Managed Futures and Commodities Are Not the Same

Post on: 4 Апрель, 2015 No Comment

The managed futures industry has always suffered a kind of identity crisis that is reinforced in popular culture as well as by our own nomenclature. Images of the Chicago and New York exchange pits from the 1980s and 90s featuring open outcry, hand signals, pit runners and the prospect of fortunes made and lost on beans or oil are far more stimulating to the publics imagination than the reality of todays largely computer-driven, trend following trading systems.

Eddie Murphy and Dan Ackroyd selling short the market in orange juice futures in the 1983 film Trading Places is arguably more entertaining to most than watching a team of researchers discussing stochastic oscillators. Names like,the Grain Futures Act of 1922, the Commodity Exchange Act of 1936, the Commodity Futures Trading Commission (CFTC), Commodity Trading Advisors (CTAs) and Commodity Pool Operators (CPOs) lead many people, including financial reporters and investors, to just assume that todays managed futures managersand therefore the asset class category as a wholetrade exclusively in commodities. However, the data, I believe, points toward a different conclusion.

What does the data show? And how does it relate to managed futures?

The general perception is that the words commodity and volatility are normally found in the same sentence. Two of the best known commodity indexes are the S&P Goldman Sachs Commodity Index (GSCI Total Return Index) and the Reuters-Jefferies CRB Index (CRB Index). Both feature baskets of futures contracts designed to represent a broadly diversified, unleveraged long-only position in commodity futures. Significant differences in composition methodology, weighting and revision policies require more detail than we have room for in this discussion. However, a key difference between the two is the role of energy contracts. specifically crude oil. The CRB Index limits the impact of petroleum on the index to 33%. The GSCI Total Return has no such limit.

Accordingly, the respective performance of both indexes reflects this difference in energy contracts. Since 1990, the GSCI Total Return Index has returned 4.1% compounded annually through September 30, 2010. Volatility. driven mostly by fluctuations in crude oil and measured by annual standard deviation, comes in at 21.8% over the same period. The worst losing period, known as worst drawdown in the alternative investment world, captures the worst losing streak from top to bottom (in months). The statistic is a whopping -67.7% for the GSCI Total Return Index, and occurred between June 2008 and February 2009. The collapse in crude prices from over $140 a barrel to below $40 is arguably the primary explanatory variable. Meanwhile, over the same time frame, the CRB Index has returned just 1.1% annually, with a 12.8% standard deviation and a — 54.3% worst drawdown. Despite the lower weighting of crude oil, the losing period also occurred between June 2008 and February 2009.

Correlation statistics between the two indexes are interesting. The correlation coefficient is a number between -1 and +1 with the number zero representing non-correlation. Over 20+ years since January 1990, these two long-only commodity benchmarks correlate at 0.76, which is materially high. Over shorter periods, the correlation is even higher; since January 2000 (10+ years) it is 0.84 and since January 2005 (5+ years) it is 0.94.

Interesting (or not), but how does managed futures relate to this discussion? Despite the commodity nomenclature that drives the industry, managed futures should generally not be considered an exposure to commodities It can be, if you choose a specific

manager or fund that is commodity focused, but the largest proportion of the managed futures industry trades in financial futures, rather than commodity futures.

As of the end of Q3 2010, derivatives based on interest rates, currencies and equities accounted for nearly 90% of all trading volume on over 76 global exchanges, while the remaining trading volume was reflective of activity in the agriculture, energy, metals and other categories. (The source for the above data is the Futures Industry Association. Please note that energy includes contracts based on emissions. The Other category includes contracts based on commodity indexes, credit, fertilizer, housing, inflation, lumber, plastics and weather.)

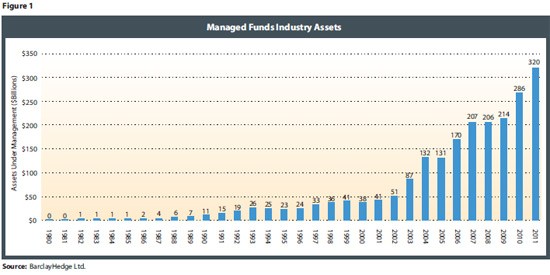

Of course, this trading volume accounts for all futures market participants. In this context, the $220 billion or so of assets invested in the managedfutures industry as of the same date (Source: BarclayHedge.com ) is a relatively small piece compared to sovereign wealth funds and multinational corporations with hedging requirements, along with all the other natural users of futures contracts. When we take a cross-section of the aggregate managed futures industry, as represented by the Altegris 40 Index of leading managers, we estimate that the financial market component is generally between 70% and 80% of manager exposures, with 20% to 30% invested in commodities.

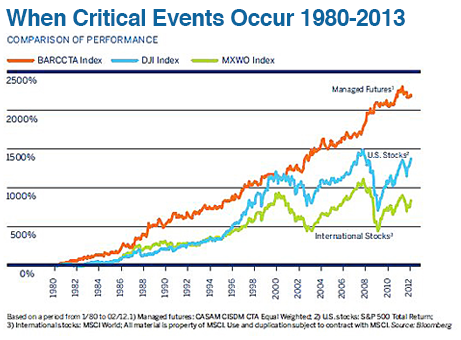

The comparisons to long-only commodity indexes dont end there. The Altegris 40 Index has compounded at 9.1% since 1990. with volatility of 12.0% and a worst drawdown of -15.0%. Even though they are known as Commodity Trading Advisors (CTAs), the professional investors running managed futures accounts on behalf of investors have the flexibility to be both long and short of all four major asset classes, including stock indexes, currencies, fixed income and, of course, commodities. As usual, past performance is not indicative of future results and commodity markets may outperform the Altegris 40 Index in any given period, but the historical data makes a strong case for managed futures.

If you need further evidence that we are indeed dealing with a separate asset class category. look no further than the correlation statistics. The Altegris 40 Index has a correlation of 0.08 with the CRB Index and 0.15 with the GSCI Total Return Index from January 1990 through September 2010. While there is no guarantee that correlations will not change in the future, these historical numbers are statistically negligible. Further, over the 10+ and 5+ year time frames discussed above, the correlations are little changed at 0.12 and 0.11 for the CRB Index, and 0.17 and 0.07 for the GSCI Total Return. Managed futures is historically non-correlated with long-only commodity indexes across all rolling time frames greater than two years.

The bottom line: historically, commodities have indeed been volatile. However, this asset class may still be suitable for client portfolios as a diversifier from stocks and fixed income.

I see managed futures as a separate and distinct asset class category that has historically delivered superior risk-adjusted returns when compared to long-only commodities. Although they will also experience periods of volatility and possible losses, managed futures have the potential to provide compelling portfolio diversification benefits. My recommendation is that you do not let the commodity-centric labeling confuse your search for diversification in these challenging times.

The views expressed by the author are his own, and do not constitute an opinion or analysis of Altegris Advisors, LLC or its affiliates . The risk of loss in trading futures can be substantial. You can lose all or a substantial amount of your investment and should only invest risk capital. Past performance is not necessarily indicative of future results.