Mini Options by

Post on: 1 Июль, 2015 No Comment

Mini Options — Definition

Options that cover only 10 shares of the underlying stock instead of 100 and cost only about 10% of the price of regular options.

Mini Options — Introduction

Let Mr. OppiE, Author of Optiontradingpedia.com, Mentor You One To One,

Step By Step, To Making Thousands Per Month Using His Star Trading System!

What Are Mini Options?

Just as Dr. Evil has his Mini-Me in the movie Austin Powers, options also have their mini counterparts known as Mini Options. Mini Options are options contracts that cover only 10 shares instead of the usual 100 shares covered by plain vanilla options or even weeklies or quarterlies (Read about Options Distinguished by Expiration ). Yes, while Mini-Me is one-eighth the size of Dr. Evil, Mini Options are one-tenth the size of regular options. They were launched on 18th of March 2013 and were available only for five heavily traded high value stocks across several industries; AAPL (Apple Inc.), GOOG (Google Inc.), AMZN (Amazon.com Inc.), GLD (SPDR Gold Trust ETF) and SPY (S&P500 ETF). Like how Weeklies and Quarterlies started, it is expected that if trading response is good, mini options would be made available for more stocks down the road.

In a nutshell, mini options are exactly the same as regular, weekly and quarterly options, have the same strike prices and expiration dates, almost the same premium price but covers only 10 shares instead of 100. That means that when you buy a mini option, you would multiply the premium by only 10 instead of 100 to arrive at the price of one contract. Yes, the main reason behind the creation of mini options is to cater to the needs of small retail investors.

1 Contract of Mini Options vs 1 Contract of Regular Options

Assuming AAPL’s May $425 strike price call options are asking at $20.00 with its mini options asking at $20.00 as well.

1 contract of regular May $425 options = $20.00 x 100 = $2000

1 contract of mini May $425 options = $20.00 x 10 = $200

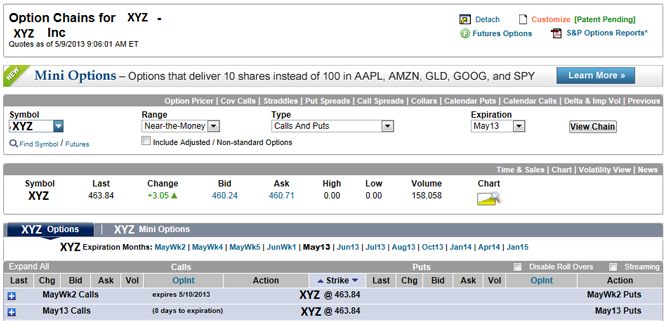

Even though mini options share the exact same characteristics as their regular counterpart, they are not sold as fractions of the regular options but are seperate trading instruments of their own and accounted for in their own options chains. This means that when you buy a mini option, you are not buying one-tenth of the regular option of the same strike price but rather a seperate different option that has only ten shares of the underlying stock as their contract size. This also mean that buying ten contracts of a mini option doesn’t mean you bought one contract of the regular option counterpart. They are both different and have their own options symbols. Here’s a look at the June2013 regular option and mini options chains for AAPL on 14 April 2013:

Mini Options Specifications

Contract Size

10 shares per options contract

Strike Price Intervals

Expiration Dates

Same expiration date as its regular, weekly or quarterly options counterpart.

Minimum Margin for Uncovered Positions

Writers of uncovered puts or calls must maintain 100% of the option proceeds plus 20% of the aggregate contract value (current equity price x $10) minus the amount by which the option is out of the money. if any, subject to a minimum for calls of option proceeds plus 10% of the aggregate contract value and a minimum for puts of option proceeds plus 10% of the aggregate exercise price amount.

Exercise Settlement

Physically Settled. Delivers on third business day following expiration.

