Managing Your Portfolio During a Recession

Post on: 12 Июль, 2015 No Comment

Keys to Reducing Risk and Keeping Your Assets Safe

You can opt-out at any time.

First, let’s cover a bit of background. According to the dictionary, a recession is defined as, “a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in the Gross Domestic Product (GDP) for two successive quarters.” In plain English, that means that business drops, on the whole, for six straight months. People stop or reduce spending on dining out, new furniture, cars, jewelry, and other so-called “discretionary” items, while businesses often cut capital expenditures such as new machinery, hiring employees, or moving to larger facilities.

Fortunately, there are general measures you can take to potentially reduce the long-term damage to your net worth during times of economic stress. As is our custom, grab a cup of coffee, browse through this feature, and consider what you can do to protect yourself and your family.

Focus on Consumer Staple Stocks

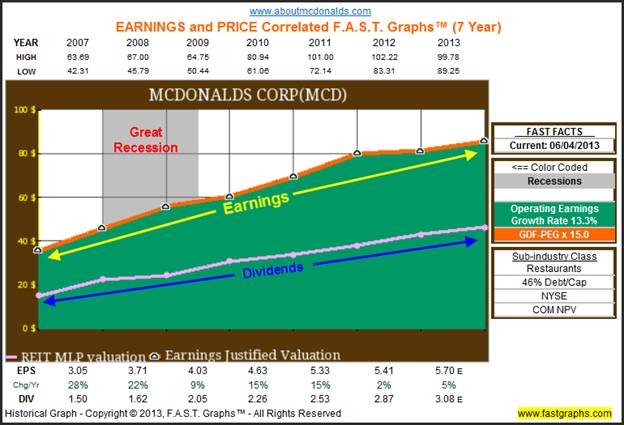

No matter how bad things get, people are going to figure out how to eat, buy toilet paper, and heat their homes. When money is scarce, items and services such as these, known as “consumer staples” and “energy”, constantly churn out profits for the companies that manufacture and sell them. Corporations like Procter & Gamble, Clorox, and Colgate-Palmolive aren’t likely to sell less toothpaste, shaving cream, laundry detergent, and dish soap unless things get really, really bad. They are bastions of financial strength in times of trouble.

Likewise, “affordable luxuries,” such as William Wrigley, Coca-Cola, PepsiCo, Hershey, and H.J. Heinz aren’t likely to feel too bad of a squeeze compared to the broader markets because a man or woman is very unlikely to give up his afternoon Coke or switch to an off brand chocolate bar because he suffered a pay cut or temporary job loss. In fact, products such as Folgers may even do better as people shy away from $4 lattes and cappuccinos yet want to stick to brand names they know and trust.

Some businesses, such as pawn shops and pay day lending stores, are probably going to experience sharp increases in profits and business, so it’s even possible to make outsized gains if you have no ethical qualms about owning these sorts of enterprises. That’s a decision that you will have to make for yourself.

Look for Companies with High Sustainable Dividend Yields

Jeremy Siegel, author and respected professor (read Why Boring is Almost Always More Profitable ), has shown in his research that dividends can lower the amount of time it takes you to regain losses in an investment. This is because reinvested dividends during crashes and market corrections purchase more cheap shares that will, in the future, generate far higher profits when the market rebounds.

In addition, dividend stocks often cause a stock to fall far less than non-dividend paying equities because they become “yield supported”. Imagine you were watching GPE Consulting Group common stock (a fictional company) at $100 per share. The shares pay a $5 dividend, yielding 5% ($5 cash dividend divided by $100 per share price = 0.05, or 5.00%), while United States Treasuries are paying 4.65%. Future prospects look decent; not terribly exciting, but as good as one can expect. Now, imagine that there is another company, River Rock Chocolate and Ice Cream (another fictional company) with a $100 per share price and no cash dividend.

Now, picture for a moment the following scenario: The stock market crashes. Investors panic, ordering their 401k plans to dump the equity mutual funds, forcing professional money managers to get rid of stocks they know are cheap. In the beginning, both GPE Consulting Group and River Rock Chocolate and Ice Cream crash to $60 per share. GPE now has a dividend yield of 8.33% while River Rock continues its no-payout policy. If the mutual fund manager has to sell off more shares, which one do you think he’s going to choose? I can almost guarantee that if prospects for the firms are equal, the dividend paying stock makes it to the next round while the non-dividend paying stock gets cut. International investors, wealthy individuals, and institutions are also likely to notice, at some point, the shares of companies trading at prices where the dividend yield grossly exceeds bond yields. If they believe that the payout is sustainable (the company will continue to make enough profit to pay, or “service” its dividend in industry speak), they are going to be inclined to invest. The end result of this is that portfolios consisting of more cash-generating dividend stocks tend to have far less volatility and suffer gentler falls than their counterparts.

Remarkably, this is true even when the dividend is cut provided that the stock price declines at a greater percentage than the dividend was lowered. Another benefit is that cash dividends signal to the broader market that the profits reported on the income statement are tangible. In times of financial crisis, the fact that one firm can prove it is making money by sending you cash in the mail provides it a lot of favor in investors’ collective eyes.