Metric Cash Flows from Investing Activities

Post on: 24 Апрель, 2015 No Comment

Cash Flows from Investing Activities represent the net change in cash from the use or sale of income-generating assets

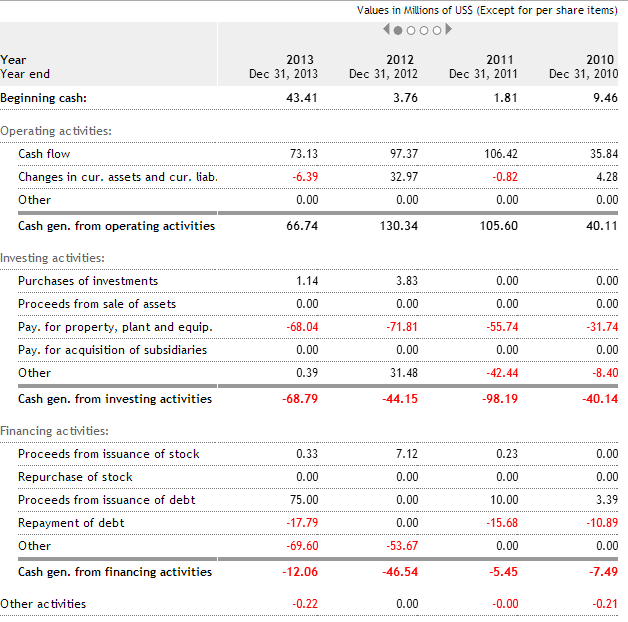

Cash Flows from Investing Activities (alternately Investing Cash Flow) is a measure (listed on a company’s Cash Flow Statement ) of the total cash generated or lost by a company’s investments (items purchased with the purpose of generating future cash returns). Typically included in this calculation are cash flows from stocks, bonds, physical property (such as plants and equipment) and money made (or lost) from the buying and selling of subsidiaries.

Different accounting standards vary as to exactly what items can be classified as investments. For example, International Financial Reporting Standards (IFRS) hold that because certain research and development expenditures can be itemized on a balance sheet. they are investing activities. U.S. Generally Accepted Accounting Principles (GAAP) dictate that all research and development costs must be instantly expensed on a company’s income statement and appear as a cash outflow for that accounting period.

Unlike most other metrics, negative Cash Flows from Investing Activities are not necessarily bad, nor are positive Cash Flows from Investing Activities necessarily good. Negative Cash Flows from Investing Activities may simply mean the company is purchasing long-term investments for the future health of the company, while positive Cash Flows from Investing Activities may mean the company has sold off investments to generate short-term cash, potentially even at a loss from the original price paid for the investment.

Because of the ambiguous nature of the metric, Cash Flows from Investing Activities must be considered alongside other metrics such as Cash Flows from Operating Activities.

Examples

- Company A purchases a profitable subsidiary. The net income generated by that subsidiary after its acquisition by Company A will be considered part of Company A’s investing cash flow (as a cash inflow).

- In fiscal 2007, Company B purchased $1,000,000 in government bonds as a low-risk investment for the future. On it’s annual Cash Flow Statement. this $1,000,000 is recorded as a negative Cash Flow from Investing Activities (or cash outflow). In early 2009, in the wake of the 2008 Financial Crisis. Company B sells off these bonds to generate much needed cash for continued operations. The value of the sale is reported as a positive cash inflow, listed under Cash Flow from Investing activities, regardless of whether the final value is greater than or less than the initial purchase value of the bonds.