Money Watch Is it time to rebalance your portfolio

Post on: 3 Июнь, 2015 No Comment

Story Highlights

- Determine if your financial goals have changed Consider if your risk tolerance has changed over time Rebalance your portfolio to match your time horizon and comfort level

Money Watch, a personal finance column that runs every Saturday, features a financial planner from the National Association of Personal Financial Advisors answering reader questions about saving, protecting and growing your money.

Q: I have a variable annuity with a portfolio of various index funds, stocks and bonds that has earned well for the last four years when it was allocated for me. Would it be a good idea to rebalance the portfolio to retain the same percentages I started with, or just keep it as is? How would I do that?

A: Your portfolio allocation should be based on your financial goals. Have they changed in the past four years? In most cases, they didn’t.

As an example, if your goal was to retire at a certain age, you probably still want to retire at that age (maybe earlier). But today, your portfolio is worth more and you have a shorter time horizon.

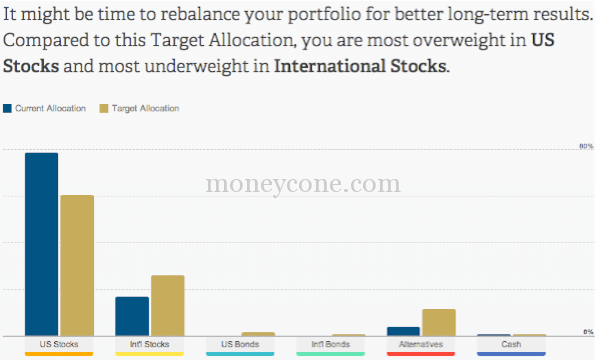

You ask if you should rebalance to the original percentages or keep as-is. I suggest there is a third choice. You may want to adjust your portfolio to reflect a new allocation based on today’s financial goals and current situation. You need to determine the division of index funds, stocks and bonds that provides the best chance of success with the least amount of risk.

If your goals haven’t changed, at a minimum, you would rebalance back to your original percentages.

Your review may determine that your recent success allows you to take less market risk while still providing a similar likelihood of achieving your goals. It sounds like an adviser helped you develop an allocation four years ago. You could return to that adviser (or another one) or re-balance yourself based on your comfort level.

If you want to rebalance yourself, consider a simplified example. Let’s say that your portfolio was divided equally between three index funds. The first is a domestic equity fund, the second is a bond fund and the third is a foreign stock fund.

If you determine that you would like to return to the initial allocation, you would calculate the current percentage of each fund. And you would sell those that are now greater than 33.33% and buy the ones that are below 33.33%. If you change your desired allocation, adjust your percentages accordingly.

Your easiest answer is to leave as-is. After all, your current portfolio has performed well. Why change it?

History provides many examples of why the easiest is not always the best. Think of the rise of the stock market bubble in the late 1990s. Why would you then have rebalanced an equity portfolio that performed so well? The reason was that the level of market risk also had increased. The increased risk was paid for when the bubble burst in the early 2000s.

If your portfolio was created properly four years ago, you are likely carrying too much market risk today. At the very least, a review is warranted.

Sensible Money, Scottsdale, Ariz.