Metric Price to Earnings

Post on: 22 Апрель, 2015 No Comment

P/E equals current share price divided by earnings per share

The P/E (or Price to Earnings ratio) is the most common measure of the cost of a stock. The P/E ratio can be calculated one of two ways, either as a stock’s market capitalization (total shares times cost per share) divided by its after-tax earnings. or as the current share price divided by earnings per share.

For example, the P/E ratio of company A with a share price of $50 and earnings per share of $5 is 10.

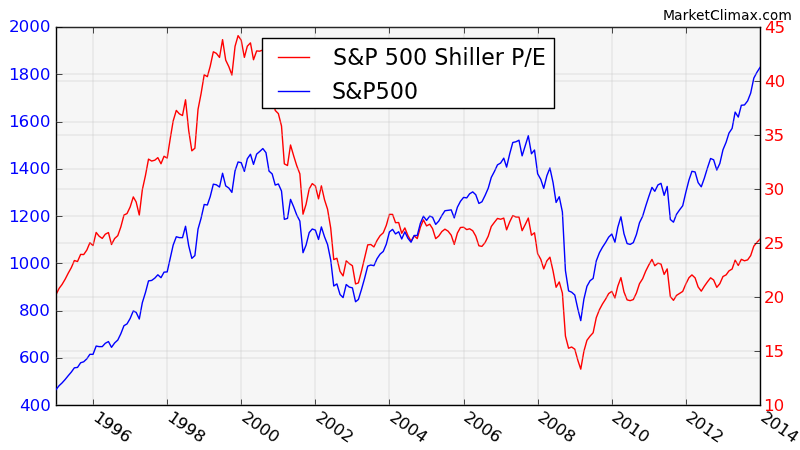

The higher the P/E ratio, the more the market is willing to pay for each dollar of annual earnings. In general, a low P/E is considered a sign that a stock may be undervalued, or that investors expect poor future earnings. By contrast, a high P/E is thought to indicate an over-valued stock, or one that is expected to post significant earnings increases.

It should be noted that there is no mathematical basis for what a company’s P/E should be. Rather, a high or low P/E is defined only in relative terms. Historically, P/E ratios for US listed companies have averaged between 14 and 16, though functionally, stocks with P/E below about 12 are considered low while P/Es above 40 or 50 are considered high, in absolute terms. A P/E’s significance (i.e. high or low) on more general terms is dictated by a company’s P/E in relation to its industry and competitors. In other words, the industry a company is in often has as much to do with its P/E ratio as the company’s performance, and therefore the metric may be useless unless taken in context. Thus, because of the major discrepancies in earnings results across sectors, P/E ratios are most useful when comparing companies in the same industry.

Capital Structure Bias

One weakness of P/E ratios is that they are impacted by a company’s choice of capital structure. Companies that have chosen to raise money via debt will often have lower P/Es (and therefore look cheaper) than companies that raise money by issuing shares, even though the two companies might have equivalent enterprise values. For example, if a company with debt were to raise money by issuing shares of stock, and then used the money to pay off the debt, this company’s P/E ratio would shoot up because of the increased number of shares — although nothing about the fundamental value of the business has changed.

This makes it difficult to use P/E ratios to compare different companies with different amounts of leverage. As a result, ratios of EV / EBITDA. which are unaffected by capital structure, are a more effective way of comparing the price of two different companies.