Mutual Fund Choices Open End ClosedEnd or ETF

Post on: 10 Апрель, 2015 No Comment

OK, youve heard about why you need a Mutual Fund and about all the benefits: Professional management, diversification, low minimum investment, convenience, fair pricing, etc. But what about all the different types of mutual funds?

Mutual Funds The Open-Ended Variety

When people hear the term mutual funds, the topic is most often open-ended mutual funds. They are called open-ended because there is not a limit to the number of shares issued and sold. When new money comes in, new shares are issued. Shares are not traded on a stock exchange, but are issued and redeemed directly by the mutual fund company.

There are three main types of open-end mutual funds: No-load, low-load, and loaded funds. No-load funds charge no sales fee when you purchase shares. Low-load funds charge a fee, typically under 3%, when shares are purchased. Loaded funds charge a sales fee, typically in the 4% to 6% range, most of which goes to the stockbroker who sold the fund.

Many of this type of mutual fund have very low entry requirements (as low as $50 per month) and offer convenient ways to invest like direct draft of your bank account. Of course, there are positives and negatives, as with any type of investment.

One of the key pitfalls with open-ended mutual funds are the hidden costs and fees. For example, the turnover cost (the amount of times the managers buy and sell stocks or bonds in the portfolio) can often far exceed the management feesand the turnover cost does not have to be reported! Also, when the managers change the whole approach of the fund may change. So the fund you thought you were buying may take a completely different direction with the new manager.

There are thousands upon thousands of open-end funds, in all types of asset classes.

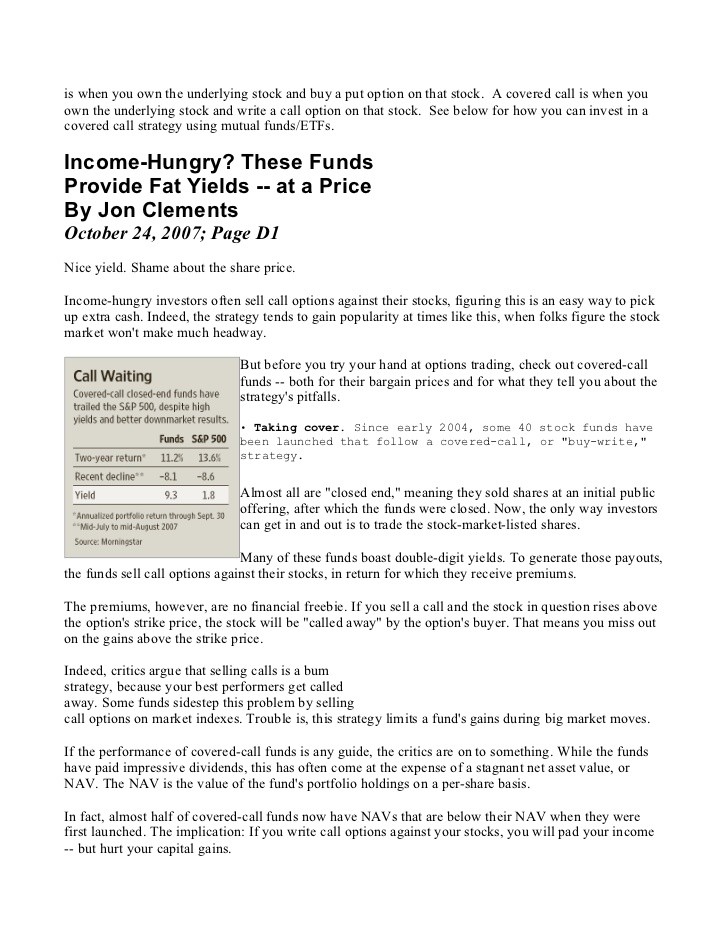

Mutual Funds The Closed-End Variety

Closed-end funds differ from open-end mutual funds in that there are not an unlimited number of shares issued and sold. A certain number of shares are issued and sold and after the initial offering, there are no more shares issued.

Unlike open-end mutual funds, the shares are not issued or redeemed directly by the mutual fund company. After the initial offering and sale of shares, the original shares trade in the secondary market. Because of this, Closed-end funds trade just like stocks. You can buy or sell closed-end funds any time during the trading day, without having to wait until the end of the day to find out the price of the transaction. Also, the shares may trade at a premium or a discount to the underlying net asset value.

Exchange Traded Funds

Exchange traded funds came into existence in the United States in January 1993 with the introduction of Spiders. This nickname was based on the initials of the name of the ETF: Standard & Poors Depository Receipts, or SPDR. Initially, ETFs were designed to track indexes, but By September of 2010, there were 916 different ETFs available, again in all different types of asset classes.

At first glance ETFs seem a lot like a closed-end fund: they trade like stocks all during the trading day, and they can trade at a premium or a discount to the actual net asset value. However, there are a number of differences.

One major difference is that new shares may be created and issued, but only in large blocks called creation units which may consist of tens of thousands of shares. This puts creating new shares out of the reach of the average investor, who must buy and sell shares in the secondary market (just like closed-end mutual funds). So, in fact, many ETFs are actually structured like open-end mutual funds, but to the average investor they will have the same characteristics as closed-end funds.

Which type is best? Only you can decide which mutual fund fits your situation best.