Trading Hours

9:30am EST to 4:00pm EST

As you can see in the specifications above, apart from the multiplier of underlying asset making them cheaper to own, there are basically no differences between mini options and their regular, weekly or quarterly counterpart.

Why Are Mini Options Created?

Mini options are primarily created with the hedging needs of small retail investors in mind. Small retail investors were frequently unable to buy full 100 shares round lots of these expensive stocks and instead only hold a few shares at a time. Since regular options cover 100 shares of the underlying stock, small retail investors holding lesser than 100 shares of these stocks would not be able to protect their stock using put options nor write Covered Calls against their stocks since each contract of regular options cover 100 shares.

The creation of mini options seek to provide an avenue of hedging for these small retail investors by chunking down the amount of shares covered from 100 to just 10. This allows small retail investors to buy put options in order to protect their shares or write covered calls against their shares in multiples of 10 shares instead of 100 shares.

Mini options are obviously not created with the express intention of helping small retail options traders buy cheaper options because the options of some of these expensive stocks, such as SPY, are really as cheap as options on stocks trading at $50 or below. However, options of stocks such as GOOG and AAPL are indeed expensive. In fact, their options can be as expensive as buying cheaper stocks. However, if allowing small retail options traders buy options for speculation is one of the main objective of the mini options program, then certainly expensive stocks with cheap options, such as SPY, would not be included. On the other hand, mini options have indeed given small retail options traders an avenue of trading more expensive options, such as those of GOOG and AAPL, with just a few hundred dollars a time.

Mini Options Initial Reception

Even though the launch of mini options is considered a success in the industry and is widely acclaimed as a respectable start, trading volume on mini options is still only a fraction of the trading volume of regular options of the same stocks (2013). Most options premiums of mini options also tend to be slightly higher than their regular options counterpart due to wider bid ask spread from being thinly traded (read more about options liquidity ).

Why Are Mini Options So Thinly Traded Compared With Regular Options?

Indeed, it is quite surprising to the industry that mini options are so thinly traded when compared with regular options. Prior to the launch of mini options, most experts speculated that mini options would attract most of the retail investor herd and would explode in trading volume and surpass that of regular options. Some even expect mini options to be a game changer. Since mini options are one-tenth the size of regular options, they can easily get up to ten times the trading volume of regular options. However, none of that happened. A few possible reasons are:

1. Options traders are mainly directional speculators rather than hedgers or covered call writers. As stated above, one of the main reasons for the creation of mini options is the fact that small retail covered call writers owning non-round lot (100 shares per lot) of these expensive shares would not be able to write even one contract of call options against them without incurring margin. However, since there are alot more directional speculators who trades options directly rather than use options for hedging, there is lesser reason to use mini options especially since options on expensive stocks such as SPY isn’t more expensive than options on other cheaper stocks.

2. Mini options could still be so new that very few options traders know about their existence or understand how they work yet. This situation could change as time goes by but whether mini options would become more heavily traded than their regular counterparts as more and more options traders know about them remains a question.

3. There isn’t as much small retail investors and options traders involved in these big stocks than previously expected. Such big stocks are mainly the favorite instruments of bigger institutional investors.

Characteristics of Mini Options Trading

1. Mini options tend to have slightly different premium and bid ask spread than their regular options of the same strike price and month. Premium and bid ask spread could be slightly higher or lower due to the fact that mini options are independant of their regular counterparts and are affected by demand and supply of their own. Generally, in the current state, most mini options tend to have slightly wider bid ask spread due to the lack of trading volume and hence liquidity.

2. Most options brokers still apply the same round lot commission that they do to a single contract of regular options to a single contract of mini options. For instance, if your options broker is charging $0.15 per contract for regular options, they are most likely charging the same $0.15 per contract for mini options as well. This results in commission inefficiency for mini options as you are basically paying more commmissions for lesser exposure.

