McDonald s Profit Margins Are Going Down McDonald s Corporation (NYSE MCD)

Post on: 14 Июль, 2015 No Comment

We remain in what I have been calling a golden age of corporate profits. Huge deficits, low savings rates and low wages relative to productivity gains are funneling dollars into the bottom lines all over corporate America.

The recent data on Q3 corporate profits shows an ever-extending gain in after tax corporate profits as a percent of GDP.

Hats off to corporate America for being in fantastic shape. It’s lean, highly efficient and highly profitable.

Take McDonald’s (NYSE:MCD ) for example. Here are its net profit margins over the last 10 years.

2002 11.0%

2003 10.7%

2004 12.9%

2005 12.3%

2006 13.3%

2008 17.9%

2009 19.4%

2010 20.6%

2011 20.4%

2012 19.7%

2013 19.7% Est. Value Line

It helps that they have raised the price of their Big Mac faster than the rate of inflation since 2002; the same year the margins started to expand.

Source: h/t James Cornehlsen

In July of 2008, according to the Big Mac index, a Big Mac cost $3.57. In July of 2012, the Big Mac cost $4.33. In 4 years, the price went up 76 cents or 21.3%.

In those same 4 years, the average hourly wages for all private employees was $21.62 in 2008 and up to $23.63 as of November of 2012.

Average hourly wages are up only $2.01 per hour or 9.3% from 2008.

This is in spite of the average nonfarm business sector output per hour or productivity being up 8.7% in that same period.

In the standpoint from McDonald’s and their Big Mac. U.S. employees, the working class who are more or less the ones who eat at McDonald’s are being asked to pay more as a share of their hourly earnings for a Big Mac. It is much of this asking to pay more that has contributed to expanding profit margins from 11% in 2002 to 19.7% in fiscal year 2012.

Seems like a very easy way to increase profits: raise prices.

You can’t have your cake and eat it too as McDonald’s is now just starting to find out. In October, sames stores sales at McDonald’s declined 1.8% globally. That was the first time same store sale declined year over year since 2003.

However, just looking at the Big Mac index chart above, it was 2003 when the big price push began.

Has McDonald’s reached their price break point? Are folks going to buy ground beef and make burgers on the BBQ instead? Of course not all at once but perhaps that is a shift we may well be seeing in the future unless McDonald’s lowers prices.

This aggregate demand problem is something that I’ve been forecasting given the negative real wage growth, especially since 2011.

See this chart below of year over year CPI Vs. year over year average weekly earnings in the private sector.

Blue bars are average weekly earnings

Red bars are CPI

Wages simply aren’t keeping up with inflation, again, in spite of gains in productivity.

Here are the variables:

Wages and the price of items like B ig Macs.

If wages keep rising below the rate of inflation, aggregate demand will continue to be a problem and companies will have to lower prices which will likely cause margins to fall.

If wages pick up and start outpacing the rate of inflation again, those wage increases will also put a dent in profit margins.

Given the current state of profit margins across corporate America, there is ample room for price wars to occur as aggregate demand becomes more and more a problem.

I’m less optimistic wages will rise faster than the rate of inflation in the near future. Until we see a greater % of the population drop out of the work force, lowering the unemployment rate, folks will have to accept the wages offered because there is a good chance that there is someone else more desperate for the job and will be willing to accept the going rate of pay.

In the event McDonald’s doesn’t lower prices, I expect aggregate demand to drop. While this may not impact margins to much, overall profits would suffer.

I would also expect margins to drift back down to the 11%-15% range over the next 3-5 years based on this analysis.

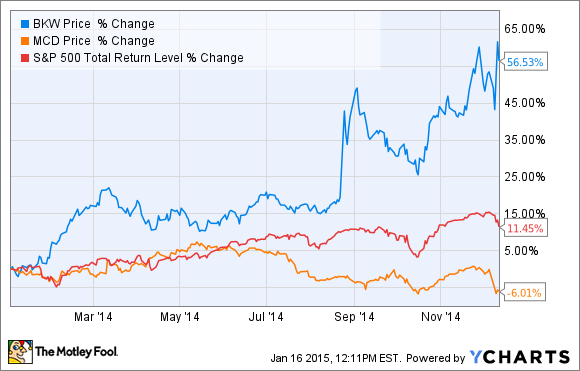

Here is a 10 year price chart of McDonald’s:

Current P/E is 17.1 with a yield of 3.4% makes the shares fairly valued in a growth environment. In the event the growth is no longer the environment, just as improving margins worked wonders for the share price over the last 10 years, declining margins should prove to have the opposite effect.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Since you’ve shown interest in MCD, you may also be interested in