Monte Carlo software can help with retirement planning

Post on: 16 Март, 2015 No Comment

Demeuse (Photo: Submitted)

The theme of many articles focuses on saving for retirement. Obviously, these articles go on to say people are afraid of running out of money during their retirement years.

A long, enjoyable retirement should be the preferred outcome, but having no money during the final years of life can be a terrifying thought.

Even people with a lot of savings can be worried. Bad investment performance or advice can consume a nest egg just as quickly as an extravagant lifestyle.

When it comes to properly planning for your financial future, so much time is put into how much to save and where to invest.

However, when you’re at or near your golden retirement years, you must begin to focus on how you’re going to efficiently withdraw the savings and investments for you to enjoy.

You should plan for your retirement savings to last 30-plus years from the day of your retirement party.

When the focus turns away from the accumulation phase and into the withdrawal phase at retirement, the basic and most important question retirees need to ask is, How much can I safely withdraw without running out of money?

This question, I believe, takes priority and the very important role of over analyzing the appropriate mix of stocks, bonds, and cash during your retirement years.

Another very common question and discussion topic, in addition to how much to safely withdrawal, is from which accounts should my withdrawals be tapped.

For many retirees, the choices can range from tax-free Roth IRAs, pre-tax IRAs, work retirement accounts, or tax-deferred annuities.

For this reason, financial advisers need to have a very good understanding of their clients’ income tax return as the withdrawal plan needs to compliment the overall tax picture.

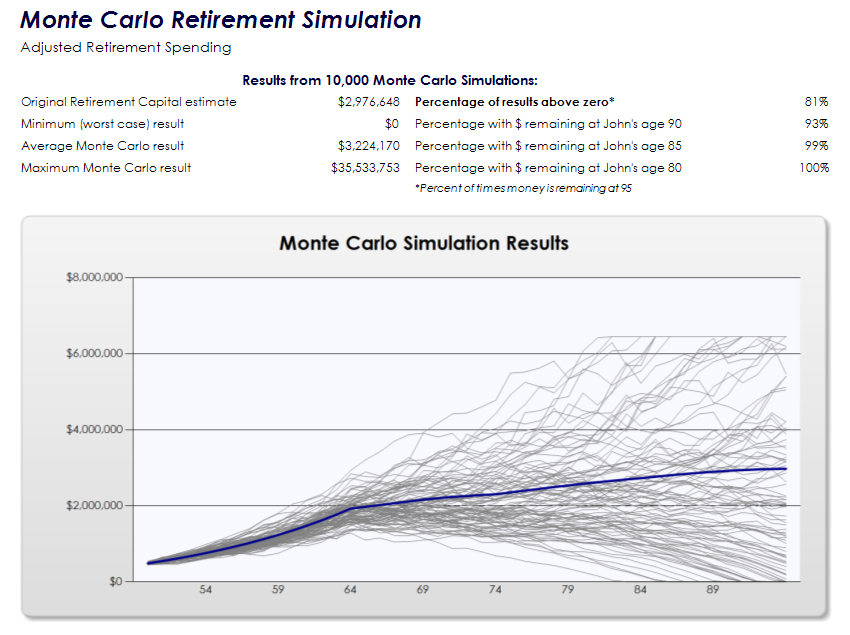

One valuable tool to help determine a safe withdrawal strategy is called Monte Carlo simulation.

Most Monte Carlo software programs look back to the stock and bond market return history of the early 1900s to the present day. From here, Monte Carlo randomly picks annual performance returns from the past and scrambles them all up to come up with thousands of different possible future outcomes.

Most Monte Carlo programs allow for you to enter a starting investment balance, annual withdrawal amount, and the years in retirement.

What makes Monte Carlo so valuable is that it doesn’t assume the same return on investment each year. The reality is that you will have years of both high and low returns.

Ultimately, the software will calculate the likelihood of success that you won’t run out of money anytime during your retirement years.

Let’s take a look at a $1 million starting portfolio, 50/50 stock/bond mix, 4 percent or $40,000 withdrawal rate for 30 years in retirement.

Most Monte Carlo programs will arrive at a better than 90 percent chance of not running out of money. Why? Is it because our portfolio in this example is split 50/50 between stocks and bonds? Is it because we have $1 million in our portfolio?

No. It’s because we are withdrawing a reasonable amount of money each year. A 4 percent withdrawal rate is what I call the speed limit. Staying within the 4 percent withdrawal speed limit is why the likelihood of a successful retirement is above 90 percent according to the Monte Carlo software.

If, on the other hand, we decide to withdraw 8 percent or $80,000 annually, the probability of not running out of money reduces from over 90 percent to under 20 percent.

The news gets worse. There’s a fair probability that your retirement nest egg doesn’t last even halfway into your 30-year retirement.

That’s not a good number to be working with in your retirement years and sets the stage for concern. What do you do? Do you go back to work when you’ve already said your goodbyes?

Monte Carlo simulation assumes that we don’t make any changes during your retirement years, which is why this tool serves as only the framework to real life.

If the portfolio does much better or worse than our original plan, we may want to modify our original plan.

At Summit, we like to see and talk to our retired clients a few times each year in order to be proactive in making any changes.

For some, exceeding our 4 percent withdrawal speed limit might, at times, be OK for a little bit of time. Maybe a family member needs help financially because of an illness. Maybe gifting money to children or a charity is important. Just maybe, that dream vacation at retirement is awaiting.

It’s vital to stay in touch with the tempo of life as we never want to put a portfolio on cruise control.

As advisers, we sometimes have to deliver the bad news. Other times we have to remind clients of the speed limit when it comes to rate of withdrawal. But it’s always our concern that our clients’ pot of money lasts as long as their retirement goals and aspirations.

Dave Demeuse, is a partner and certified financial planner for Summit Planning Group. He can be reached at dave.demeuse@summitplanninggrp.com or at (920) 884-9000.