Motives for Acquisitions

Post on: 1 Июль, 2015 No Comment

Acquire undervalued firms

Firms that are undervalued by financial markets can be targeted for acquisition by those who recognize this mispricing. The acquirer can then gain the difference between the value and the purchase price as surplus. For this strategy to work, however, three basic components need to come together.

1. A capacity to find firms that trade at less than their true value. This capacity would require either access to better information than is available to other investors in the market, or better analytical tools than those used by other market participants.

2. Access to the funds that will be needed to complete the acquisition. Knowing a firm is undervalued does not necessarily imply having capital easily available to carry out the acquisition. Access to capital depends upon the size of the acquirer � large firms will have more access to capital markets and internal funds than smaller firms or individuals � and upon the acquirer�s track record � a history of success at identifying and acquiring under valued firms will make subsequent acquisitions easier.

3. Skill in execution. If the acquirer, in the process of the acquisition, drives the stock price up to and beyond the estimated value, there will be no value gain from the acquisition. To illustrate, assume that the estimated value for a firm is $100 million and that the current market price is $75 million. In acquiring this firm, the acquirer will have to pay a premium. If that premium exceeds 33% of the market price, the price exceeds the estimated value, and the acquisition will not create any value for the acquirer.

While the strategy of buying under valued firms has a great deal of intuitive appeal, it is daunting, especially when acquiring publicly traded firms in reasonably efficient markets, where the premiums paid on market prices can very quickly eliminate the valuation surplus. The odds are better in less efficient markets or when acquiring private businesses.

Diversify to reduce risk

We made a strong argument in Chapter 6 that diversification reduces an investor�s exposure to firm-specific risk. In fact, the risk and return models that we have used in this book have been built on the presumption that the firm-specific risk will be diversified away and hence will not be rewarded. By buying firms in other businesses and diversifying, acquiring firms� managers believe, they can reduce earnings volatility and risk and increase potential value.

Although diversification has benefits, it is an open question whether it can be accomplished more efficiently by investors diversifying across traded stocks, or by firms diversifying by acquiring other firms. If we compare the transactions costs associated with investor diversification with the costs and the premiums paid by firms doing the same, investors in most publicly traded firms can diversify far more cheaply than firms can.

There are two exceptions to this view. The first is in the case of a private firm, where the owner may have all or most of his or her wealth invested in the firm. Here, the argument for diversification becomes stronger, since the owner alone is exposed to all risk. This risk exposure may explain why many family-owned businesses in Asia, for instance, diversified into multiple businesses and became conglomerates. The second, albeit weaker case, is the closely held firm, whose incumbent managers may have the bulk of their wealth invested in the firm. By diversifying through acquisitions, they reduce their exposure to total risk, though other investors (who presumably are more diversified) may not share their enthusiasm.

Create Operating or Financial Synergy

The third reason to explain the significant premiums paid in most acquisitions is synergy. Synergy is the potential additional value from combining two firms. It is probably the most widely used and misused rationale for mergers and acquisitions.

Sources of Operating Synergy

Operating synergies are those synergies that allow firms to increase their operating income, increase growth or both. We would categorize operating synergies into four types.

1. Economies of scale that may arise from the merger, allowing the combined firm to become more cost-efficient and profitable.

2. Greater pricing power from reduced competition and higher market share, which should result in higher margins and operating income.

3. Combination of different functional strengths. as would be the case when a firm with strong marketing skills acquires a firm with a good product line.

4. Higher growth in new or existing markets. arising from the combination of the two firms. This would be case when a US consumer products firm acquires an emerging market firm, with an established distribution network and brand name recognition, and uses these strengths to increase sales of its products.

Operating synergies can affect margins and growth, and through these the value of the firms involved in the merger or acquisition.

Sources of Financial Synergy

With financial synergies, the payoff can take the form of either higher cash flows or a lower cost of capital (discount rate). Included are the following.

� A combination of a firm with excess cash, or cash slack. (and limited project opportunities) and a firm with high-return projects (and limited cash) can yield a payoff in terms of higher value for the combined firm. The increase in value comes from the projects that were taken with the excess cash that otherwise would not have been taken. This synergy is likely to show up most often when large firms acquire smaller firms, or when publicly traded firms acquire private businesses.

� Debt capacity can increase, because when two firms combine, their earnings and cash flows may become more stable and predictable. This, in turn, allows them to borrow more than they could have as individual entities, which creates a tax benefit for the combined firm. This tax benefit can take the form of either higher cash flows or a lower cost of capital for the combined firm.

� Tax benefits can arise either from the acquisition taking advantage of tax laws or from the use of net operating losses to shelter income. Thus, a profitable firm that acquires a money-losing firm may be able to use the net operating losses of the latter to reduce its tax burden. Alternatively, a firm that is able to increase its depreciation charges after an acquisition will save in taxes and increase its value.

Clearly, there is potential for synergy in many mergers. The more important issues are whether that synergy can be valued and, if so, how to value it.

Empirical Evidence on Synergy

Synergy is a stated motive in many mergers and acquisitions. Bhide (1993) examined the motives behind 77 acquisitions in 1985 and 1986 and reported that operating synergy was the primary motive in one-third of these takeovers. A number of studies examine whether synergy exists and, if it does, how much it is worth. If synergy is perceived to exist in a takeover, the value of the combined firm should be greater than the sum of the values of the bidding and target firms, operating independently.

