Mutual fund investing How to use Morningstar s new mutual fund ratings

Post on: 12 Апрель, 2015 No Comment

Morningstar Overhauls Mutual Fund Ratings

Mutual fund investing: New ratings help you research and analyze mutual funds

Morningstar, the Chicago mutual fund rating service, has just overhauled its fund rating system. That’s big news because it’s by far the most significant change since Morningstar began rating funds back in 1985.

Morningstar rates funds by awarding one to five stars, where five is best, Those ratings are available free on its site at www.morningstar.com.

Morningstar mathematically computes its star ratings by comparing each fund’s historical returns to its measure of risk based on historical volatility. Funds showing the highest return to risk ratios get five stars, and those with the lowest ratios get one star. The ratings are based entirely on historical performance, and do not necessarily reflect a Morningstar analyst’s view of a fund’s future potential.

Morningstar’s ratings are widely followed, and everything was copasetic until recent events exposed problems with its methodology. Until now, Morningstar calculated its ratings for U.S. stock funds by comparing each fund’s performance to all other domestic stock funds.

Mutual Fund Rating Problems

In the late ‘90s, growth stocks, primarily techs, surged while value-priced issues floundered. Thus tech funds and others with big tech holdings outperformed the market and dominated Morningstar’s ratings. Even mediocre tech funds collected high ratings. Conversely, value funds were lucky to garner even three stars.

Exacerbating the problem, Morningstar’s risk measure only took negative historical returns into account. Volatile funds that doubled or tripled in a short time were judged no more risky than funds that moved up only five or ten percent annually.

Although most investors know in their heart of hearts that hot sectors eventually cool, it’s still tempting to chase after the funds with the best recent performance. Morningstar made matters worse by giving low ratings to good funds in then out-of-favor sectors.

