Market Capital Earnings Per Share (EPS) PricetoEarnings (P

Post on: 26 Апрель, 2015 No Comment

Market Capital, Earnings Per Share ( EPS ), Price-to-Earnings (P/E)

DISCLAIMER: If you trade stocks, you do so at your own risk. Trading/Investing in stocks carry high risk. Any trade or action you take in the market is your own responsibility. Techpaisa.com will not be liable for any loss arising out of the use of any information on the website by anybody.

We are pleased to announce that now you can view following fundamental information regarding stocks:

- Market capital

- Earnings Per Share (EPS)

- Price-to-Earnings (P/E or PE)

Market Capital

Market capital of a company is equal to the total number of shares times the share price of the company. Stock market indices such as NIFTY use free float market capitalization to get the weightage of company in index. Free float market capital of a company is equal to the number of publicly traded shares times the share price of the company.

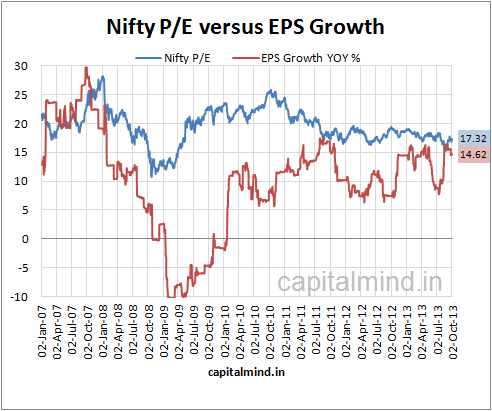

Earnings Per Share (EPS) and Price-to-Earnings (PE)

EPS is the profit made by company per share. Total net profit is not a good figure to compare two companies as their market capital will be different. EPS is the normalized profit per share. To compare two companies, EPS only is not enough as a company’s share might be worth Rs. 100 and other might be worth Rs. 1000. Company with share price Rs. 100 and EPS Rs. 20 is doing better than the company with share price Rs. 1000 and EPS Rs. 20. So to get a comparable metric share price is divided by EPS to get Price-to-Earnings Ratio (PE).

Companies release their financial results quarterly. There are two types of financial results: consolidated and non-consolidated. Consolidated results are better than non-consolidated results as they include results of all subsidiary companies too. We take consolidated results whenever available.

To calculate current PE, current share price is divided by sum of EPS of last 4 quarters. This PE is known as trailing twelve months (TTM) PE.

For each sector (on sector page at techpaisa), you can sort using PE or market capital to compare stocks from the sector on the basis of PE and market capital. You should not compare two companies from different sectors on the basis of PE as average PE of different sectors tend to be different. This is because some sectors have higher profit margins and thus higher average PE than some other sectors.