Market Enters Deliberation Mode Ahead of FOMC LMAX Exchange Opinions

Post on: 19 Апрель, 2015 No Comment

Technical & Fundamental highlights

EURUSD – technical overview

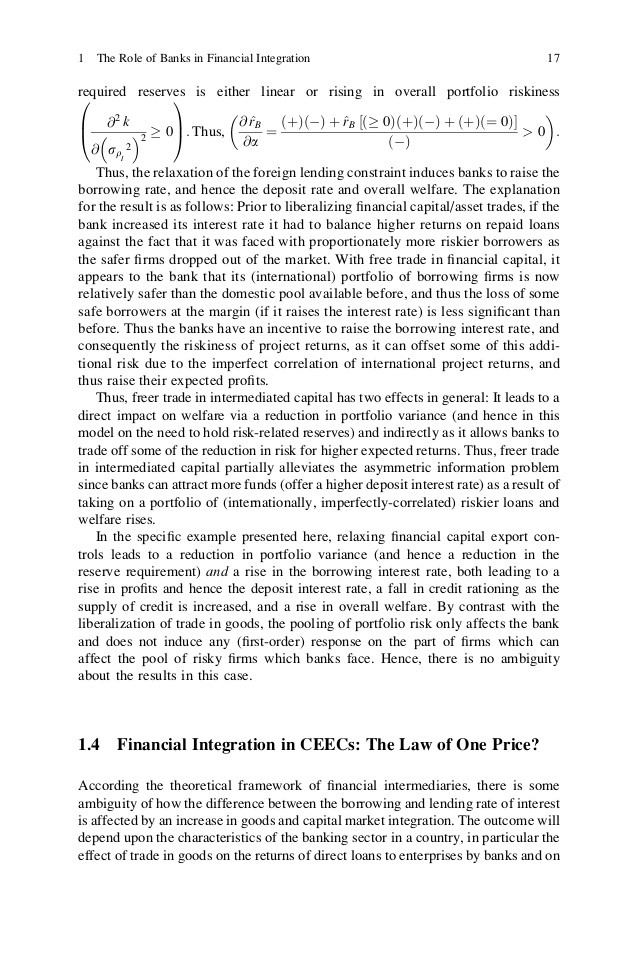

The market could finally be warning of some form of a short-term bottom after putting in a bullish close on Thursday. Technical studies are severely oversold across daily, weekly and monthly time frames and in desperate need on turning up. Still, a break and daily close back above 1.0717 will be required to confirm the onset of a correction and take the immediate pressure off the downside. Inability to close above 1.0717 will keep the the pressure on the downside for a move into the 1.0300-1.0400 area.

EURUSD – fundamental overview

Finally some relief for the Euro in Thursday trade. with the market benefitting from a sizable round of profit taking on USD longs after breaking down to another multi-year low below 1.0500. The Euro was able to hold on to a decent amount of the gains despite some heavy offers, with the much weaker than expected US retail sales print casting some doubt over the certainty of the Fed confirming an H1 rate liftoff at next weeks meeting. The economic calendar for Friday is rather light, with the only standouts coming in the form of US PPI and Michigan sentiment.

GBPUSD – technical overview

The recent break below 1.4951 has resulted in fresh 2015 lows. while confirming a medium-term lower top at 1.5552. This opens the door for the next major downside extension towards a measured move objective at 1.4350 in the weeks ahead. Still, with the market looking a little stretched below 1.5000, there is risk for a short-term bounce. But any rallies are now expected to be very well capped ahead of 1.5300, with only a break above 1.5555 to force a shift in the structure.

- R2 1.5096 – 11Mar high – Strong

- R1 1.5028 — 12Mar high – Medium

- S1 1.4813 – 2013 low – Strong

- S2 1.4700 – Figure – Medium

GBPUSD – fundamental overview

Solid UK trade data and a broad based sell-off in the US Dollar didnt do much to help the Pounds cause, with the UK currency coming under some relative pressure and dropping to fresh multi-month lows against the Buck. BOE Carney was sourced as the primary driver of underperformance, after flagging extended risk for a longer period of lower inflation. It seems the Pound has also suffered in sympathy with the US Dollar given the market assessment the BOE is the closest to the Fed as far as the timing of a hike is concerned. So with Fed liftoff expectations being cut back somewhat on the softer retail sales print, this has caused the Pound to be weighed down in sympathy.

