Momentum Trading Strategies

Post on: 16 Март, 2015 No Comment

Momentum traders and investors look to take advantage of upward trends or downward trends in a stock or ETF’s price. We’ve all heard the old adage, “the trend is your friend.” And who doesn’t like riding a trend? Momentum style traders believe that these trends will continue to head in the same direction because of the momentum that is already behind them.

Price momentum

If you’re looking at a price momentum, you’re going to be looking at stocks and ETFs that have been continuously going up, day after day, week after week, and maybe even several months in a row. Some people hate getting into markets making new highs. But it’s important to know that there’s a lot of evidence that shows markets making new highs have a tendency of making even higher highs.

Momentum trading carries with it a higher degree of volatility than most other strategies. Momentum trading attempts to capitalize on market volatility. If buys and sells are not timed correctly, they may result in significant losses. Most momentum traders use stop loss or some other risk management technique to minimize losses in a losing trade.

One method to find the top stocks and ETFs is to look at the percentage of stocks and ETFs trading within 10% of their 52-week highs. Or you may like looking at the percentage price change over just the last 12 weeks or 24 weeks. Generally, the former method is more sensitive to recent price movements.

Take the oil and energy sector in mid-2008 as an example. Based on its 12-week or 24-week price performance, it was continuously ranked as one of the top sectors using those metrics—even while it was collapsing. That was because the gains were so large in the first part of the 12- or 24-week periods, even a large pullback over a span of many weeks got lost within the larger run-up that preceded it.

To spot trend early on, you may want to include a shorter-term price change component, for example a 1-week or 4-week price change measure. This works both getting into and getting out of a particular stock or ETF.

To be a successful momentum trader, you need to be able to identify the best sectors quickly and accurately. You can probably do this manually with many screeners out there, but the basic steps are a follows:

- First you need to identify the stocks and ETFs you are interested in.

- Determine the number of stocks and ETFs trading close to their yearly highs.

- Sort the chosen stocks and ETFs from highest to lowest to see which are doing the best.

- Devise an entry strategy. You may want to enter when an instrument is showing short-term strength or wait for a pullback and buy on weakness. Either approach can work; the important point is to execute a plan.

- Devise an exit strategy. You should know going into the trade at what point (or conditions) you will take profits and at what point (or conditions) you will exit with a loss.

More advanced tools

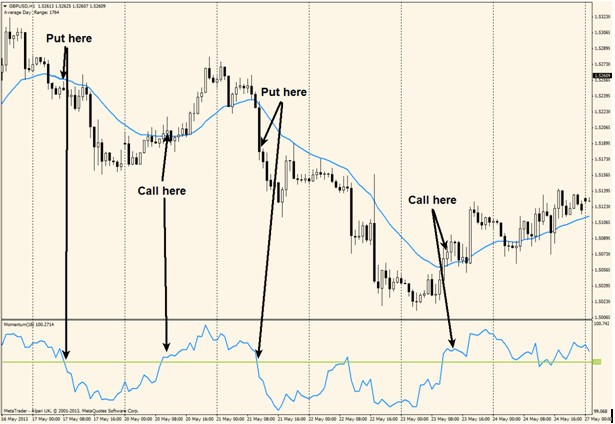

A variety of technical tools can be used to assist with a momentum-based approach, including: chart reading, moving averages, oscillators, relative strength. These tools are accessible on most investment platforms. For the modern trader, the challenge is to select tools that complement one another and provide a means to analyze the market in a consistent manner and provide well-defined entry and exit points.

For most technically oriented traders, the analysis of momentum begins with defining the condition of the trend in prices. Generally, momentum is strongest at the earliest stage of a trend and weakest at the latter stages just prior to a trend reversal, in the same manner that a ball accelerates fastest when leaving your hand and slows down its rate of ascent prior to its final peak and return to earth

Consequently, a trader looking to ride a wave of momentum should attempt to fine-tune technical indicators that identify a stock or ETF that is bursting out of a period of subdued price action, such as short-term moving averages. In the later stages of a trend, momentum often begins to fade, even as prices keep advancing higher. Many traders take this as a signal to exit their positions and/or to enter the market on the short side.

The risks of momentum trading

It’s important to understand that momentum trading involves a good deal of risk. In essence, you’re making a decision to invest in a stock or ETF based on recent buying by other market participants. There’s no guarantee that buying pressures will continue to push the price higher. For example, a news development may impact investor market perception and lead to widespread selling. Or, with many investors already holding long position in the ETF or stock, it’s possible that profit-taking on existing positions will overpower new buyers coming into the market, forcing prices down.