Measuring Investment Risk and the Significance of Sharpe Ratio

Post on: 30 Июнь, 2015 No Comment

Investment pros borrow a tool from the statisticians’standard deviation’to measure investment risk. It shows the range of returns that investments are likely to earn over a given period of time and it has two sides, the out-performance and the under-performance of an average rate of return.

For example, let’s look at the S&P 500 Stock Index1 and consider the average rate of return 12.1% and standard deviation +/-19% for 100 years. The standard deviation tells us that a relatively bad year for the Large Cap market overall would have been negative -6.9% and a relatively good year would have yielded a higher positive return 31.1%. The range from -6.9% to 31.1% corresponds to outcomes within one standard deviation of the 12.1% average. It captures 68 of the total 100 observations. If the trend of this previous century carries into the next, we might expect that 2/3 of the time, this collection of stocks will provide a return within this range.

Of course some of the outcomes fall outside of the one standard deviation range either worse than -6.9% or better than 31.1%. While one standard deviation is commonly cited in the press, and most financial literature, you can go out to two standard deviations, which covers about 95% of observations or three, which accounts for over 99%. Naturally, the highs are much higher and the lows are much lower for these broader ranges of outcomes. In other words, the greater the degree of dispersion, the greater the risk.

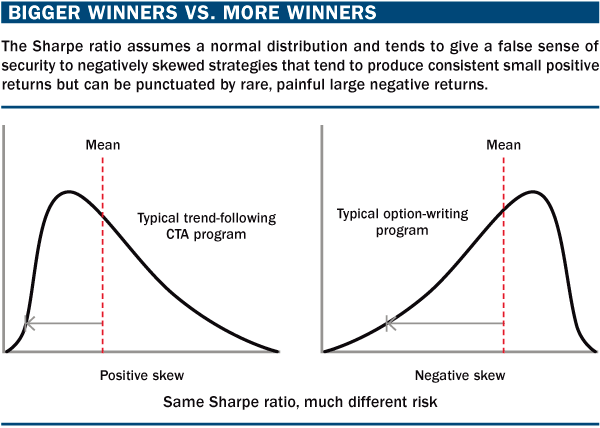

The Sharpe Ratio, on the other hand, is a commonly used measure of portfolio earnings quality. In short, the Sharpe Ratio is a measure of return achieved per risk taken. Sharpe ratios can be better than just looking at performance because it incorporates the issue of risk. Some would say it is a measure of a manager’s ability to perform consistently. The number by itself, however, is hard for many to understand without comparing it to something.

Let’s again take a look at the S&P 500 Index for a quick comparison. The Standard & Poor’s 500 Index is usually considered the benchmark for US equity performance. As the name suggests, the S&P 500 consists of 500 companies from a diverse range of industries. Contrary to popular belief, the S&P 500 is not a simple list of the largest 500 companies by market capitalization or by revenues. Rather, it is 500 of the most widely held US-based common stocks, chosen by the S&P Index Committee for market size, liquidity, and sector representation. For the last ten years, the Sharpe Ratio for the S&P 500 is less than 0.40 and it doesn’t look much better when looking over the past thirty years.

Are you familiar with Morningstar, Inc. They are a Chicago-based, global investment research firm, providing information, data, and analysis on the mutual fund industry. They say that a Sharpe Ratio of over 1.0 is pretty good and outstanding funds achieve something over 2.0.

For most investors, the Sharpe makes good intuitive sense because they not only hate to lose money but they often compare the returns to risk free investing. You owe it to yourself to understand and consider this measure when making investment decisions.