USDJPY – technical overview

A multi-week consolidation going back to December has finally been broken, with the market taking out the 7-year high at 121.85 and triggering a bullish continuation. From here, the door is now open for the next measured move upside extension towards 128.15 over the coming weeks. Still, on a short-term basis, there is risk for some corrective weakness. However, any setbacks should be well supported in the 118.00 area, with only a break back below 115.55 to negate the constructive outlook.

- R2 122.50 – Mid-Figure – Medium

- R1 122.02 – 10Mar/2015 high – Medium

- S1 120.61 – 9Mar low – Medium

- S2 119.90 – 6Mar low – Strong

USDJPY – fundamental overview

A bout of broad based profit taking on US Dollar longs. aided by some much softer than expected US retail sales data, have kept a lid on USDJPY, despite the major pairs recent break beyond the December, 7-year peak at 121.85. Even a resurgence in equities hasnt done much to support this pair in recent trade and the lackluster topside follow through has been a little surprising. But overall, Fed, BOJ monetary policy divergence continues to be the primary driver in this market, and there is plenty of risk for additional medium-term USDJPY upside on this merit. A well known US think tank has strengthened this outlook after issuing a piece calling for a June Fed liftoff. As such, any setbacks should continue to be very well supported on dips. US PPI and Michigan sentiment are the main releases in Friday trade.

EURCHF – technical overview

The recovery out from the historic low from several weeks back continues, with medium term technical studies breaking up from oversold levels. However, the correction has finally come into some stiff resistance just over 1.0800, with the market rolling back over and at risk for deeper setbacks in the sessions ahead. Still, the recovery remains intact while above 1.0415, with a higher low sought ahead of the next upside extension towards 1.1000. Only back below 1.0415 would give reason for pause.

- R2 1.1000 – Psychological – Strong

- R1 1.0815 – 20Feb high – Medium

- S1 1.0550 – 16Feb low – Medium

- S2 1.0415 – 9Feb low – Strong

EURCHF – fundamental overview

The initiation of ECB QE is giving the SNB a headache. with Eurozone bond yields recently dipping to record lows and opening a fresh wave of Franc demand. Still, talk the SNB could move further into negatives rates, potentially from -0.75% to -1.50%, has done a good job of offsetting, keeping the EURCHF rate well supported into dips. But with plenty of uncertainty still out there, the SNB will need to keep a close watch, as scope exists for additional safe haven Franc flow, especially with global equities showing signs of topping. Thursdays softer US data and subsequent recovery in US equities has been EURCHF supportive.

AUDUSD – technical overview

Despite the latest bounce, the downtrend remains firmly intact. with a lower top now confirmed at 0.7913 following the recent break below 0.7625. This opens the door for the next major downside extension, with setbacks projected towards a measured move objective at 0.7335. Any rallies should be well capped below 0.7800 on a daily close basis, while ultimately, only back above 0.7913 would delay the bearish outlook and give reason for pause.

- R2 0.7800 – Figure – Medium

- R1 0.7740 — 9Mar high – Strong

- S1 0.7560 – 11Mar/2015 low – Medium

- S2 0.7500 – Psychological – Strong

AUDUSD – fundamental overview

The Australian Dollar had initially been supported in early Thursday trade following the on the whole better than expected Aussie employment data which showed unemployment dropping to 6.3% versus 6.4% forecast. We have since seen some broad based profit taking on an exhausted US Dollar run, which has helped to bid Aussie up some more against the Buck, though the currency is still quite pressured against Kiwi. Softer US retail sales have also contributed to the AUDUSD recovery. However, with commodities still under pressure and the RBA prepared to cut again, any upside should continue to be very well offered. The economic calendar for Friday is rather light, with broader macro flows expected to dictate trade.