Mini Options are Different From Mini Index Options

Mini options should not be confused with Mini Index Options. Mini Index Options are a different option type of their own and are created specifically to trade indexes directly instead of their ETF like in mini options. Yes, the main difference between mini options and mini index options is that mini options are created for equity shares which you can buy and sell in the stock market while mini index options are created for indexes which cannot be directly traded on their own. Their main similarity is that they are both one tenth the size of their regular options. Mini options cover one tenth the number of shares of regular options and mini index options are one tenth the value of regular index options.

Options Strategies Using Mini Options

You can perform any options strategies using just mini options exactly as you would using regular options. However, there are some unique options strategies that are made possible only with mini options and that is when you using mini options in combination with stocks or regular options.

Covered Call using Mini Options

As mentioned repeatedly above, the most notable options strategy for mini options is perhaps the Covered Call. This is because mini options has been created for the covered call needs of small retail investors who cannot buy round lots of the underlying expensive stock (1 round lot = 100 shares). Small retail investors holding lesser than 100 shares of the underlying expensive stock were not able to write even one contract of covered call against those shares. However, with mini options, small retail investors can now write covered calls for additional income or partial hedging even if they own only 10 shares of the underlying stock.

Covered Call Using Mini Options

Protective Put using Mini Options

Another purpose for which mini options are created is the hedging needs of small retail investors through protective puts. Just like the Covered Call, a single put option covers 100 shares of the underlying stock. As such, small retail investors holding only 10 shares (or multiples of 10 but lesser than 100), could not protect their shares using put options even if its just one contract of a put option. With mini options, small retail investors can now buy protective put for protection even if they own only 10 shares of the underlying stock.

Protective Puts Using Mini Options

Buy To Open Mini May $450 Call = $10 x 10 = $100 paid

ITM Ratio Spreads using Mini Options

This is perhaps the most overlooked options strategy opportunity using mini options. Small retail options traders have never been able to take advantage of the advantageous risk profile of ITM ratio spreads due to holding only one contract of an expensive option. ITM ratio spread is transforming a long call bullish position or a long put bearish position into a volatile position that profits when the underlying stock goes upwards or downwards strongly. This is useful when your bullish or bearish outlook is no longer true and you wish to profit from a more volatile condition (learn more about the Six Directional Outlooks in Options Trading ). This is done by writing lesser number of contracts of ITM options against your existing long options. However, the problem is, if you are a small retail options trader who is holding only 1 contract of an expensive option, how would you be able to write lesser than 1 contract against it? This is where mini options come in!

With mini options, it is now possible to perform a 2:1 ITM Ratio Spread by writing 5 contracts of ITM mini options against your single contract of regular option! Since 5 contracts of mini options covers only 50 shares of the underlying, it is effectively half of a regular option. This kind of opportunity has never before existed for small retail options traders who can afford to buy only one contract of an expensive option!

ITM Call Ratio Spread Using Mini Options & Regular Options

Assuming AAPL’s May $425 strike price call options are asking at $20.00 and its Mini May $405 are asking at $43.00. You have enough money to buy only one contract of AAPL’s May $425 Call Options on your bullish outlook on AAPL. However, due to uncertainty that hit the market, you have decided to transform the position into an 2:1 ITM Call Ratio Spread so that you can profit no matter if AAPL went upwards or downwards strongly.

Buy To Open 1 contract of May $425 Call = $20 x 100 = $2000

Sell To Open 5 contracts of Mini May $405 Call = $43 x 50 = ($2150)

5 contracts of Mini May $405 = $500 — $405 = $95 — $43 = $52 x 50 = $2600 loss

1 contract of May $425 = out of the money = $2000 loss

The good news is, most options brokers do recognise the short mini options as part of an options spread against the long regular option so very little margin is required.

Advantages of Mini Options

2. Allows Protective Puts to be bought on as little as 10 shares.

3. Allows ITM Ratio Spreads to be written against just 1 contract of regular options.

4. Allows expensive options to be traded with smaller investment.