Markets Live Profit taking sends ASX back to 5900

Post on: 29 Июль, 2015 No Comment

Date February 26, 2015

- (1) Comments 241 Read later

Patrick Commins, Jens Meyer

5:06pm: Thats it for Markets Live today.

Thanks for reading and your comments.

See you all again tomorrow morning from 9.

5:05pm: Investors hopes for a push by stocks through the 6000 mark were quashed on Thusday as profit taking ended the market’s three-day winning streak, despite several strong earnings results and growing expectations of a rate cut next week .

The S&P/ASX 200 closed down 36 points to 5908.5, while the All Ordinaries closed 31 points lower to 5877.9.

The drop came after the global sharemarket rally took a breather and some disappointing local data soured the mood, Suncorp head of treasury research Darryl Conroy said.

We saw a record low of 2.7 per cent in annual growth in wages. we also had construction work data in the negative and a significant revision down on the previous month, and today we’ve had the highly anticipated capex data which surprised. I think those factors played on the Australian market, he said.

Data from the ABS showed a 2.2 per cent fall in business investment (capex) over the past quarter, and 3.6 per cent drop over the year, leading CBA chief economist Michael Blythe to call a rate cut at the Reserve Bank of Australia’s meeting next week.

This adds to the case for the RBA to step up to the plate again , he said. I think we’ll see a 2 per cent cash rate next Tuesday.

The story in Asian markets was markedly different. Chinese markets jumped to four-week highs on Thursday after shaking off the previous day’s slow return from the weeklong Lunar New Year festivities, Hong Kong’s Hang Seng climbed 40 points and the Japanese Nikkei was up over 0.5 per cent.

We have moved contrary to our Asian peers, it seems it was those local events trading the market down, Mr Conroy said.

Thursday proved another busy day in reporting season, with a broad selection of companies posting results.

Qantas’s half-year results were the most buoyant of the day. The company turned around a previous first half’s pre-tax loss of $252 million to post an underlying profit of $367 million, which came in above its guidance of up to $350 million. But its share price stayed muted, rising just 1.4 per cent to $2.85. Its shares have more than doubled since October.

Nine Entertainment posted a loss of $88.8 million, a 6.7 per cent fall on the first half of the 2014 fiscal year, inline with guidance. It will pay an interim dividend of 4.2. Nine shares were suprisingly the strongest performer for the day, up 9.4 per cent to $2.03.

The market loser was Transfield Services. which delivered a 75 per cent rise in first half profit to $8.4 million, but investors dumped the stock, and its share price lost 6.4 per cent tp $1.53 as mining services companies continued to get battered as the big miners tighten their belts on the sinking iron ore price.

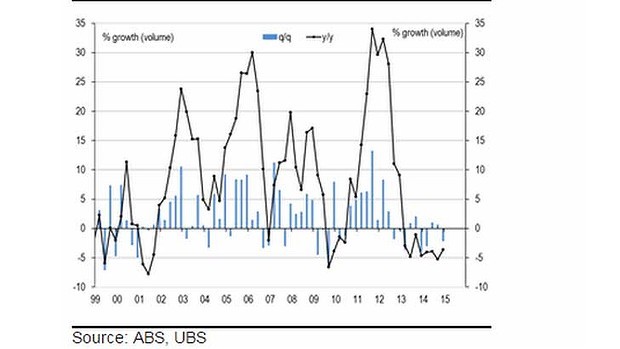

4:49pm: Here’s a nice chart by Gerard Minack that dramatically illustrates just how important mining capex has become for Australian economic growth, and why everyone is so worried about investment in the sector ‘falling off the cliff':

4:48pm: Shareholders of Australia’s largest listed food manufacturer Goodman Fielder have voted in favour of a $1.3 billion takeover offer from Singapore oils trader Wilmar International and Hong Kong investment company First Pacific.

More than 99 per cent of votes were cast in favour of the 67.5-a-share offer on Thursday in Sydney, while just over 80 per cent of shareholders approved overall.

A Federal Court hearing is scheduled for 2 March to approve the takeover. and Goodman Fielder shares are expected to stop trading the day after.

Goodman Fielder owns brands such as Helga’s and Wonder White bread, MeadowLea margarine and Praise mayonnaise .

Chairman Steve Gregg said: We are very mindful of the iconic status of Goodman Fielder across Australia and New Zealand and the rich history it enjoys across this region.

Wilmar’s scale and distribution networks, together with First Pacific’s experience and both parties’ financial resources, will provide meaningful scale to Goodman Fielder’s existing operations and allow the company to grow its presence further in the Asia Pacific region.

Goodman Fielder last week reported a 54 per cent fall in baking earnings to $9.1 million and 13 per cent fall in grocery profits.

20Lead%20-%20wide6670959013ptnhimage.related.articleLeadwide.729×410.13ptg6.png1424927816413.jpg-620×349.jpg /%

Shareholders of food company Goodman Fielder have approved a $1.3 billion takeover. Photo: Peter Morris