Master Limited Partnerships (MLPs)

Post on: 21 Май, 2015 No Comment

Master Limited Partnerships ( M LPs)

Natural Gas Pipelines

Given the shaky global economy, this might be a good time to consider Master Limited Partnerships (MLPs), in particular, those that operate natural gas pipelines.

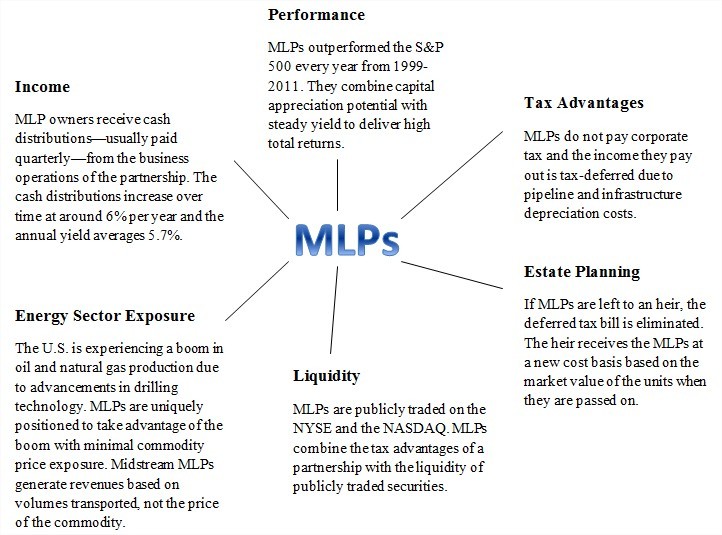

Many pipeline operators, relatively immune to economic downturns, already paying dividends equating to 5% to 7% yields, will probably grow their payouts substantially over the next few years.

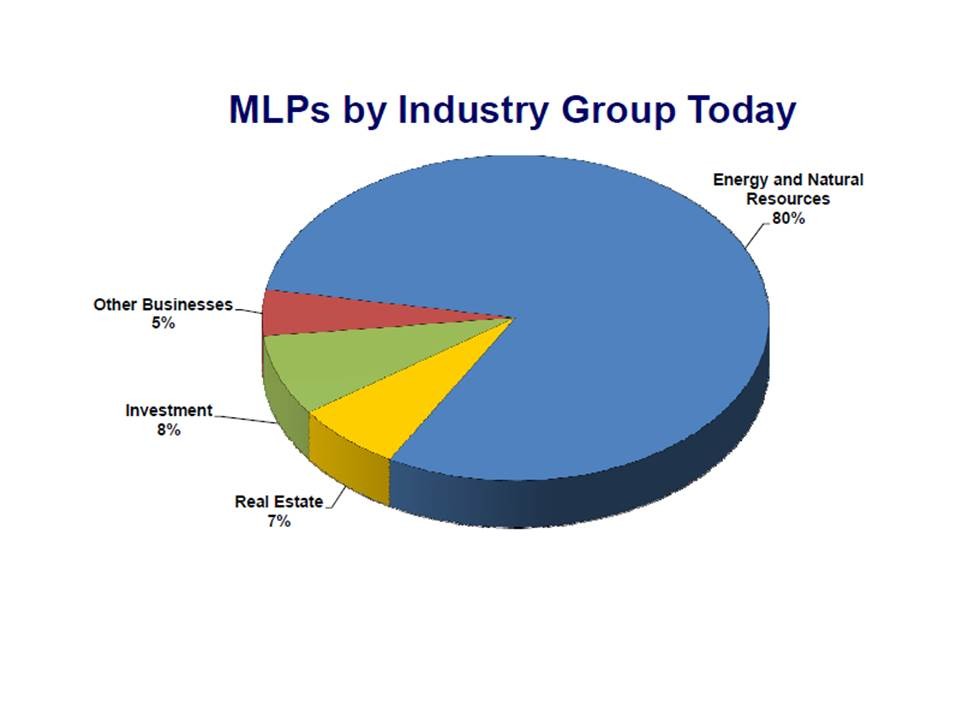

Besides for natural gas pipeline operators, you can find MLPs that operate crude oil and/or refined petroleum product pipelines, MLPs that are propane distributors, and others that produce oil crude oil and/or natural gas.

