Michael James on Money A Retirement Income Strategy

Post on: 2 Июнь, 2015 No Comment

Wednesday, October 23, 2013

A Retirement Income Strategy

I find most rule-of-thumb strategies for drawing retirement income from savings very unsatisfying. We have things like the 4% rule and using your age as a percentage for your bond allocation, but such one-size-fits-all rules cant possibly fit everyone. Here I introduce my own candidate strategy for generating retirement income.

Troubles with the 4% Rule

The 4% rule says that when you start retirement you can calculate 4% of your initial savings and spend this much each year rising with inflation. So, if you have $1 million saved, you spend $40,000 in the first year and increase this amount by inflation every year.

Of course, the main problem with this rule is the possibility of running out of money. If your investments perform poorly in the first few years, you just keep spending based on your initial savings even though your savings will start to dwindle quickly.

A second problem is that everyone uses the same percentage regardless of how they invest their money. Suppose two investors, April and Ben, have exactly the same asset allocation. But April is a do-it-yourself investor who pays 0.2% in ETF fees each year, and Ben pay 3% fees each year on his mutual funds. Obviously, Bens spending has to be 2.8% lower than Aprils. If April can only spend 4%, then Ben can only spend 1.2%.

Yet another problem is the inconsistency of treating two investors differently when they have exactly the same portfolio size. Suppose that Cheryl and Dan are both 70 years old, have been retired for 5 years, and both have $1 million in savings. However, Cheryls portfolio began 5 years ago with $1.1 million and Dans has stayed steady at $1 million. The 4% rule will have Cheryl spending 10% more than Dan because she started with the larger portfolio. But this makes no sense given that they are in the same position now. You could even argue that Cheryl should spend less than Dan because her portfolio returns are weaker than Dans and, being a woman, she is likely to live longer.

Troubles with using your age as a bond percentage

People have different risk tolerances. Some of these differences are rational and some irrational. A tenured professor might reasonably have more appetite for stock risk than a middle manager in a high-tech company. A retired 55-year old might reasonably have less appetite for risk than a 55-year old who plans to work for another 10 years. On the irrational side, some people simply cant sleep at night with any of their money in risky investments no matter what a rational analysis might conclude. Given these differences, how can we have a one-size-fits-all bond allocation rule make sense?

Income variability

Any strategy that keeps income completely stable (like the 4% rule) is going to either have a risk of running out of money or have such a big margin of safety that income will be very low. So, we need a strategy that adapts monthly spending based on portfolio performance. The goal is to find a way to keep spending as steady as possible without undue risk of running out of money.

Im sure that financial advisors will tell me that many of their clients simply could not tolerate a reduction in their monthly spending. While this may be true, I would rather slowly reduce my spending than just run off the edge of a cliff when the money runs out. So, even if many people cant adjust their lifestyles until all the money is gone, Im more interested in a strategy that makes sense. That said, I still think controlling the volatility of cash flow is an important goal.

My proposed retirement income strategy

So heres the idea. After retirement, we maintain 5 years of spending in a high-interest savings account (HISA). The rest gets invested the same way it was before retiring. In my case, thats 100% low-cost stock index ETFs. The tricky bit is calculating the appropriate monthly spending amount. And because this amount will vary somewhat, the 5 years worth of savings in the HISA will vary somewhat. This means that there will be rebalancing between the HISA and the investment portfolio.

To calculate monthly spending, we need to make a series of assumptions. We choose a spending level so that if our return assumptions are exactly correct, we will run out of money at a chosen life expectancy. If returns are higher than expected then spending will go up the next month, and if returns are lower than expected then spending drops. As we will see in an experiment, monthly spending based on this rule turns out to be more stable than portfolio returns.

Here are some of the assumptions that I used in an experiment:

Portfolio return. inflation + 3%

This may seem conservative for an all-stock portfolio, but if we choose this to be too high then retirement spending will drop over time. I think it makes sense to choose this percentage to be lower than historical returns, but how much lower depends on how accepting you would be of reduced monthly income. Another thing to consider is that this percentage should be lower for investors who choose to include investments in bonds, real estate, or any other asset classes that historically have had lower returns than stocks.

HISA return. inflation +0%

Im assuming here that the high-interest savings account interest will just match inflation.

Years of spending money to keep in the HISA. 5

I dont have any particular justification for using 5 years other than it seems like long enough to stay sheltered from some wild swings in the stock market.

Life expectancy. 95

This is conservative, but hey, who wants to run out of money early. It probably would make sense to increase this life expectancy age is we get closer to it. Perhaps the remaining life expectancy should never go below 15 years.

