Mortgage 101 What is a Reverse Mortgage

Post on: 19 Июль, 2015 No Comment

Its often said that life is a game. If thats true, then our 60s are a bit like the 7th inning stretch of a baseball game. The hard work is behind us, its time to catch our breath, and if were far enough ahead, then we can coast through the last few innings and enjoy the spoils of our labors as they retire our number to the halls of Cooperstown.

If youve bought a house during the game, it can make getting through those last couple innings a bit easier. By taking a reverse mortgage out, you can give yourself a little extra financial cushion as the game comes to a close.

A reverse mortgage is a tax-free payment your lender gives based on the equity youve built up in your home. Its effectively a loan you dont have to pay back until you move out of your home or after you pass away and the home is sold.

Who is eligible for a reverse mortgage?

Youre eligible to take a reverse mortgage out on your home if youre 62 years or older. The home does not have to be fully paid off for you to qualify, but youll need to have built up sufficient equity in the home. In most cases, there are usually no income requirements to meet in order to qualify. Your disability and social security status will also not influence your ability to qualify.

Who should seek a reverse mortgage?

Deciding to take a reverse mortgage out on your home is a big decision to make. For most individuals, their house is the most valuable asset they own. Thus, it should be viewed as a piggy bank that shouldnt be raided until its absolutely necessary. Thus, you should not seek a reverse mortgage to take vacations, purchase furniture, or upgrade your lifestyle. Rather, you should consider using a reverse mortgage to help cover necessary expenses, such as medical bills or to offset a fixed income.

Some people choose to take a reverse mortgage out because it gives them a little extra money to invest in every month. This is a risky financial strategy, and its one you should take only if youre a savvy investor with a solid track record backing your decisions. Otherwise, taking money out of your home to invest in stocks and bonds is a risk you may come to regret.

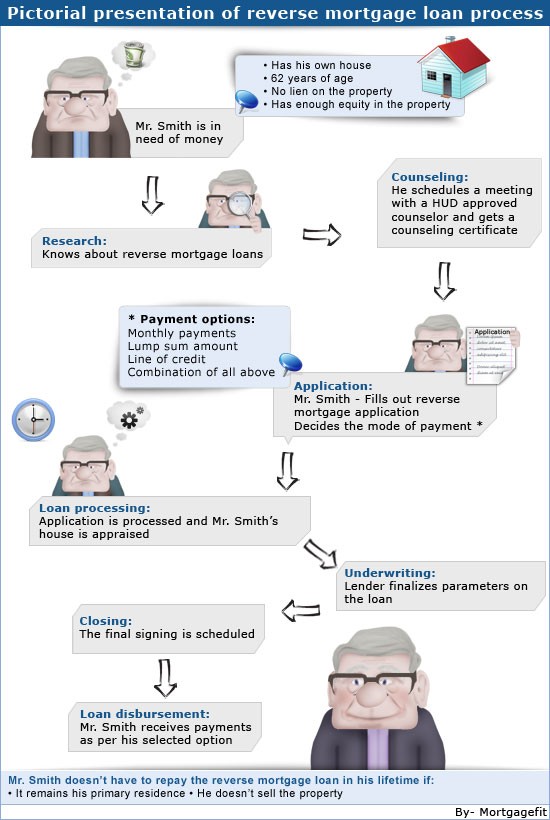

What is the application process like for a reverse mortgage ?

The application process for a reverse mortgage involves counseling, an appraisal, underwriting and closing. This process ensures you understand the terms of the mortgage, and it reassures the lender that they wont lose money on the deal.

What if I still owe money on the home?

You will not be required to make monthly mortgage payments as long as the home remains your primary resident. Though, youll still need to make payments for taxes, insurance, and, of course, maintenance.

What if I want to leave my home to my heirs?

This is possible, and your heirs will not assume the debt you have on the home when you pass away. At such time, your heirs can purchase or refinance the house.

Gateway Mortgage has been helping our clients secure reverse mortgages for many years. Were happy to help guide you through the process, and invite you to contact us at 314-822-3999. When you call, well answer your questions and outline the steps you need to take to finish the game with a grand slam.