V(AB) > V(A) + V(B)

where

V(AB) = Value of a firm created by combining A and B (Synergy)

V(A) = Value of firm A, operating independently

V(B) = Value of firm B, operating independently

Studies of stock returns around merger announcements generally conclude that the value of the combined firm does increase in most takeovers and that the increase is significant. Bradley, Desai, and Kim (1988) examined a sample of 236 inter-firms tender offers between 1963 and 1984 and reported that the combined value of the target and bidder firms increased 7.48% ($117 million in 1984 dollars), on average, on the announcement of the merger. This result has to be interpreted with caution, however, since the increase in the value of the combined firm after a merger is also consistent with a number of other hypotheses explaining acquisitions, including under valuation and a change in corporate control. It is thus a weak test of the synergy hypothesis.

The existence of synergy generally implies that the combined firm will become more profitable or grow at a faster rate after the merger than will the firms operating separately. A stronger test of synergy is to evaluate whether merged firms improve their performance (profitability and growth) relative to their competitors. after takeovers. On this test, as we show later in this chapter, many mergers fail.

Take over poorly managed firms and change management

Some firms are not managed optimally and others often believe they can run them better than the current managers. Acquiring poorly managed firms and removing incumbent management, or at least changing existing management policy or practices, should make these firms more valuable, allowing the acquirer to claim the increase in value. This value increase is often termed the value of control.

Prerequisites for Success

While this corporate control story can be used to justify large premiums over the market price, the potential for its success rests on the following.

1. The poor performance of the firm being acquired should be attributable to the incumbent management of the firm, rather than to market or industry factors that are not under management control.

2. The acquisition has to be followed by a change in management practices, and the change has to increase value. As noted in the last chapter, actions that enhance value increase cash flows from existing assets, increase expected growth rates, increase the length of the growth period, or reduce the cost of capital.

3. The market price of the acquisition should reflect the status quo, i.e, the current management of the firm and their poor business practices. If the market price already has the control premium built into it, there is little potential for the acquirer to earn the premium.

In the last two decades, corporate control has been increasingly cited as a reason for hostile acquisitions.

Empirical Evidence on the Value of Control

The strongest support for the existence of a market for corporate control lies in the types of firms that are typically acquired in hostile takeovers. Research indicates that the typical target firm in a hostile takeover has the following characteristics.

(1) It has under performed other stocks in its industry and the overall market, in terms of returns to its stockholders in the years preceding the takeover.

(2) It has been less profitable than firms in its industry in the years preceding the takeover.

(3) It has a much lower stock holding by insiders than do firms in its peer groups.

In a comparison of target firms in hostile and friendly takeovers, Bhide illustrates their differences. His findings are summarized in Figure 25.3.

As you can see, target firms in hostile takeovers have earned a 2.2% lower return on equity, on average, than other firms in their industry; they have earned returns for their stockholders which are 4% lower than the market; and only 6.5% of their stock were held by insiders.

There is also evidence that firms make significant changes in the way they operate after hostile takeovers. In his study, Bhide examined the consequences of hostile takeovers and noted the following changes.

1. Many of the hostile takeovers were followed by an increase in debt, which resulted in a downgrading of the debt. The debt was quickly reduced with proceeds from the sale of assets, however.

2. There was no significant change in the amount of capital investment in these firms.

3. Almost 60% of the takeovers were followed by significant divestitures, in which half or more of the firm was divested. The overwhelming majority of the divestitures were units in business areas unrelated to the company’s core business (i.e. they constituted reversal of corporate diversification done in earlier time periods).

4. There were significant management changes in 17 of the 19 hostile takeovers, with the replacement of the entire corporate management team in seven of the takeovers.

Thus, contrary to popular view [1]. most hostile takeovers are not followed by the acquirer stripping the assets of the target firm and leading it to ruin. Instead, target firms refocus on their core businesses and often improve their operating performance.

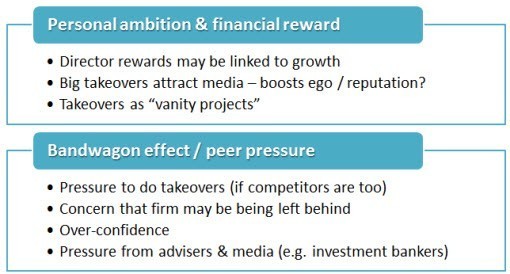

Cater to Managerial Self Interest

In most acquisitions, it is the managers of the acquiring firm who decide whether to carry out the acquisition and how much to pay for it, rather than the stockholders of the firm. Given these circumstances, the motive for some acquisitions may not be stockholder wealth maximization, but managerial self-interest, manifested in any of the following motives for acquisitions.

� Empire building. Some top managers interests� seem to lie in making their firms the largest and most dominant firms in their industry or even in the entire market. This objective, rather than diversification, may explain the acquisition strategies of firms like Gulf and Western and ITT [2] in the 1960s and 1970s. Note that both firms had strong-willed CEOs, Charles Bludhorn in the case of Gulf and Western, and Harold Geneen, in the case of the ITT, during their acquisitive periods.

� Managerial Ego. It is clear that some acquisitions, especially when there are multiple bidders for the same firm, become tests of machismo [3] for the managers involved. Neither side wants to lose the battle, even though winning might cost their stockholders billions of dollars.

� Compensation and side-benefits. In some cases, mergers and acquisitions can result in the rewriting of management compensation contracts. If the potential private gains to the managers from the transaction are large, it might blind them to the costs created for their own stockholders.

In a paper titled �The Hubris Hypothesis�, Roll (1981) suggests that we might be under estimating how much of the acquisition process and the prices paid can be explained by managerial pride and ego.

[1] Even if it is not the popular view, it is the populist view that has found credence in Hollywood, in movies such as Wall Street. Barbarians at the Gate and Other People�s Money.

[3] An interesting question that is whether these bidding wars will become less likely as more women rise to become CEOs of firms. They might bring in a different perspective on what winning and losing in a merger means.