MBIA Priced for Catastrophe

Post on: 16 Март, 2015 No Comment

Error.

Updated Jan. 21, 2008 11:59 p.m. ET

THE EQUIVALENT OF A MASSIVE METEOR strike hit the bond-insurer industry last week, which rendered even the leading concern, MBIA, a smoking crater.

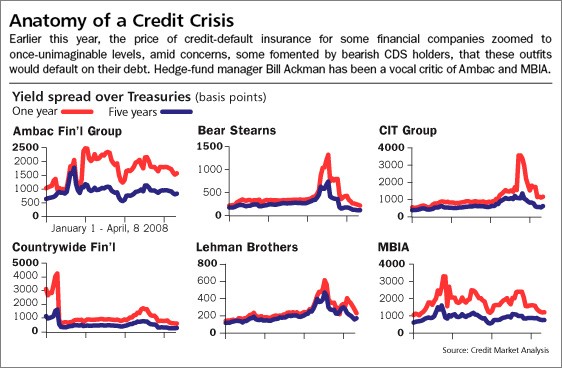

Yet in the week’s last three sessions the stock resumed its slide, plummeting some 60% at one point before settling Friday at around 8. The $1 billion of capital-surplus notes MBIA had issued earlier in the week to yield 14% had sunk in value to the mid-70s, for a yield- equivalent of more than 20%. Credit protection on MBIA’s debt likewise jumped to a first-year cost of $3.1 million per $10 million of debt exposure and an insurance-premium cost of $500,000 a year for the next four years, according to Bloomberg. This implies a more-than-70% chance that MBIA will default on its debt in the next five years, Bloomberg added.

These sorts of numbers overstate the severity of MBIA’s admittedly substantial problems.

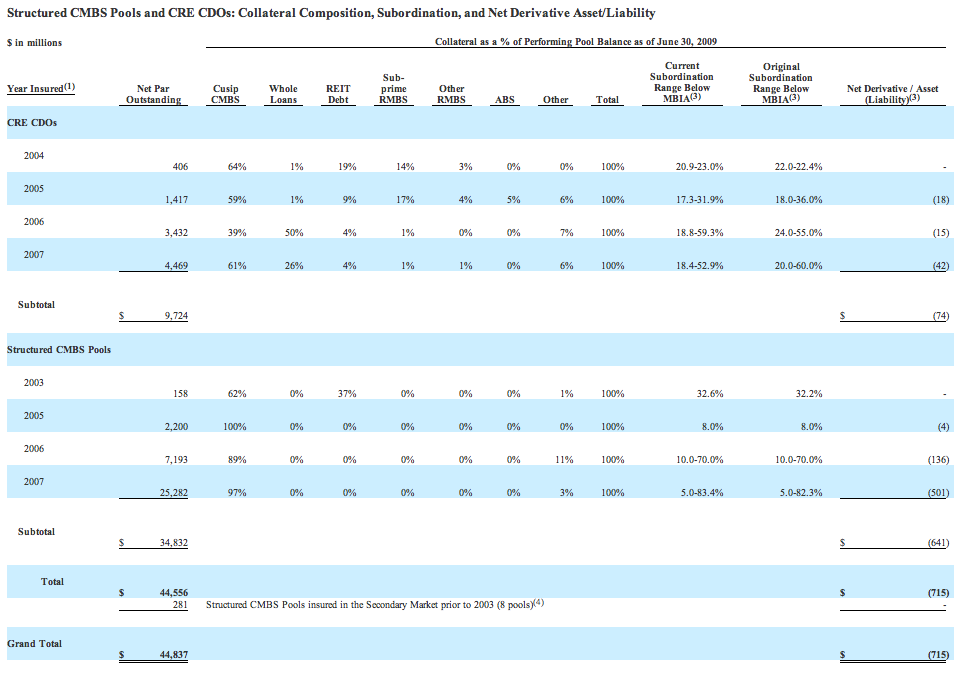

The reasons behind the latest collapse are several. Worries have grown that MBIA’s statutory capital — which, following the completion of its capital raise, will stand at around $8 billion — won’t be enough to make good on the subprime-securities default risks embedded in a $652 billion portfolio insured at par value. And it didn’t help that during the week, Standard & Poor’s suddenly upped its projection of cumulative losses on 2006-vintage subprime mortgages from around 14% to 19%, which, if valid, might eliminate much of the subordination layer protecting MBIA from claims losses.

A Cheap Stock: MBIA remains a profitable entity, but its shares are off nearly 90% from their highs.

We can’t say that Barron’s was surprised by MBIA’s fall from grace. We’ve written skeptical pieces on the company, marveling at its once-elevated stock price and the less-than-candid disclosure policies of its frequently oleaginous management team. Our latest effort (A Mortgage Meltdown for MBIA? , June 25, 2007), proved prescient in exposing some of its then-ignored subprime exposure. The stock then was trading at 65.

Still, we find the current price levels of its debt, credit-default swaps and, yes, even its stock to be absurdly low. For one thing, MBIA isn’t nearly as troubled as Ambac because it has far less exposure to the really-troubled subprime paper. Also MBIA has already completed raising, or locked in commitments for the additional capital demanded last month by Fitch and the other rating agencies. Ambac wasn’t so lucky.

Likewise, MBIA’s triple-A rating seems to have passed muster with both Fitch and S&P even after the latter ran a new stress-test on its 2006-vintage subprime exposure using the 19% cumulative default rate. MBIA said it’s now working closely with Moody’s to resolve the agency’s concerns. Moody’s worries seem to arise more from the uncertainty that exists in the housing market than MBIA’s capital levels, according to one third party. Without Ambac competing for new business, MBIA and the other bond-insurer survivors should be able to grow faster and strike more attractive insurance deals.