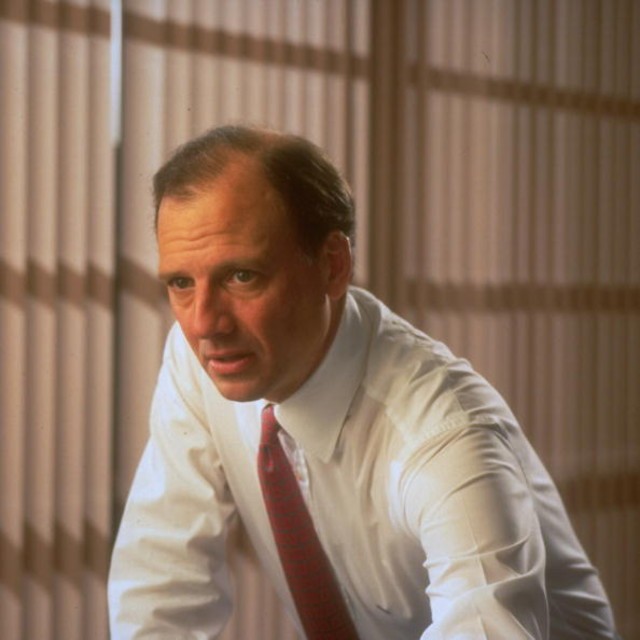

Martin Zweig

Post on: 3 Апрель, 2015 No Comment

Martin Zweig was born in 1942 in Cleveland, Ohio and died at his home in Fisher Island, Florida in February, 2013. He was a huge fan of Jesse Livermore, and often mentioned it.

He took his first degree at the University of Pennsylvanias Wharton School of Finance, then an M.B.A. at the University of Miami, studying by night and working as a stock-broker by day. He completed his formal education in 1969, with a Ph.D. in finance at Michigan State University.

Shortly after completing his Ph.D. Zweig invented the puts/call ratio, a well-known market indicator.

A Growing Reputation

Between 1970 and 1972, Martin Zweig wrote several articles for Barrons magazine. In each, he made a successful prediction for the coming direction of the market.

The resulting public demand led him to begin small-scale publishing of The Zweig Forecast, a market letter. After he advertised The Zweig Forecast in Barrons, it took off.

Zweig Forecast

The Zweig Forecast was the top market advisory for the 15 year period between 1980 and 1995*. Zweig Forecast delivered a 16 percent per annum compounding return, the highest risk-adjusted return of any market advisory service during that time.

According to the AAII**, out of more than 50 stock-screens it operated between 1998 and 2006, the Martin Zweig Stock Screen was been its top performer rising more than 1700 percent.

From Crash to Public Prominence

Martin Zweig was a regular guest on PBSs Wall Street Week and he rose to public prominence when, during one of his appearances, he predicted the stock market crash of October 1987. Zweigs prediction was timely, coming the weekend before the collapse.

The success of investors who bought and followed the methods described in his book, Winning on Wall Street, further enhanced his reputation.

Investing Strategy

The basic Martin Zweig stock market strategy is to be fully invested in the market when the indications are positive and to sell stocks when indications become negative. Risk minimization and loss limitation are crucial to the strategy. His book Winning On Wall Street describes how he determines whether to be fully invested or not.

In the book, Zweig says, People somehow think you must buy at the bottom and sell at the top to be successful in the market. Thats nonsense. The idea is to buy when the probability is greatest that the market is going to advance. Zweig used fundamental company data to select stocks to buy while the market is positive.

The inspiration behind a number of Martin Zweigs methods came, he said, from Jesse Livermore.

William ONeils highly successful CANSLIM investing method shares a number of features with Zweigs methods.

Less Publicity Please

In contrast to his frequent appearances on television in the late 1980s and early 1990s, Martin Zweig lived more privately in his later years. He was well known for owning the most expensive apartment in Manhattan a triplex penthouse on Fifth Avenue.

* Hulbert Financial Digest

** American Association of Individual Investors