Match Your Mutual Funds to Your Investment Objectives

Post on: 21 Июль, 2015 No Comment

7b61332863-ef44-46d6-95cc-606115fe0c32%7d_fts_bp_header_a.png /%

Choose Mutual Funds to Match Your Investment Objectives

As you and your investment professional select investments for your portfolio, you may decide that buying mutual funds 1 will help you meet your investment goals. But which funds should you choose?

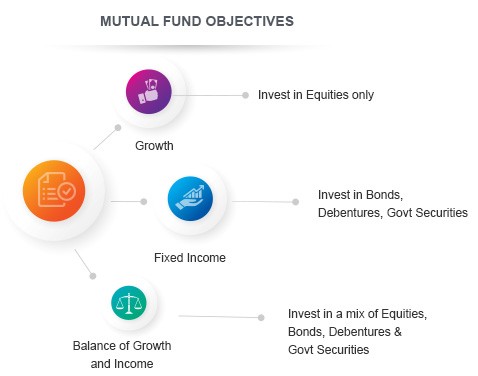

The mutual fund world offers many choices that may complement your other investments. In addition to choosing from among stock, bond, and money market funds, you’ll want to select funds whose objectives match your investment goals.

Aggressive Growth Funds typically invest in higher growth, higher risk companies. Although some investments will be unsuccessful, others may do well over the long term.

Growth and Income Funds generally hold stocks of established companies that are expected to grow and currently are paying high dividends. These funds may offer more consistent returns than more speculative funds.

Growth Funds invest in stocks of growing companies, with the expectation that the companies — and the stocks — are likely to increase in value. Funds may invest in small, mid-size, or large companies, or in all three.

High Yield Funds invest in low-rated or unrated bonds — known as junk bonds — that may produce high income. Because such bonds have a higher likelihood of default than higher rated bonds, they’re considered risky investments.

Income Funds hold investments that generate current income. They can be stock or bond funds, or balanced funds that invest in both.

Municipal Bond Funds invest in tax-exempt 2 bonds issued by a single state or several states. Income is generally exempt from federal taxes.

Sector Funds 3 focus on one area of the economy, such as technology, pharmaceuticals, utilities, etc. Performance generally depends on how well the sector is doing.

Value Funds invest in stocks of companies that are considered to be undervalued — that is, their stock prices are lower than they seem to be worth — in the belief that the stocks’ true values will be recognized over time.

Your Fifth Third Securities investment professional can help you choose mutual funds or other investment options that suit your needs.

1 An investor should consider the funds investment objective, risks, sales charges, expenses, and ongoing fees carefully before investing or sending money. This and other important information about the investment company can be found in the fund’s prospectus. To obtain a prospectus, please call (888) 889-1025. Please read the prospectus carefully before investing.

2 Fifth Third Securities does not provide tax or legal advice. Please consult your tax advisor or attorney before making any decisions or taking any action based on this information.

3 Sector funds may be subject to greater volatility than funds that invest more broadly.