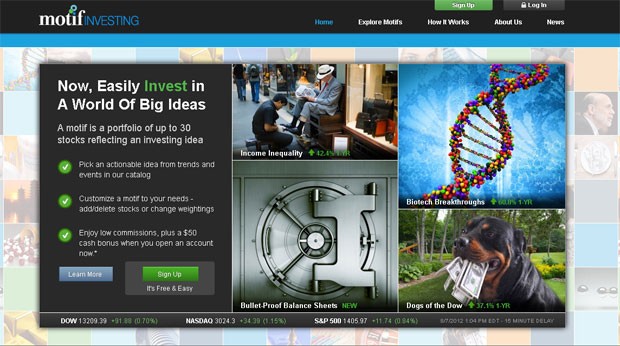

Motif Investing Review Create Your Own Custom ETF ( $150 Bonus)

Post on: 4 Июль, 2015 No Comment

Ready for a start-up online brokerage site with a twist? Its called Motif Investing . As a motif is a dominant theme or central idea, here you can invest in a group of up to 30 individual stocks that fit into a theme like Housing Recovery or Lots of Likes (companies that have the most Likes on Facebook). You can buy the entire basket of stocks with just one $9.95 commission, with no ongoing management fees. The minimum motif investment amount is $250.

My initial impression was that it felt a bit too trendy and gimmicky to recommend as a long-term investment. Indeed, I dont really care how many Facebook Likes a company has, and I doubt I would buy stocks based on my love of pets or my political views. Its just not my style.

But if you take a step back, since they let you customize the basket, anyone could essentially make their own ETF/mutual fund with zero expense ratio. You cant track a broad index like the S&P 500 this way, but if you do have a basket of stocks that you buy regularly, this would be a very cost-efficient way of doing it. You can also set the relative weighting of each of the stocks in the motif.

Personally, I might try creating a basket of dividends stocks that hopefully will provide a long-term stream of growing income. For example, take the SPDR S&P Dividend ETF (SDY ) that holds 60 highest-yielding stocks of the S&P 1500 that have raised their dividends every year for the past 25 years. Its a nice idea, but it leaves out some good companies and the 0.35% expense ratio eats up 10% of the original yield of the underlying companies. Why not hold them directly and keep the 0.35% as extra return for yourself? There are a number of other dividend-themed motifs available as well.

In many ways, this is similar to the unlimited plan at Folio Investing. but Motif Investing has the potential to be a lot cheaper ($10 per motif trade with no minimum trade requirement vs. $29 every month for Folio) and is closer to a ETF in that they do real-time market trades. Motif also uses dollar-based trades, using fractional shares to keep everything organized. You can still do regular real-time trades of individual stocks for $4.95 per trade. No maintenance fees, no inactivity fees. Currently there is no automatic dividend reinvestment, you have to reinvest the cash yourself.

Right now, Motif Investing is offering up to a $150 cash bonus when you open a new brokerage account with $2,000+ and make 5 trades. If you make 1 trade, youll get $50. 3 trades will get $75.