers are buying and holding stocks or if they are doing a more active trading strategy. If you compare this to their objective you will know if they are sticking to the funds goals.

Following is how the mutual fund turnover ratio is calculated, how the turnover ratio impacts your investment and how to find the right ratio for you.

How Mutual Fund Turnover Ratio is Calculated

The mutual fund turnover ratio is calculated by taking either the total of the new securities purchased or the amount of securities that are sold (whichever is less) and then dividing that by the average monthly assets. This will give you the percentage of the assets that change each year.

What this tells you is that a turnover ratio of 25% means that on average stocks are held for about four years. A turnover ratio of more than 100% means the fund manager is holding stocks for less than a year. The higher the number the more trading activity is happening in the fund.

Why High Mutual Fund Turnover Ratio is Bad

Fees

When you have high turnover you are increasing your costs due to higher commissions. Every time your fund manager sells or buys a stock there is a cost associated with that transaction. Those funds that have a lower turnover ratio will have lower transaction costs. This cost is not included in your annual operating expense, so it does increase your costs overall.

Tax Implications

When a mutual fund sells its holdings it creates either a profit or a loss. These profits are passed along to you the fund owner and you pay taxes on the gain. If your mutual fund is in a tax protected account, such as a 401K, then you have no worries. However if you own the fund in a taxable account you will pay taxes on these gains at the end of the year (even if you have not sold any of your shares). This decreases your earnings, so if you are buying in a taxable account, check on the possible tax issues before you buy.

Moving the Market

This one is hard to track the exact impact on your portfolio, but if the fund has enough assets and they are liquidating a big enough position then it can move the market lower. Thus you get less for the shares that are sold. Likewise if the fund buys a big enough position the price may go up, causing the fund to pay more per share.

Flaws in Mutual Fund Turnover Ratio

Unfortunately it is not as easy as looking at the ratio to know if the fund is good or bad. There are many other components that go into picking out funds. Plus there are two situations where the turnover ratio might not be accurate. They are:

- If the fund has taken on more money and the rate of trading has not changed the ratio will automatically decrease because the assets are higher.

- Likewise if the fund has a decrease in assets then the ratio will go higher because there are fewer assets.

How to Decide Your Right Turnover

Deciding what turnover ratio works for you is all personal preference. If you believe that the market can be timed and that the gains will offset your costs, then you may prefer a more active manager. (Read this market timing article first if that is your belief!) If you believe in buy and hold then you will want a low number. As a broad guideline 20 – 30 % is a buy and hold strategy.

Personally most of my funds have turnover ratios around 25% for actively managed and around 3% for index funds. I believe in the buy and hold strategy, plus I know that fees can kill your performance faster than just about anything!

Where to Find the Turnover Ratio

The best place to locate the ratio is on Morningstar. Simply go to Morningstar.com. type in your fund that you are looking at in the quote box. This will pull up the quote overview, on the right hand side you will find turnover.

Example of Morningstar Overview Page

While the mutual fund turnover ratio tells us a lot about how the managers prefer to invest, it does not tell us the entire story. Remember to look at many different statistics before picking out the right mutual fund for you.

- Shawn James April 4, 2013, 1:27 am