Mutual Fund Investing Best Funds And 2015 Strategies

Post on: 15 Май, 2015 No Comment

A small-cap fund with hefty weightings in cash and industrials, a large-cap fund using a variety of stock screens and a Vanguard fund with big bets on health care were among the leaders of 2014’s top performing U.S. diversified stock mutual funds with at least $100 million in assets.

Tops was $110 million Meridian Small Cap Growth, up 20.28%, with an 18% weighting in cash and 32% in industrials as of Sept. 30, according to Morningstar Inc.

Second was $861 million Glenmede Large Cap Growth. up 20.01%, with a mix of fundamental and quantitative stock-seeking screens. Third was $7.3 billion Vanguard Primecap Core Fund. which advanced 19.29%. Its largest sector was health care, with a 31% weighting as of Sept. 30.

The stock market delivered a decent return of 13.69%, but that was well below 2013’s 32.39%.

U.S. diversified stock funds averaged a 2014 gain of 7.56%, modest in comparison’s to 2013’s 32.95%, according to Lipper Inc.

Large-cap core funds led the 2014 style-and-market-capitalization parade with an 11.30% gain.

Investors wanted not only the stability of size but also dividends. S&P 500 funds hammered out a 13.06% total return. Equity income funds delivered a 9.73% return.

Health/biotechnology and real estate funds led sectors, gaining 27.66% and 27.63% respectively.

General commodities were the worst laggards among major groups. Their 16.45% loss reflected the impact of economic slowdowns in Europe and China.

World equity funds lost 2.27% overall. India region funds skyrocketed 40.89%, while Latin American funds gave back 13.38%.

The market had to overcome several hurdles in 2014. Last winter’s unusually cold weather put consumer spending in the deep freeze in the first quarter.

In July, the market pulled back amid better-than-expected U.S. economic news, which fueled investors’ fears that the Federal Reserve would begin to raise interest rates sooner than expected.

Steady GDP Growth

By Q4, signs of steady U.S. GDP growth were key drivers of the bull market, which was nearing its sixth year. Most U.S. stocks also got a lift from falling energy prices. Oil fell below $60 a barrel in December. Investors were also drawn to U.S. equities by a strengthening U.S. dollar, the end of the Fed’s easy money policy and the prospect of rising rates. At the same time, investors were fleeing economic slowdowns in Europe, China and commodity-focused emerging markets.

Now investors preparing their financial action plans for 2015 want to know, What’s next?

2015 is likely to see a different market, said Russ Koesterich, BlackRock’s global chief investment strategist.

That’s because volatility is likely to increase as the start of the Fed’s rates hikes approaches.

Defensive step No. 1 recommended by Koesterich is to diversify by holding foreign stocks. He likes Japanese stocks, whose valuations have been beaten down. Japan’s central bank is aggressively promoting easy money. Key pension funds are buying their domestic stocks.

And corporate governance improvements are leading to rising profits, he said.

In U.S. stocks, Koesterich likes cyclicals as long as the economy continues its slow growth. He especially likes financials and large integrated oil companies.

Both benefit from a relatively strong U.S. economy. Both pay dividends but are better priced than utilities and REITs, which investors crowded into for yield in 2014.

Unlike often small-cap oil exploration and production companies, large integrateds have downstream operations like refineries, which make money even when the price of crude is low.

He also likes some tech areas. Avoid speculative parts of the market that have benefited from momentum, like social media, where valuations are stretched, he said.

In fixed income, he likes tax-exempts. They’re reasonably priced, especially longer-dated ones, he said. And many 20- and 30-year munis have higher absolute yields than comparably dated Treasuries, even before you factor in their tax advantage.

Plus, muni credit quality has improved amid rising tax revenues and budget cuts.

Koesterich also likes dollar-denominated emerging markets debt, especially from countries that are not big exporters of commodities. Debt issued in dollars protects an investor from a rising dollar.

And he likes unconstrained bonds and funds. They’re actively managed and have the flexibility to seek niches that are doing well and are not overly expensive.

Running Out Of Room?

Charles Shriver, who manages several T. Rowe Price funds, including $4.2 billion T. Rowe Price Balanced Fund. is concerned that U.S. equities are running out of room after a long run-up and earnings growth pressured by slow GDP growth.

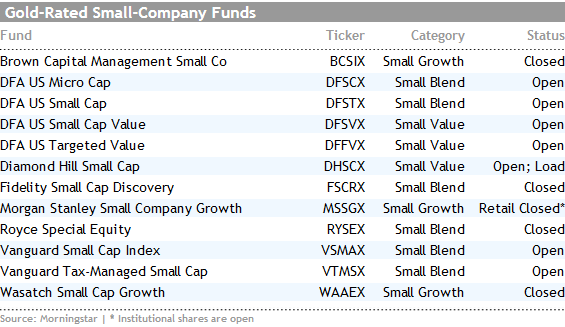

And small caps are generally too costly even after their underperformance in 2014.

He has a modest overweight in foreign stocks, where he favors markets producing goods and services — India, Mexico, South Korea, even China — over commodity producers.

Jurrien Timmer, Fidelity Investments’ director of global macro, says that his advice hinges on the economy staying in its Goldilocks mode — growth that is neither too fast nor too slow.

If the economy speeds up, the Fed will raise rates more aggressively, hastening the end of the bull market, he says.

In equities, he calls the U.S. the best house on a bad street.

With both Japan and Europe, the rising dollar threatens to offset securities’ price gains. Emerging markets are the most interesting segment outside the U.S., he added.

Still, it will be important to avoid markets hurt by the slowdown in demand from China. And it will be important to avoid markets whose earnings depend on commodity exports. So he’s bearish on markets such as Brazil and Russia.

He prefers Mexico and Indonesia. Mexico is a big trading partner of the U.S., Timmer said. It benefits as the U.S. economy grows.

Indonesia is powered by a rising middle class. Domestic consumption as a percent of GDP is 65%, twice as strong as China’s, he says. India is another success story, he said.

In bonds, with foreign sovereign yields generally lower than the U.S. he sees little reason to buy.

In the U.S. high-yield corporates and bank-loan bonds remain pretty viable choices, he added. High yield’s Q4 sell-off has boosted its yield spread over comparable-length Treasuries.