New Approach

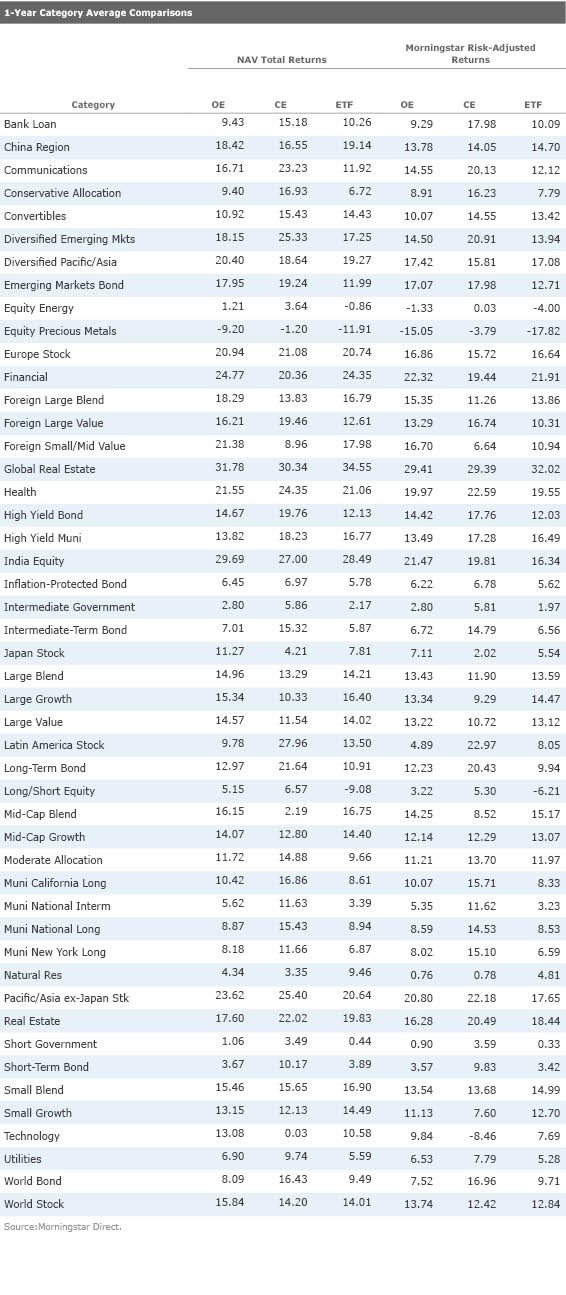

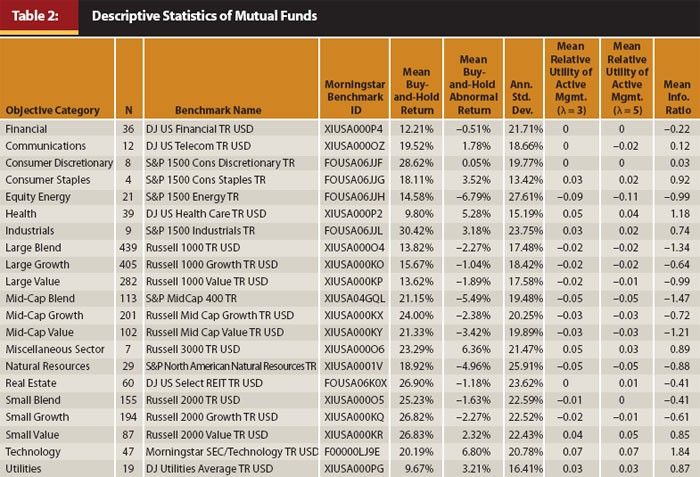

Morningstar’s new system addresses these problems. It segregates funds into 48 categories, such as large growth, small value, specialty financial, and the like, depending on their holdings. It compares each fund only to other funds in the same category, rather than to the entire market.

Morningstar also overhauled its risk calculation. In addition to underperforming funds, it now classifies funds with excess volatility on the upside as risky.

As before, Morningstar computes a score for each fund by comparing its returns, after adjusting for loads and other sales charges, to its risk rating. However now, the top 10 percent of funds in each category, based on the return to risk ratio, receive five-stars, and the lowest 10 percent receive one star.

Because funds are only compared within their categories, a two-star-rated fund in a hot category may in fact, be outperforming a five-star-rated fund in a down and out category. For instance, the Icon Information Technology fund, although down 26 percent over the past twelve months, rates five stars, while the Heartland Value Plus fund although up 15 percent in the same period, garners only two stars. That’s because, in general, value funds are currently outperforming tech funds.

Under the new system funds are not automatically rated high just because they’re in a hot sector. Even better, you can use the ratings to pick the best mutual funds in currently weak sectors that that you think will outperform when the market recovers.

Locating Promising Mutual Funds

You can use Morningstar’s Fund Selector (select Fund Selector from MStar’s Funds page) to pinpoint promising funds in a specific sector, or in all sectors. When I checked, Morningstar rated 200 funds at five stars. You can see the entire list by selecting five stars only in the Ratings and Risk section of the screener. I honed that list down to only 25 funds by adding the following criteria:

I’m most interested in funds investing in U.S. stocks, so I specified “domestic stock” in the fund group category to preclude bond and foreign funds.

Since Morningstar’s ratings are based on historical performance, they’re useless if fund management changes, so I required a manager tenure of at least three years to rule out that possibility.

A fund’s load is intended as a sales commission paid to the recommending broker or financial advisor. There’s no point in paying it if you’re finding your own funds, so I specified no-load funds only.

I also specified a minimum initial purchase requirement of no more than $2,000, and a maximum two percent expense ratio to avoid unaffordable or spendthrift funds.

Morningstar’s risk rating is essentially a volatility measure. I’ve had the best results selecting low volatility funds so I screened for funds with below average or better (lower) risk ratings.

Since we’re experiencing a weak market, most of the 25 funds on my list were down year-to-date, but eight showed positive returns over the past 12 months. All but three were up over the past three years, compared to a 10 percent loss for the market as measured by the S&P 500 index over the same period.

Keep in mind that Morningstar’s ratings are based on past performance, and as the saying goes, that is “no guarantee of future returns.” You still have to do your due diligence. There’s no room to cover that here, but Morningstar offers tutorials about evaluating funds in its University section accessed from its Funds page.

published July 14, 2002