Market Manipulation in the Financial Crisis

Post on: 13 Май, 2015 No Comment

The Trader has covered many of the market microstructure questions over the past months, that should concern many more. Majority of investors, managers, traders and others have not adapted to the “new” market, nor have they realized what is actually going on. With HFT dominating every market move, people still feel an increasing frustration, but have not adapted accordingly. This is due to lack of insight. Our biggest “fear”, is that an increasing amount of investors, end up avoiding the markets, purely due to the fact that the markets have become a “monster”, that is overseen by nobody. The competence gap between the regulators (worldwide, not only the SEC) and the market has become huge.

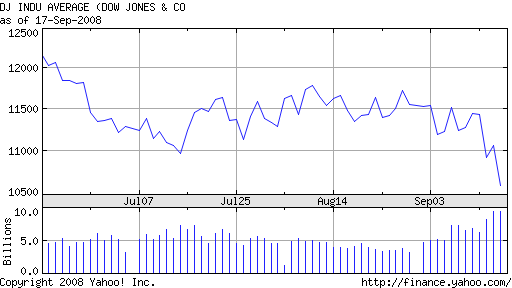

We have still not read any intelligent analysis from regulators what actually happened during the flash crash last year. We have not read too many reports of what happened after the uptick rule was abolished etc. We are pro technical “algo” development, but are not pro broken markets. One of our biggest fears, is the fact this market is showing signs of fatigue, and where some external events might trigger a total failure of the market microstructure. Market micro structure must be overseen by the regulators, but in order to do so successfully, they need to gain competence and understanding of what is going on in “live” trading. HFT is one aspect, but there are many more. Below interesting observations on the bear raid in Citi at the beginning of the 207 crisis (still ongoing). Could this bear raid have caused the crisis to become much deeper? By Misra, Lagi and Bar-Yam;

We provide direct evidence of market manipulation at the beginning of the financial crisis in November 2007. The type of market manipulation, a bear raid,” would have been prevented bya regulation that was repealed by the Securities and Exchange Commission in July 2007. Theregulation, the uptick rule, was designed to prevent market manipulation and promote stabilityand was in force from 1938 as a key part of the government response to the 1928 market crash andits aftermath. On November 1, 2007, Citigroup experienced an unusual increase in trading volumeand decrease in price. Our analysis of nancial industry data shows that this decline coincidedwith an anomalous increase in borrowed shares, the selling of which would be a large fraction of thetotal trading volume. The selling of borrowed shares cannot be explained by news events as thereis no corresponding increase in selling by share owners. A similar number of shares were returnedon a single day six days later. The magnitude and coincidence of borrowing and returning of sharesis evidence of a concerted eort to drive down Citigroup’s stock price and achieve a pro t, i.e. abear raid.

Interpretations and analyses of nancial markets should consider the possibility that theintentional actions of individual actors or coordinated groups can impact market behavior. Marketsare not suciently transparent to reveal or prevent even major market manipulation events. Ourresults point to the need for regulations that prevent intentional actions that cause markets todeviate from equilibrium value and contribute to market crashes. Enforcement actions, even ifthey take place, cannot reverse severe damage to the economic system. The current alternative”uptick rule which is only in eect for stocks dropping by over 10% in a single day is insucient.Prevention may be achieved through a combination of improved transparency through availabilityof market data and the original uptick rule or other transaction process limitations.