Lump Sum Investing Value Cost Averaging DCA Investment Timing Strategies

Post on: 25 Апрель, 2015 No Comment

by Silicon Valley Blogger on 2008-02-18 20

Should you dollar cost average or invest your savings in a lump sum?

Looking back at my investing track record and past experiences, theres a lot I couldve done to get better results. Not that Im complaining after all, weve been in the midst of some major returns over the last several decades, during which Ive been an active investor in the stock market. But it was eye-opening to put myself to the test by asking this basic question:

How would you invest a windfall?

My answer 15 years ago would have been:

- Buy into individual tech stocks at lower prices and sell them when prices peaked.

- Buy the best performing or most popular no-load funds of the previous years.

- Dollar cost average into funds over the course of a year. Buy low and hold on, as they say.

Today, my philosophy is quite different. Ask me now and Id reply:

- Create and maintain an asset allocation that suits my risk profile and time horizon. This cool wizard helps!

- Buy index funds and index ETFs.

- Invest in a lump sum (if I happen to have a bulk of cash lying around).

In hindsight, not only would I place any large amount of investable cash in a different type of investment (index funds, rather than actively managed funds or stocks), but I would also opt to change the frequency upon which Id invest it: by performing lump sum investing (LSI) rather than my erstwhile preferred strategy of dollar cost averaging (DCA). [Though Id still DCA savings from an income stream.]

Before I get into detail as to why, lets talk about the various ways we decide to enter the market.

3 Popular Investment Timing Strategies

#1 Lump Sum Investing (LSI): You invest all you have in one fell swoop.

#2 Value Cost Averaging (VCA) or Value Averaging: You invest your money gradually in the market by picking a target amount or value for your account to reach, for each time period (e.g. per month). Youll end up adjusting the amount of money you invest each period, with bigger amounts being invested when security prices are low and smaller amounts when prices are high.

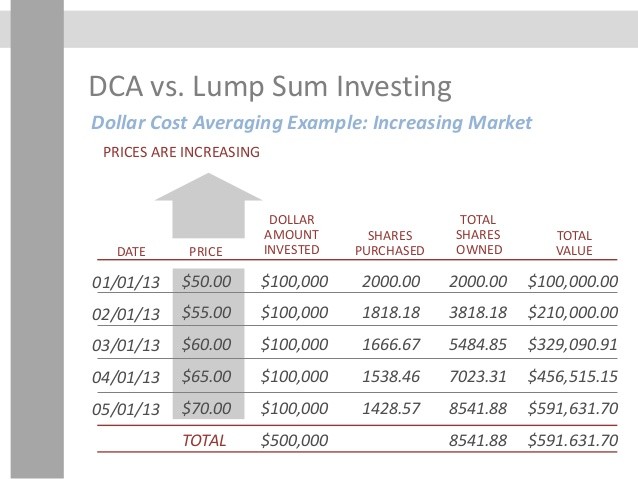

#3 Dollar Cost Averaging (DCA): Similar to VCA, this is what we commonly describe as investing with set amounts in regular fixed intervals, typically seen when we put money into our retirement accounts on an automatic schedule. You also benefit from lower market prices by ending up buying more shares as security prices go down and less shares when prices go up.

Since VCA and DCA sound similar, heres an example that distinguishes them based on a hypothetical situation where we have shares that start out at $10, decline to a low of $6 over a few months and then go back to $10 at the end of 4 months.