The way MLPs are structured, a general partner runs the business, while individual investors are limited partners. The general partner receives a percentage of the profits before the limited partners get their cut.

When MLPs first started in the mid-1980s, oil and gas producers set them up for tax purposes. They would transfer their pipeline assets to an MLP, with the oil or gas producer as the general partner.

Although that still happens, nowadays some general partners are in unrelated businesses. In fact, many general partners are themselves MLPs, which are also publicly traded.

The terminology for MLPs is different than for corporations. You own units instead of shares, and the payouts are called distributions instead of dividends.

So, why am I telling you about MLPs now?

Pipeline owners operate relatively stable businesses. Profits depend more on the volume of product transported than on oil or gas prices. They’re not affected by what happens in Greece or Italy. A slowing U.S. economy might cut the volume of products transported, but not by that much. Since they usually serve different geographic areas, pipelines don’t to worry much about competition.

Most pipeline operators are growing steadily, both by increasing the capacity of existing pipelines and by building or acquiring new pipelines. However, the outlook for natural gas pipeline operators is especially bright.

National policy encourages finding ways to substitute natural gas for crude oil and coal wherever possible. New drilling techniques have made natural gas plentiful, driving down prices, further encouraging its use, and hence, the need for pipelines.

Besides for long-haul pipelines, natural gas pipeline MLPS also operate gas-gathering systems, which connect wells to public pipelines, as well as processing plants that produce natural gas liquids such as propane or butane.

The gathering and processing operations expose pipeline operators to short-term natural gas price fluctuations, so profit margins can vary when prices change rapidly.

Tax Issues

Roughly 75 % to 85 % of MLP distributions (dividends) are classified as return of capital, which are not taxable until you sell your holdings. The balance, typically 15% to 25% of distributions, is return on capital and is taxable in the year received.

If you hold MLPs in a tax-sheltered account, such as an IRA, your return on capital distributions (from all MLPs) should not total more than $1,000 in a single year. If they do; the amount exceeding $1,000 may be considered unrelated business income and subject to taxes. For that and other reasons, MLP tax reporting is more involved than for regular dividend stocks.

Finding MLPs

You can use the free stock screener provided by FINVIZ.com to find pipeline MLPs. If you’re not familiar with the term, a stock screener allows you to search through all listed stocks to find those meeting your specific requirements.

Find the screener from the FINVIZ homepage (finviz.com ) by selecting Screener. FINVIZ calls its selection parameters “filters.” On the Filters bar, select “All” so that you can see all of the available filters at the same time. Use the associated dropdown menus to select the desired filter values. Start by specifying “Oil & Gas Pipelines” from the Industry menu. Then, select “Market-Cap Over Two Billion” to rule out small players, which are inherently riskier than larger firms.

Next, select “Over 5% ” for dividend yield to limit your search to high-dividend candidates. Then, specify “Over 5% ” for “return on equity,” which is a profitability measure, to limit your list to the most profitable firms.

You need growing earnings to power dividend growth, so specify “Over 5% ” for “EPS Growth Next Five Years,” which means that analysts are expecting at least 5% average annual long-term earnings growth.

Finally, specify “over 40%” for institutional ownership to limit the field to MLPs that are in favor with the “smart money.” Try reducing this limit to “over 30%,” or “over 20%” if you want to see more choices.

My screen turned up three natural gas pipeline MLPs.

• BPL Buckeye Partners (BPL) pays a 6.1% distribution yield.

• Magellan Midstream Partners (MNP) 7.1% yield.

• Targa Resources Partners (NGLS) 6.5% yield.

As is the case for all stock screens, consider the MLPs turned up by the screen to be research candidates, not a buy list. The more you know about your stocks, the better your results.

For more on MLPs, check out the Master Limited Partnerships section of my Dividend Detective site.

published 11/6/11