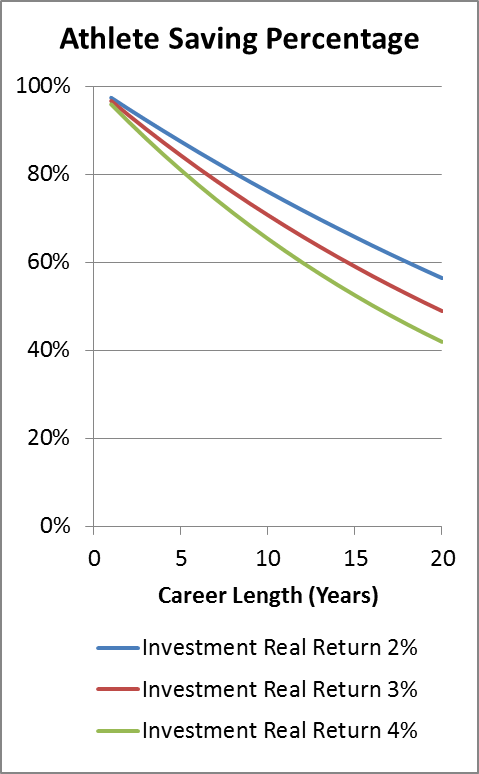

Using these assumptions, I did an experiment based on a 60-year old retiring at the start of the year 2000 with $1 million in todays dollars. (All of the dollar amounts in the experiment are adjusted for inflation.) The portfolio holdings other than the money in the HISA are invested 100% in the Canadian stock ETF XIU. I dont recommend such a high concentration in Canadian stocks, but the goal here is to see how portfolio volatility affects monthly retirement income.

A few other details were that I assumed stock trades cost a $10 commission, a one-cent per share loss due to spreads on each XIU trade, and we only make stock trades when the amount of cash in the HISA is more than 5% from its target value.

Here are the steps that get performed at the start of each month.

1. Take the total portfolio value and calculate the monthly spending amount (rising with inflation) so that we would run out of money exactly at age 95. Transfer this amount to a chequing account from the HISA or form the investment account if there is cash there, possibly from dividends. (If any readers are interested the details on how to calculate the monthly spending amount, Ill answer questions about it in the comments section for this post.)

2. Calculate the amount that needs to be in the HISA to support 5 years of this monthly spending.

3. If the actual HISA balance is low by more than 5% of its target value then sell enough stock (or other investments) to bring the HISA up to target. Selling stock periodically is inevitable as we spend down our savings.

4. If the actual HISA balance is high by more than 5% of its target value then transfer the excess from the HISA and buy stock (or other investments). This can happen when stocks drop sharply.

Experimental results

The following chart shows how monthly spending, adjusted for inflation, varied from the year 2000 to the present. Also shown on the chart is the value of XIU with reinvested dividends adjusted for inflation. The starting dollar amount of XIU was chosen to best contrast XIU price with monthly retirement spending in the chart.

While the XIU investment value varied over a range of 98% of its starting level, monthly spending varied over a range of 56% of its starting level. So, monthly retirement spending is less volatile than stock prices, but perhaps still too volatile.

At this point you may ask why monthly spending has to be so volatile. After all, if the stock market drops, it will probably come back eventually. This may or may not be true, but the model I used always assumes that whatever the current stock market level, this is the base from which steady 3% above inflation gains will be made. So, in this sense, we assume any big drop in stock prices is permanent and spending must go down. Factoring in some amount of stock price reversion of the mean in the model may be a path to improving my strategy, or it may just increase the risk of running out of money.

To try to reduce monthly spending volatility, I did a second experiment where we hold 10 years worth of spending in the HISA. Here are the results:

This time the monthly spending is steadier; it varies over a range of only 45% of its starting value. The trade-off is that monthly spending is generally about 10% lower in this case because more of the retirees portfolio is locked up in the low-return HISA instead of in XIU. Despite XIUs volatility, it did give a positive return above inflation from the year 2000 to the present.

Limitations of this analysis

I havent dealt with taxes or the complication of a portfolio split across a number of different types of accounts, like RRSPs, RRIFs, TFSAs, and taxable accounts. I havent factored in CPP benefits or old age security. As well, Ive only experimented with one time period for stocks. However, I did choose a very volatile period that included two significant bear markets for stocks, so at last we have a test of severe conditions.

Overall I consider this to be just a starting point for my thinking on how Ill handle my own portfolio when I choose to retire. To be clear, I think it would be crazy for anyone to blindly follow my recipe for retirement spending. Im very interested in ideas for improving it.