Momentum of comparative strength Stock Screener

Post on: 2 Июль, 2015 No Comment

168 posts

msg #47739

10/30/2006 4:29:48 PM

i saw this in SFO magazine. Any filter possibilitues?

sfomag.com/homefeaturedetail.asp?ID=226115828&MonthNameID=November&YearID=2006

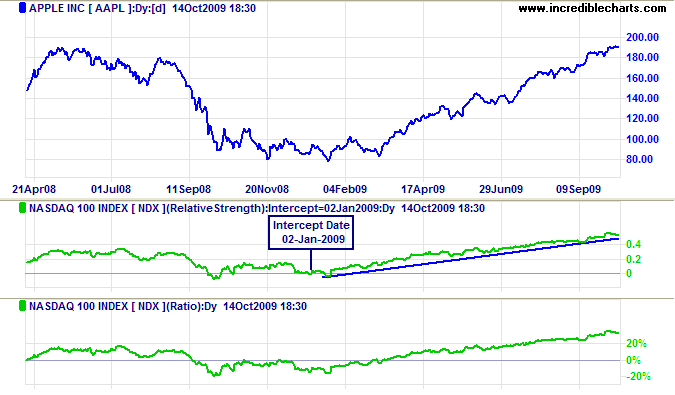

The momentum of comparative strength (MoCS) formula:

The MoCS is essentially the traditional comparative strength formula run through a MACD formula.

“Data Series” is the close/last of the stock or ETF being analyzed.

MoCS = (12-period exponential moving average of ( data series / S&P 500 )) minus (26-period exponential moving average of ?( Data Series / S&P 500 )).

A 9-period moving average is then placed on the MoCS to act as the signal line.

[The MoCS is noted as being “positive” or “negative” in an exchange traded fund (ETF) matrix posted each morning by Hendrix on www.mytechnicalanalyst.com.]

Don’t Look Over Your Shoulder

I have developed an indicator called the momentum of comparative strength indicator (MoCS), which shifts the assessment to forward looking and thus is more on target. In addition to describing the MoCS, in this article I will outline the process in which a technically based investor can develop his or her idea into an indicator.

The goal of most market participants is to invest in stocks that will outperform the broad market. Like the students with inexact answers to the peanut butter assignment, investors often implement technical analysis methods that are not a direct bull’s eye hit. Assessment of relative strength is commonly implemented but is similar to putting the peanut butter on the sides of the bread. A close attempt, but not specific enough.

What Is Relative Strength?

Relative or comparative strength most often compares the performance of a stock to a broad index such as the S&P 500. The method can be narrowed to compare a stock to its sector, group, or even another stock. A simple scan for outperforming sectors, groups or individual stocks is to compare returns over a set period. For example, a stock up five percent year-to-date is considered an outperformer versus the S&P 500 index up 2.5 percent. A more complex example is the assigning of relative strength ratings as posted in the Investor’s Business Daily in which a stock’s performance is compared to all stocks in their database and ranked on a scale of: 1 (lowest) to 99 (highest). A third method is to divide the price of the stock by the level of the S&P 500 index (or other index), the result of which can be charted. A rising slope displays out-performance and a negative slope notes under-performance.

These common methods of conveying comparative strength have merit but they are often used in an attempt to answer the question: “What will be an out-performing stock?” These methods, however, are accurate in defining how a stock has performed in the past versus the target index. Investors then take a leap of faith assuming that if a stock out-performed in the past, then it will likely out-perform in the future. Perhaps the old adage, “the trend is your friend” is the basis, assuming a trend of out-performance will continue. However, a modification of the question should give a different answer that comes closer to the bull’s eye desire of most investors. “What stocks are getting better and better in their performance versus the broader market?” This question exposes the weakness in traditional comparative strength measures and sets the stage for the creation of an indicator that answers the question more directly.

Don’t Be Fooled

Traditional measures can be misleading. In the prior example, noting the stock up five percent year to date versus the S 500 index up 2.5 percent, what if two weeks earlier the stock was up 15 percent and one week ago it was up ten percent—all while the market was holding steady at up 2.5 percent? The information now takes on new meaning. The out-performing stock appears less attractive as it is losing ground or momentum in its relative performance.

The more narrow focus allows the clearing of a path to a new indicator. The preferred charting method of comparative strength, as mentioned earlier, is derived from dividing the stock price by the price of the index. The result of the calculation simply needs to be run through a momentum formula. Numerous measures of momentum exist but I favor the moving average convergence divergence (MACD), popularized by Gerald Appel. Most technically based investors are familiar with the MACD, typically used to measure momentum of a stock or index. The momentum of comparative strength tool (MoCS) uses the MACD as a foundation of the formula but instead of using the stock’s price as the input, the comparative strength figure drives the formula.