Mortgage Interest Rates Forecast Predictions Trends

Post on: 17 Май, 2015 No Comment

Posted October 13, 2014

by Dan Green

As Seen On

- Mortgage Rates

Mortgage interest rates change constantly. On some days, mortgage interest rates rise; and, on some days, mortgage interest rates fall. Many days, though, you’ll find them doing both, which make it difficult to shop for today’s lowest rates.

Mortgage rates are unpredictable. However, when we understand a little bit about how they work, we can put ourselves in a better position to shop for them.

Learn about mortgage interest rates to be a better consumer.

Why Mortgage Interest Rates Change

Shopping for low mortgage rates can be a challenge. Mortgage interest rates live in perpetual flux, and often change with no advance warning. This is different from years past, when mortgage rates were set by a bank.

Today, mortgage interest rates are set by Wall Street; more specifically, by the price of an instrument known as a mortgage-backed security (MBS). And, when you understand how mortgage-backed securities work — even from a basic level — you can teach yourself to be a better shopper of mortgage interest rates.

Thankfully, mortgage-backed securities are pretty simple to understand.

Mortgage-backed securities are bonds, which are bought and sold on Wall Street. Similar to how stocks trade, mortgage bonds have prices at which they can be bought. When demand for the bonds outpaces their supply, bond prices rise overall.

Now, mortgage interest rates move in the opposite direction of the price of a mortgage-backed security. Rising bond prices lead to lower mortgage rates.

Of course, the reverse is true, too. When MBS prices drop, mortgage interest rates rise.

As a consumer, you can’t be expected to know whether the price of a mortgage-backed bond is rising or falling on any given day. Getting access to MBS quotes is difficult and expensive.

There are several ways, though, by which a layperson consumer can make an educated guess on today’s MBS pricing.

In general, and in isolation, the following events tend to result in 30-year mortgage rates moving lower:

- Falling inflation rates, because inflation makes bonds more valuable to investors

- Weaker-than-expected economic data, because a weak economy drives investors toward safe investments such as mortgage-backed bonds and away from riskier ones, including stocks

- War, disaster and calamity, because mortgage-backed bonds provide certainty to an uncertain market

Conversely, rising inflation rates; stronger-than-expected economic data; and the calming down of a geopolitical situation all tend to lead mortgage interest rates higher.

Many of the stories which affect current mortgage rates are headline-type news, and readily accessible to the public — even if real-time mortgage bond pricing is not.

The Most Common Mortgages And Mortgage Rates

Mortgage interest rates are not the same for everyone.

Consumers with high credit scores may get access to lower mortgage rates than consumers with low credit scores; just as home buyers of a multi-unit rental home may get a higher quote than a person buying a single-family home in which they plan to live.

Mortgage rates also vary by loan type.

There are four main mortgage loan types, which account for more than 90 percent of mortgage loans made to U.S. consumers.

Interest rates for each are governed by mortgage-backed bonds, which means that by watching the news or by getting alerts, you can make mortgage rates predictions with reasonable certainty.

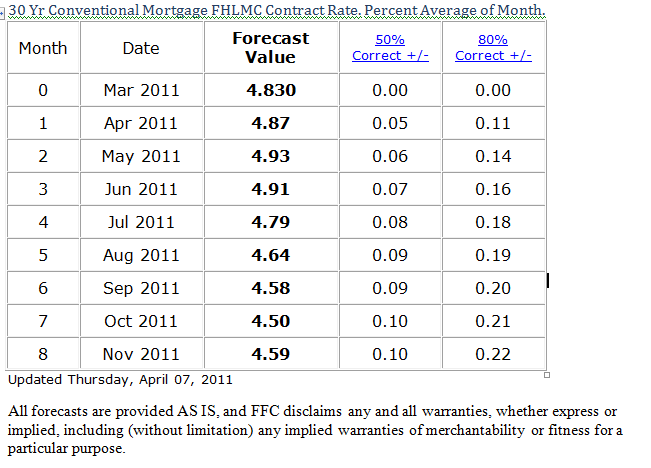

Conventional Mortgage Interest Rates

Conventional mortgages are mortgages backed by Fannie Mae or Freddie Mac. Each has its own mortgage-backed security which controls in which direction mortgage interest rates are headed.

The Fannie Mae mortgage-backed bond is lined to mortgage interest rates via Fannie Mae. The Freddie Mac mortgage-backed bond is linked to mortgage-backed bonds via Freddie Mac.

Mortgage programs which use conventional mortgage interest rates include the standard 30-year fixed-rate mortgage rate for borrowers making a 20% downpayment or more; the HARP loan for underwater borrowers; the Fannie Mae HomePath mortgage for buyers of foreclosed properties; and, the equity-replacing Delayed Financing loan for buyers who pay cash for a home.

FHA Mortgage Interest Rates

FHA mortgage interest rates apply to loans insured by the Federal Housing Administration (FHA).

FHA loans are available in all 50 states and are most often used by home buyers in search of a low downpayment. This is because FHA loans require a downpayment of just 3.5%.

FHA mortgage interest rates are based on mortgage bonds issued by the Government National Mortgage Association (GNMA). Among investors, GNMA is more commonly called Ginnie Mae.

As Ginnie Mae bond prices rise, the mortgage interest rates for its related FHA programs drop. These programs include the standard FHA loan, as well as the FHA’s specialty products which include the 203k construction loan ; the $100-down Good Neighbor Next Door program; and the FHA Back to Work loan for homeowners who recently lost their home in a short sale or foreclosure.

VA Mortgage Interest Rates

VA mortgage interest rates are also controlled by the price of a Ginnie Mae bond. This is why VA mortgage rates and FHA mortgage rates tend to move in tandem, and differently from conventional rates.

On some days, for example, VA mortgage interest rates will improve whereas mortgage rates for conventional loans will not.

VA mortgage interest rates are used for loans guaranteed by the Department of Veterans Affairs such as the standard VA loan for military borrowers; the VA Energy Efficiency Loan; and the VA Streamline Refinance .

VA mortgages offer 100% financing to U.S. veterans and active service members, with no requirement for mortgage insurance.

USDA Mortgage Interest Rates

USDA mortgage interest rates are governed by the same Ginnie Mae mortgage bonds as the interest rates for FHA and VA loans. Of the three, however, USDA mortgage rates are often lowest. This is because USDA loans are guaranteed by the government, but also accompanied by a small mortgage insurance requirement.

USDA loans are available in rural and suburban neighborhoods nationwide. The program provides no-money-down financing to U.S. buyers at very low mortgage rates.

Predicting The Future Of Mortgage Interest Rates

Mortgage rates are unpredictable. However, with an understanding of how mortgage bonds work — and what makes them move — you can be a better position to lock your lowest rate possible.

Compare today’s live mortgage rates and see for what you’ll qualify. Rates are available online at no cost, with no obligation to proceed, and with no social security number required to get started.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.