MarketLinked CDs A Risk Free Method of Stock Investing

Post on: 27 Июнь, 2015 No Comment

- What Is a Market-Linked CD?

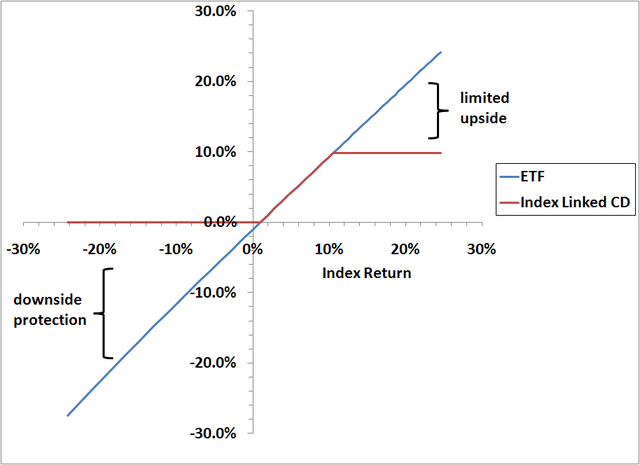

A market-linked CD is similar to any other bank CD except that the total return is linked to the performance of a specific market index such as the S&P 500. In addition to receiving a specific amount of interest on the CD the bank will pay an additional amount if the stock market goes up. The amount paid based on stock markets gains is determined by a specific formula devised by the bank and is usually capped at a certain percentage. For example, a market-linked CD may pay only a maximum of 5 per cent even if the market is up much more than that over the term of the CD.

What Is the Risk of Buying a Market-Linked CD?

The risk of principal loss is zero since the CD is insured by the FDIC up to $250,000 for an individual account and up to $500,000 for a joint account. At the end of the CD term a depositor will receive at least the original principal plus the stated interest rate on the CD. If the stock market declines for the entire period covered by the term of the CD the only gain will be the interest that the bank agreed to pay on the CD. For a very risk averse investor who refuses to invest in stocks and would have simply kept his savings in a bank it is a product well worth considering since there is a zero risk of principal loss plus the opportunity for a higher yield than could be obtained from a regular bank CD.

What Is the Downside of Market-Linked CDs?

The downside of a market-linked CD is that they are the most appealing after a market has already declined. Investing in a market-linked CD at the bottom of a bear market would result in far smaller gains compared to investing directly in stocks. During the market turmoil associated with the banking crisis, the market-linked CDs were very popular and attracted billions of dollars when the market was on the verge of a major recovery. In addition, fully understanding a market-linked CDs can be very difficult due to complicated formulas for determining when and how much an investor is paid based on changes in stock prices.

Can I Create My Own Market-Linked CD?

Thanks to the existence of U.S. government zero coupon bonds an investor can easily construct his own version of a risk free product with a guaranteed interest return and the potential for capital gains. For example, how could a long term investor with $100,000 who wants some equity exposure but also wants to make sure he has at least his original principal left at the end of 22 years accomplish his objective? The first step would be to purchase a U.S. government zero coupon bond for about $48,000 that has a maturity value of $100,000 in 22 years. The remaining $52,000 can be placed into a well-diversified equity fund. The investor can walk away at that point with peace of mind knowing that the stock market would have to collapse to zero in order for his original investment to be worth only $100,000.