LongTerm HighYield ClosedEnd Fund Results For The Last 5 Years

Post on: 16 Март, 2015 No Comment

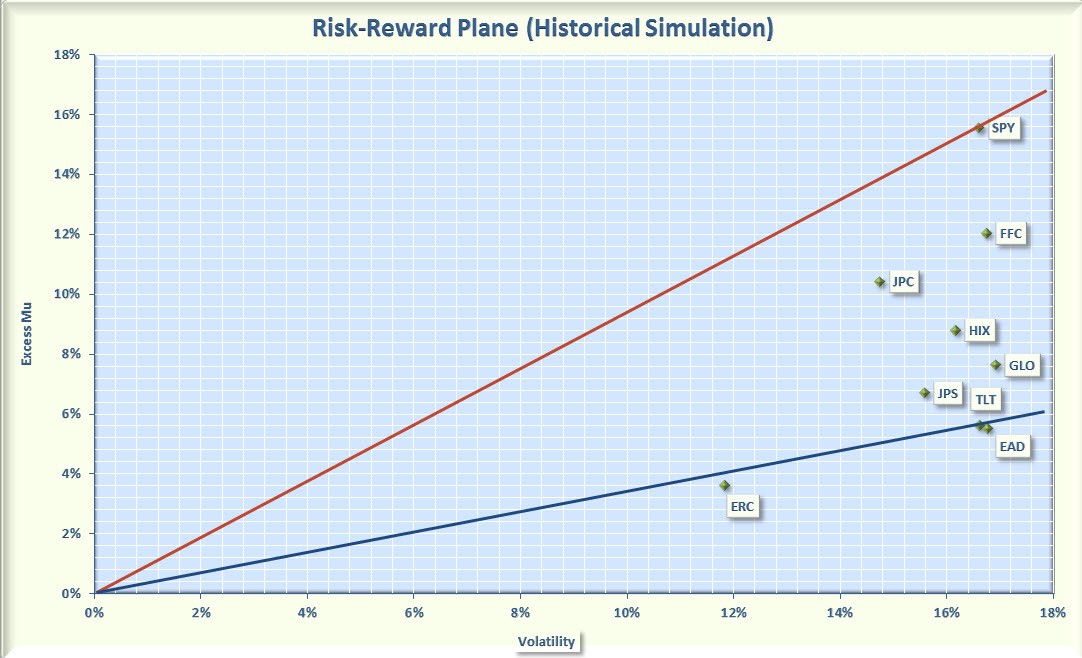

Previously, I published an article concerning the returns of high-yield, closed-end funds using a two-year look back on performance. Overall, the performance from the funds compared favorably with other investment classes, with over half the funds I watch beating the largest high-yield ETF, a quarter of the funds performing better than the S&P 500 and over 70% returning at least the dividend rate to investors. When the look-back time frame is stretched out to five years, the gap between winners and losers really starts to show.

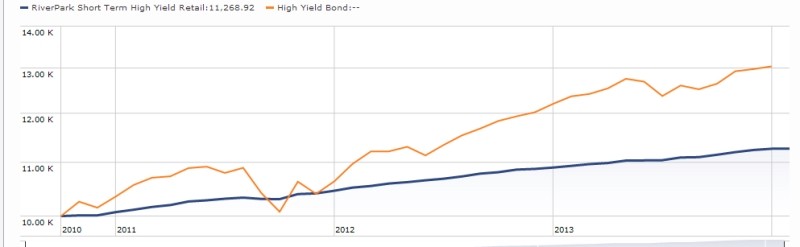

The five-year period from early July 2007 through early July 2012 were very tumultuous for investors. The stock market experienced a 50% decline bear market in 2008 and 2009. Investors who managed to hold on are barely back to where they were 5 years ago. Using the adjusted for dividends share price from Yahoo Finance, the SPDR S&P 500 ETF (SPY ) is right at break-even for the five years ending June 30, 2012. For a high-yield bond benchmark, the iShares iBoxx $ High Yield Corporate Bond Fund (HYG ) produced a 37% total return over the five-year period. An interesting point concerning HYG is that the current share price is almost at the same level of five years ago. The gain was strictly from dividends.

Closed-End Fund Results

As I discussed in the previous article. my database of closed-end funds focuses on taxable, high-yield funds with more than $250 million of assets. Of the 103 funds in the database, 86 have been in existence five years or longer. Of this group of funds, 66% have break-even or better total returns over the last five years, beating the S&P 500. Compared to the high-yield ETF, 37% of the 86 closed-end funds outperformed HYG.

Drilling deeper into the closed-end fund results: The secret to a competitive return from these funds is to have the market share price stay close to the purchase price. The top funds with the 80% plus returns produced share price gains of about 30% and the rest was from distributions. The other funds which managed to produce returns of 50% or better had share prices which are now within 10% of the price 5 years ago, plus or minus. If you buy a closed-end fund yielding 10% and it loses 2% per year in share value, it is still possible to end up with a pretty nice return after 5 years.

At the bottom of the performance list are those funds which manage to lose 40% or more of their share value over the five years. The falling share value leads to lower dividends which leads to falling share value. At the bottom of the list are two Alpine funds, the Alpine Total Dynamic Dividend Fund (AOD ) and the Alpine Total Global Dividend Fund (AGD ). Both funds have lost about 80% of their share value and have posted negative 60% total returns.

The funds at the top of the list — performance-wise — currently trade at a premium to NAV — 8 of the top 10 funds — and the bottom funds mostly trade at discounts to NAV — 25 of the 28 funds with negative 5-year total returns. This raises the chicken and egg question: Which comes first, trading at a premium or superior fund performance? Sounds like a topic for another article.

Funds of Interest

The top performing fund over the five-year period was the PIMCO Corporate Opportunity Fund (PTY ) with a total return of 105% including a 28% share price gain. PTY trades at a 21% premium to NAV. The number two performer was the John Hancock Premium Dividend Fund (PDT ) with a total return of 98% and typically trades at a small discount to NAV. PDT was suggested in a comment on my last article and appears to be a very fine fund. The dividend yield is near the bottom of my high yield list, but the total return results have been very good. Another fund with top 5 results and providing a high level of income to investors is the AllianceBernstein Global High Income Fund (AWF ) which has also produced positive comments on my articles.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.