Market Timing Stock Market Timing

Post on: 6 Сентябрь, 2016 No Comment

What is Market Timing?

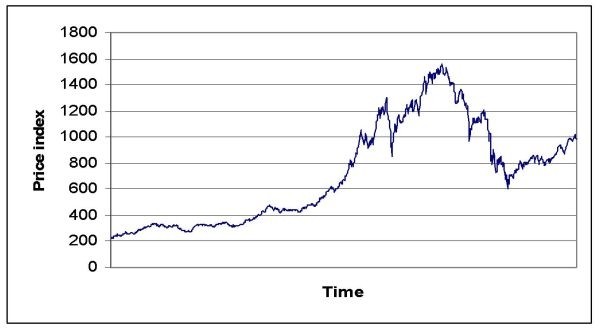

Put simply, timing the market refers to the activity of predicting the future direction of the stock market using technical analysis or other forms of forward looking data analysis. There is an overwhelming majority, Jack Bogle included, who believe in the efficient market hypothesis which suggests that it is impossible to beat the market over a longer period of time. However, a growing number of technical analysts and even fundamental analysts have developed market timing strategies which have outperformed the market, year after year. Warren Buffett is your greatest example of this. He has beaten the S&P 500 in 20 of the past 24 years.

Dont get me wrong, timing the stock market is no easy task and you dont hear about many who consistently beat the market. For those of you who are not trading as full time professionals, the efficient market hypothesis will almost definitely hold true. However, the fact of the matter is that it is possible to beat the market over a longer period of time if you have the proper tools and education to do so. The stock market is a game of odds, just as many things in life are. Being able to create successful stock market timing strategies will take time, education, dedication, and perseverance. Until you truly understand how the market operates, you will continue to believe that it is something similar to a slot machine. However, once the light bulb goes on, you will be handsomely rewarded with a skill that will never be lost.

If you are looking for a magical formula that will bring you the riches, the stock market is not the place for you. Trust me, there is no such thing as a free lunch, especially in the stock market. You are wasting your time and money if you are consistently looking for a short cut. Traders who are successful at timing the market have developed their skill at reading the flow of money which is the truest indicator of the markets intentions. They have built up their intuitive senses to realize when a trend has developed and create trading strategies to take advantage of those situations. These same traders remove their emotions from their decision making process and rely on their ability to put together various technical (or fundamental) indicators which put the odds in their favor. No matter how good you are at market timing. you will lose money if you do not have money management rules in place. I have seen countless traders who develop great trading strategies, but fail to cut their losers short and take massive drawdowns in their accounts. Remember, simple mathematics suggests that a 50% drop will require a 100% gain to break even. Great traders drop their ego, accept their losses and move on to the next trade almost effortlessly. They react to the message of the market, not their own personal wants.

Common Market Timing Strategies

When I think about market timing, I think about it in terms of primary and secondary indicators. We discuss many of these stock market timing indicators in our stock market direction article. For us technicians, primary indicators are those which allow us to assess the internal health of the market. This would include analysis of price, volume, and the relationship between the two. Candlestick charts and time tested technical chart patterns help us perform this analysis.

Additionally, the McClellan Oscillator. advance/decline line, new highs & new lows, and up/down volume are a few indicators which can help us understand the money flow and internal strength of the market.

Secondary indicators are ones which tend to be repeatable patterns that have been observed over time, and therefore respected by many traders. While these can be highly effective at times, you dont want to get caught relying on them as your only method for timing the stock market.

Some time tested cyclical stock market timing strategies are the 4 year cycle in the stock market, the January Effect. and the approach of Selling in May & Going Away. These patterns tend to repeat themselves with stunning accuracy. The 4 year presidential cycle stipulates that a stock market will make a major low every 4 years while the January Effect measures the results from the first five trading days of the year to forecast the direction of the entire year. Finally, sell in May and go away is a market phenomenon which has been very accurate for decades. Investors who only own stocks between November and April have historically done much better than those who buy and hold throughout the entire year.

Another secondary indicator that should be looked at is sentiment. When traders get too heavily positioned to one side, there tends to be a reaction to shake the trees. The AAII sentiment index does a good job of gauging this.

Our goal with this lesson was to convey that you shouldnt buy into the hype that the market is too random to be outperformed on a regular basis. However, this doesnt mean you should quit your day job and become a full time trader either. Market timing is one of the hardest undertakings for any individual to get involved with but can change your life if you learn how the machine really works.