Mortgage REITs Like The Yield But Not The Volatility Here Is An Alternative

Post on: 11 Июнь, 2015 No Comment

Summary

- Many yield starved investors have been buying mortgage REITs in order to produce income.

- The volatility that comes with mortgage REITs is often inconsistent with portfolio objectives.

- Preferred stock offers a viable alternative, but the rate environment warrants caution.

As many readers are aware, I am a firm believer in the often overlooked asset class of preferred stocks. I have managed portfolios of them institutionally and own them in retail portfolios as well — including my own.

One of the aspects of preferred stocks that I like is the ability to move up the company’s capital structure from equities and increase the yield on the investment. For income portfolios, especially retirement portfolios, a known income stream is often more important than capital appreciation. Preferreds help accomplish these portfolio objectives in two ways (not always mutually inclusive):

- Preferred stocks allow investors to buy higher quality companies lower in the capital structure rather than lower quality companies higher in the capital structure.

- Due to the fixed dividend (in most cases, except floaters), the minimum yield is known in advance and volatility is somewhat lower as preferreds react mainly to rate occurrences rather than headline/earnings/rate occurrences.

With that said, an investor must be aware of the following risks of preferred stocks:

- Interest rate sensitivity. As many preferreds have fixed dividends, the price must adjust the dividend yield to market rates given changes in interest rates. This is especially important in environments such as the one we are in — rates will be going up.

- Redemption risk is present as preferred stocks typically come with early redemption rights (often called callable). This allows the issuer to redeem the instrument at a set price after a set date sometime in the future (typically five years after issuance).

- Credit risk must also be considered as it is in all investments. A higher recovery rate in bankruptcy is nice, but not to enter bankruptcy is better.

Many investors have turned to mortgage REITs (mREITs) in order to add yield to their portfolio in recent years. The book value, dividend and price volatility have, however, kept some investors from entering this market. This is, of course, understandable, but it has also precluded many from realizing the yield available from these investments.

By way of background, mREITs differ from equity REITs in that their real estate exposure is taken through mortgages, mortgage-backed securities, commercial real estate loans and the like. I have read many pundits theorize that mortgage REITs are not investments and should not be included in an investor’s portfolio. What many of these folks fail to grasp is that a mREIT can be compared to a bank: Assets are the MBS/RMBS/CMBS, liabilities are the borrowings used to acquire these assets, and the equity is that amount raised through issuing equity and/or retaining earnings. Banks have the same balance sheets (supplemented obviously by fees, a variety of product lines, etc.). In essence, mREITs are single product banks. They are REITs because they purchase real-estate related assets, namely MBS.

The volatility in both price and income that keep many from investing in the sector is shown below in a comparison between a mortgage REIT, Annaly Capital (NYSE:NLY ), and an equity REIT, Realty Income (NYSE:O ).

The financial crisis brought out the best and the worst of both types of REITs, but mortgage REITs were especially hurt.

The bottom line of this part of the discussion is that investors should match assets up to objectives. Time, volatility, returns, taxes and personal style (among other variables) create the portfolio constraints. An investor’s security/sector selection should be consistent with her security investment objectives.

If mortgage REIT equity is not consistent with an investor’s objective and risk tolerance, is there any way she can take exposure to the mortgage REIT sector to benefit from the yields available?

It stands to reason that I would not ask the question if I did not have an answer. The answer is yes, the preferred stock of mortgage REITs (tying together the themes of the research, hopefully not too late).

I have sifted through the mortgage REIT preferred stocks in order to come up with a sample group from across the different mortgage REIT types (agency, non-agency and commercial real estate (CRE)). Among the issuers are the commonplace names: Annaly Capital, American Capital Agency (NASDAQ:AGNC ), Colony Financial (NYSE:CLNY ) and NorthStar Realty (NYSE:NRF ).

As the table above shows, yields can range from 7.8% to 8.9%. While this is below the dividend yield of the common shares — Annaly, for example, yields nearly 11% — an investor does not have to worry about the book value of Annaly or a fluctuating dividend.

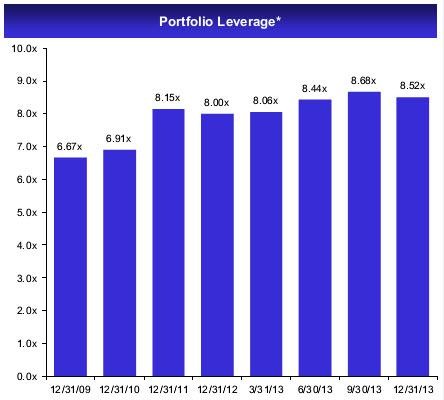

One might realize that there is a difference in yields between the agency mortgage REITs and the hybrid/CRE mREITs. This is due to investors choosing one form of risk over another. In this case, investors would rather take leverage risk than credit risk. Specifically, agency mREIT’s underlying investments don’t contain credit risk and as a result have lower yields. The lower yields force the mREIT to leverage the portfolio more times in order to create the income and, therefore, the yield. Hybrid/CRE mREITs take credit risk, which has more yield and therefore requires less leverage. It is simply a matter of choosing which risk to take. This can be evidenced by the following fundamental table:

Note that the measure of leverage used (debt/equity) is higher for the agency mREITs than the hybrid/CRE mREITs — for the reasons discussed above. On a side note, the above mREITs have seen a decent recovery in their price/book ratios rebounding from the 70% levels to the nearly 100% levels now. Confidence in the firms has recovered as has book value. Mortgage losses, changing prepayment speeds and last year’s rise in rates took their toll on mREITs:

As the following charts show, the preferred stock of a mortgage REIT is less volatile than the equity of the same company (all charted on Google Finance):

American Capital Agency (AGNCP is the preferred):

Annaly Capital:

And Colony Capital:

As the charts above show, preferreds exhibit less price volatility.

mREIT Preferred stock allows an investor to bypass equity metrics and focus on the rate environment. Both the equity and preferred have exposure to rates, so once again, it is an investor choosing their risk profile.

Bottom Line: Mortgage REIT preferred stocks allow an investor to place higher yields in their portfolio without taking exposure to the underlying portfolio movements of mortgage REIT equities. This may better fit the risk tolerance of some investors who would otherwise not invest in this sector.

It must be clearly stated, however, that an investor in mortgage REIT preferreds is exposed to changes in interest rates. Rates will go up, it is a matter of when, not if. When this occurs is when the risks of fixed dividend preferred stocks will be clearly evident. I use mortgage REIT preferred stocks as part of income focused portfolios, and typically limit exposure to the sector to 10% at most. The preferreds help supplement equities and fixed income. I cannot stress enough that all investments should be viewed as part of a portfolio and allocations should be determined by portfolio objectives subject to the portfolio’s constraints.

Disclosure: The author is long NLY, AGNC, NRF, WMC. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Long NLY common, AGNC common, NRF common and preferred, WMC common. This article is for informational purposes only, it is not a recommendation to buy or sell any security and is strictly the opinion of Rubicon Associates LLC. Every investor is strongly encouraged to do their own research prior to investing.