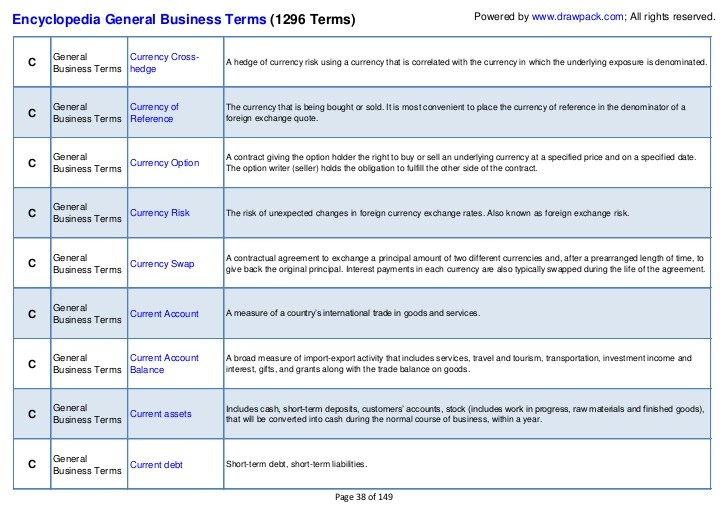

Merger arbitrage (Business) Definition Online Encyclopedia

Post on: 16 Март, 2015 No Comment

Definition: [crh] In the context of hedge fund s, a style of management that involves the simultaneous purchase of stock in a compaDefinition: ny being acquired and the sale of stock in its acquirer.

Risk arbitrage. also called merger arbitrage. is a form of speculation on the outcome of takeover bids. It is essentially an absolute return strategy and should usually be market neutral.

merger arbitrage Speculative trading strategy designed to exploit relative mispricings between the stocks of a firm and another it intends to merge with or acquire.

Merger Arbitrage Investing Opportunities

SeekingAlpha Jan 23 Comment

Cushing Shippers Discount Pipeline Space as Arbitrage Narrows.

Merger arbitrage also called risk arbitrage would be an example of this. Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company.

Merger arbitrage (Risk arbitrage ) — exploit pricing inefficiencies between merging companies.

Special situation s — specialized in restructuring companies or companies engaged in a corporate transaction.

Multi-strategy — diversification through different styles to reduce risk.

(1) Acquisition in which all assets and liabilities are absorbed by the buyer. (2) More generally, any combination of two companies. The firm’s activity in this respect is sometimes called M&A (Merger and Acquisition)

Merger Arbitrage.

The firm’s activity in this respect is sometimes called M&A (Merger and Acquisition) Merger Arbitrage In the context of hedge fund s, a style of management that involves the simultaneous purchase of stock in a company being acquired and the sale of stock in its acquirer.

Distressed and merger arbitrage also belong to the event-driven category.

In distressed strategies, the fund manager bets on the equity of companies that are going through a difficult financial period, but which the fund manager believes have a good chance of making a recovery.

Funds usecurrency options, futures, convertible bond arbitrage, merger arbitrage. and elaborate cross currency hedge s, but the most effective hedges are expensive. Among the most successful hedge fund strategies in recent years has been convertible bond arbitrage.

Trade Takeover Stocks With Merger Arbitrage

Cram-Down Deal

1. A situation in which a creditor is forced to accept undesirable terms imposed by a court during a bankruptcy or reorg anization.

In the context of hedge fund s, a style of management that combines many different types of hedge fund investing such as merger arbitrage. distressed securities and high yield investing, in conjunction with an important event that is supposed to unlock firm value (like a merger announcement.