Market Timing – Rarely a Good Strategy

Post on: 16 Март, 2015 No Comment

In our latest Private Banking study we found one quite surprising result: Many of the surveyed financial advisers recommended our test client to time the market. Their logic was that at present (this was around beginning of 2009) the risk was too high to enter the market, particularly the stock market. Later on in the year however, the timing would be much better. We asked many questions on how to determine the right point in time to invest. And we received as many different responses: Technical analysis, following intelligent money (they meant hedge funds or institutional investors), experience, gut feeling, looking at the business cycle and so on. Who should then make the timing decisions? In some cases there was an investment committee, consisting supposedly of the brightest and sharpest minds in the bank. In other cases the personal adviser claimed to make the decisions himself.

Hard data proves the failure of market timing

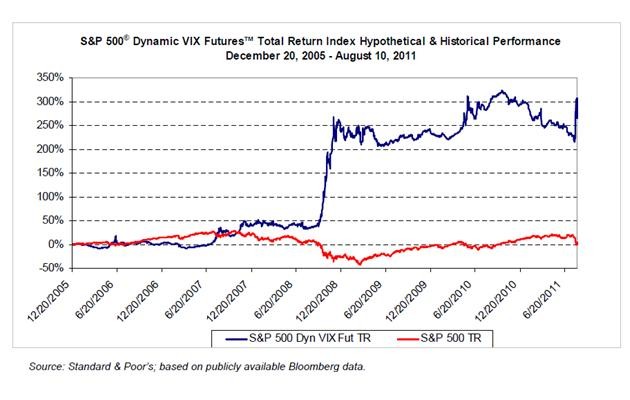

To find out if market timing that was heavily promoted by about 50% of the surveyed banks makes sense, we have checked the evidence. Here was the next surprise: There is a lot of data out there on timing strategies and the verdict is clear: Market timing rarely makes sense. In most cases the performance is far worse than for a buy-and-hold-strategy. In addition, market timing requires trading and trading generates fees (except for those cases where a flat fee covers trading costs).

So, what is the evidence? In a recent blog post we quoted a presentation made by John Bogle, the founder of Vanguard, a fund investment firm specialising in indexing products. In his speech Bogle proves backed by hard numbers that traders who use ETFs for market timing employing rapid-fire trading techniques to move in and out of ETFs, do much much worse than the fund itself. He calculates that over the last five years index funds have shown a total of 6% positive returns whereas active investors using ETFs to time the market and trade were 12% negative. That is an average, but the numbers are consistent across 40 out of 46 major ETFs. Incidentally, the data were compiled by Morning Star, a renowned fund research firm.

Way back in 1975 William Sharpe, one of the fathers of the efficient market theory, published a seminal article with the title Likely Gains from Market Timing . In this article Sharpe showed that in order to over perform with market timing you have to be right in almost 74% of your timing decisions. Consider how unlikely such a decision-making performance is unless you or your adviser have a crystal ball.

Another line of argument shows that if you missed the best 10 days in a period of 10 years (1994-2004) for the S&P 500, the average performance per year would have fallen from around 12% to 6%. If you missed the best 20 days your performance would go down to less than 3%. And if you missed the best 60 days (over the 10-year period) your performance would have been a devastating -7.9%.

Never try to time the market except when it is strongly overheated

There might be one exception: If the stock market is extremely overvalued, measured by an average long-term valuation indicator like a trailing 10-year price/earnings ratio (p/e ratio). For instance, Professor Robert Shiller has argued long before the market crash in 2008 that US equities are way above their long-term average valuation. He showed, for example, in February 2008 that the S&Ps 10-year trailing p/e ratio was above 25, more than double its historic average.

What is then to be learnt from all this data? Trying to time the market does not make a lot of sense. Most likely you will end up losing money as compared to long-term strategies. Therefore, keep your wealth manager from market timing related trading. Make an exception only when you see hard evidence that the stock market is strongly overheated. For this decision make use of long-term data, dont sell based on technical analysis, gut feeling of your adviser or some shady reference to where the intelligent money is flowing.