USDCAD – technical overview

The outlook for this pair remains constructive. after recently breaking to fresh +5 year highs at 1.2800. This has opened the door for a push towards the next major objective in the form of the 2009 peak at 1.3065. However, the market will need to break and close back above 1.2800 to trigger a bullish resumption. In the interim, any setbacks should be very well supported ahead of 1.2500, while only below 1.2350 would negate the constructive outlook.

- R2 1.2850 – Mid-Figure – Medium

- R1 1.2800 — 30Jan high – Strong

- S1 1.2617 – 12Mar low – Medium

- S2 1.2573 – 9Mar low – Strong

USDCAD – fundamental overview

Market participants have been less focused on the Bank of Canadas optimistic oil forecasts and instead are reacting more to the actual price of the commodity, which remains under intense pressure. Bank of Canadas Mendes was out highlighting the impact of the fall in oil on the Canadian economy, calling it unambiguously negative. The Bank of Canada came out a little less dovish at its recent decision, encouraged with the stabilization in oil prices. But if this market decides to break down to fresh lows, it could spell more trouble for the economy and Canadian Dollar. Clearly, any sign of weakness will prompt the Bank of Canada to revisit the possibility of more rate cuts.

NZDUSD – technical overview

The market remains locked within a very well defined downtrend, with deeper setbacks seen ahead. Recent corrective gains have stalled out at critical previous support turned resistance just over 0.7600 and a fresh medium-term lower top is now sought out ahead of the next major downside extension through 0.7176 and towards the 0.6735 area further down. Ultimately, only a daily close back above 0.7614 would delay the bearish outlook.

NZDUSD – fundamental overview

The RBNZ decision to leave rates on hold at 3.50% this week was widely expected, though the market seemed to have been caught off guard with the slightly less than dovish tone. Comments from RBNZ Wheeler that he was pleased with Kiwis current level got a lot of attention, and this inspired a fresh wave of NZD demand, with the currency then accelerating further on the back of softer US retail sales. Still, with the central bank potentially introducing macroprudential measures as an alternative to rate hikes, with global risk sentiment slowly waning, and with the Fed divergence theme very much alive, any upside in the New Zealand Dollar should be limited, with leveraged accounts looking to take advantage and build into short positions.

US SPX 500 – technical overview

The trigger of a double top on the daily chart in the previous week has proven to be a significant development, with the market accelerating to the downside through the double top objective and looking like it wants to carve a more meaningful top off record highs. Look for rallies to be well capped ahead of 2085, while a close below 2040 will open the door for a fresh downside acceleration to 2000. Only back above 2105 negates and opens a retest of the 2120 record high.

US SPX 500 – fundamental overview

A softer Thursday US retail sales print gave investors the excuse they were looking for to buy back into the market. The discouraging economic data could now mean the Fed will err on the side of accommodation next week and keep the free money flowing. Still, on the whole the US economic recovery is moving in the right direction and pushing the Fed closer to a hike, and this reality should start to weigh more heavily on stocks going forward.

GOLD (SPOT) – technical overview

The recent break below 1190 delays the recovery outlook. with the market coming back under some intense pressure and within striking distance of the key 2014, multi-year low at 1131. At this point, a break and daily close above 1170 would be required to take the immediate pressure of the downside.

- R2 1190.00 – 24Feb low – Strong

- R1 1170.00 – 10Mar high – Medium

- S1 1147.00 – 11Mar low – Medium

- S2 1131.00 – 7Nov/2014 low – Strong

GOLD (SPOT) – fundamental overview

Speculation the Fed will need to move on rates in June has opened a fresh round of buying in the US Dollar, which has weighed significantly on the inversely correlated gold market. With inflation nowhere to be seen and the Buck in demand, many see no incentive to be buying gold at current levels. Still, there are plenty of bargain hunters out there that would argue differently. These players argue that with currencies across the board in a downward spiral, and global equities at risk of a major capitulation, there is no better place to be invested than in the yellow metal. Depressed prices are also starting to invite demand from emerging market players as well.

Feature – technical overview

US OIL has entered a period of consolidation since collapsing to multi-year lows at 43.55 in late January. At this point, it is unclear which way the consolidation will break and if the market is in the process of carving a meaningful base or is readying for a bearish continuation and the next major downside extension. A break above 54.25 or below 43.55 will now be required for clarity.