Moving Average How to Use it as a Simple Trailing Stop

Post on: 16 Март, 2015 No Comment

USING A MOVING AVERAGE AS A TRAILING STOP

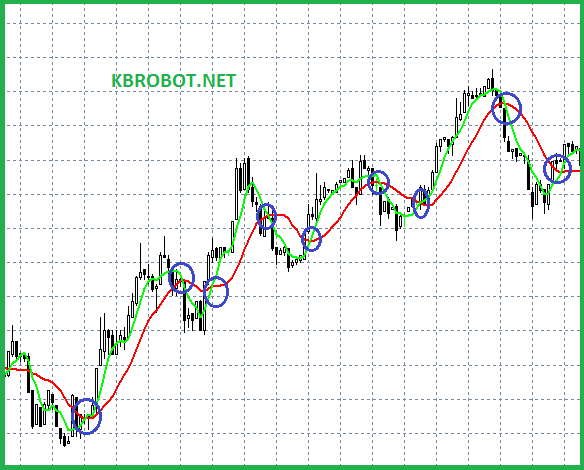

One of the simplest ways to set up a trailing stop is to use a Moving Average(MA). Once price has moved sufficiently beyond the initial stop loss and the MA is above the stop, you can then start using it as your trailing stop.

One suggestion on how to use it, is to continually adjust your sell stop just a bit below it as each price bar is created. This method has the advantage of taking you out of a trade with a profit, if price moves quickly below the average before the bar closes.

However, this method has the disadvantage of stopping you out sometimes too soon. Price will sometimes just barely dip below the line, stop you out, and then unfortunately move in your desired direction once again.

One way to help from getting stopped out too soon, is to require the bar to close below the moving average. That means to wait until the bar’s period is complete (10 min. bars in the example below).

Of course, like everything else in trading, this has its advantages and disadvantages too.

This method will sometimes keep you in the trade longer, but occasionally price will move quickly below the average before the bar closes, taking away a good portion of the profit you had in the trade.

Both of these methods, by the way, can be automated by using programs such as NinjaTrader or TradeStation.

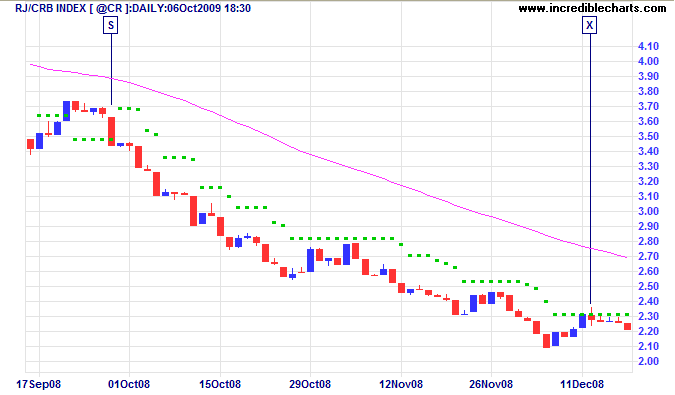

The following chart illustrates the use of a 10 period simple moving average (SMA) as a trailing stop.

Notice how it allowed the trade room to run until the afternoon when the bar closed below it.

Here’s another example using the exact same 10 period SMA. Price actually moved below the MA, but did not close below it, thereby not causing an exit, if a close below the MA was required. This method allowed the trade to move higher, before getting stopped out an hour and a half later.

In this example trade below, I wanted to show you how sometimes a particular trailing stop method will work and other times it will fail compared to other methods.

This chart once again has the same 10 period SMA. This time it exits the trade for a loss. Another type of trailing stop, a volatility stop, lets the trade run very nicely until the very end of the day. Does this mean dump the SMA and stick with the volatility stop? Of course not, the volatility stop is going to work great on some trades like this one, and it’s going to work horribly on others, just like any other method.

WHAT ARE THE BEST MOVING AVERAGES TO USE?

There is no magic behind any particular type of MA, nor is there any special number to use as the period. A simple moving average will work just as well over many trades as an exponential moving average. Same goes for a weighted moving average or any other type for that matter.

Each will excel at different times. You won’t know until it’s too late which one you should’ve used. so don’t over analyze them. It’s a waste of time.

Below you’re going to see the exact same chart with the exact same indicators, except this time I changed the SMA period to 15, instead of 10. It kept the trade going until the end of the day and into nice profits, just like the volatility stop. Does that mean you should use a 15 SMA instead of a 10 SMA. NO! Again, just as before with different trailing stop methods, different periods for the averages will have their day in the sun on different days and different trades.

You do want to use some common sense, however, when choosing periods for your moving averages. As I’ve mentioned before, you only have hours to make money day trading stocks, not days.

Choose periods that make sense for the kind of trades that you are doing. For the type of day trades that I’m writing about here, a 50 period MA just wouldn’t make sense. It wouldn’t allow you to capture enough of the profits that some trades will offer. And, like in the example below, can cause you to not only give up lots of gains, but also lose money on a potentially good trade.