LowVolatility ETFs v ETFs

Post on: 14 Июль, 2015 No Comment

Current Affairs News:

As investors continue to seek ways to diminish the effects of volatility on their investment portfolios, low-volatility and dividend focused exchange traded funds have both attracted greater attention.

Id [say] there are some similarities between high dividend strategies and low volatility strategies, but they are focused on different things, said Jeremy Schwartz, the director of research at WisdomTree, at the recent Morningstar ETF Invest Conference .

The low volatility obviously has a sort of the market on beta or volatility, and they are really focused on that return stream, whereas a dividend yield focus is really focusing on the valuation characteristics. So, its more about, what price are you paying to access those securities. So, there is this difference between returns versus valuation focus, he added.

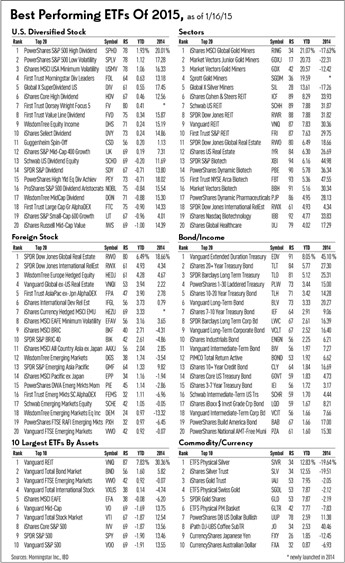

So far this year, low-volatility ETFs have brought in $3 billion in assets. Leading the charge is the popular PowerShares S&P 500 Low Volatility ETF (NYSEArca: SPLV ). which has garnered about $2.5 billion in assets. [Why Investors Have Funneled $3 Billion to Low-Volatility ETFs ]

Some note that over the past 50 years, the markets least-volatile stocks have performed about as well as the market, but with considerably less risk, according to Morningstar analyst Robert Goldsborough. The likeliest explanation for this market inefficiency which has persisted both in developed and emerging markets is leverage aversion; investors seeking above-market returns typically buy volatile stocks to do so (instead of utilizing leverage). This has the effect of whacking those risk-seeking investors with lower risk-adjusted returns. [Low-Volatility ETFs: ‘Boring is Beautiful’ ]

Low-volatility ETFs, like SPLV, specifically screen for stocks that have exhibited relatively low levels of volatility, compared to the rest of the market. However, investors will notice that during extended bull markets, the least-volatile stocks will not perform as well as riskier picks.

Other low-vol ETFs include iShares MSCI Emerging Markets Minimum Volatility Index Fund (NYSEArca: EEMV), iShares MSCI All Country World Minimum Volatility Index Fund (NYSEArca: ACWV), iShares MSCI USA Minimum Volatility Index Fund (NYSEArca: USMV), PowerShares S&P International Developed Low Volatility (NYSEArca: IDLV), PowerShares S&P Emerging Markets Low Volatility Portfolio (NYSEArca: EELV), iShares MSCI EAFE Minimum Volatility Index Fund (NYSEArca: EFAV) and EGShares Low Volatility Emerging Markets Dividend ETF (NYSEArca: HILO).

A defining characteristic of minimum volatility portfolios is that they seek to help smooth out the market’s peaks and valleys by holding low beta stocks — stocks that don’t typically exhibit excessive amounts of volatility compared with the broader market, says Daniel Morillo, global head of investment research at iShares. [Low-Volatility ETFs: A Flavor for the Behavior of Low Beta]

Investors have also utilized dividend ETFs as a buffer against market risk. The some dividend ETFs have even shown low levels of volatility because of the way their underlying indices are constructed.

For instance, the WisdomTree Emerging Markets Equity Income (NYSEArca: DEM ) has outperformed the MSCI emerging Markets Index by early 6% with lower volatility over the past five years by tilting toward dividend-paying stocks, Goldsborough said in the article.

Goldsborough also points out that WisdomTree LargeCap Dividend (NYSEArca: DLN ) has returned 0.96% over the last five years, or a little below the S&P 500 Index, but with lower volatility by weighting stocks according to total dividends paid, which results in a value tilt. [Dividend ETFs to Reap Record Quarterly Payout]

Other dividend ETFs include iShares Dow Jones Select Dividend Index Fund (NYSEArca: DVY ). iShares High Dividend Equity Fund (NYSEArca: HDV ) , SPDR S&P Dividend ETF (NYSEArca: SDY ), Vanguard Dividend Appreciation ETF (NYSEArca: VIG ), Vanguard High Dividend Yield Index Fund (NYSEArca: VYM ) and WisdomTree Dividend Top 100 Fund (NYSEArca: DTN ) .

For more information on dividend or low-volatility funds, visit our dividend ETFs category or low-volatility category.

Max Chen contributed to this article .

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.