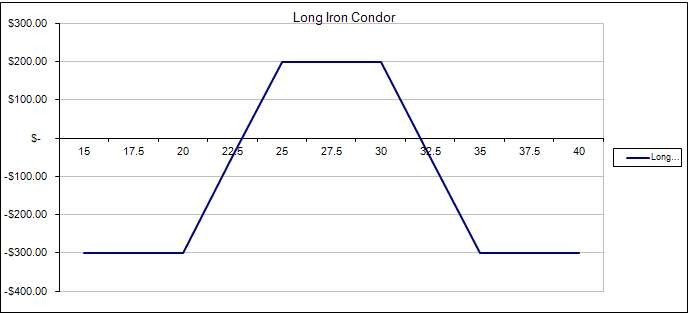

Long Iron Condor

Post on: 21 Июнь, 2015 No Comment

Description – The Long Iron Condor strategy is an income strategy that can be used on stocks that are range bound. This options trading strategy is actually a combination of a Bull Put Spread and a Bear Call Spread. Ideally you want to stock to move sideways as this is a neutral strategy. However, if you place the spread further out of the money, you will have more margin for error, but of course your profit potential will be less. Ideally you want the stock to finish in between the lower strike price call and the higher strike price put. This is where you will make your maximum profit with this trading strategy. If this occurs, all 4 of your options will expire worthless and you will keep the net option premium received.

Outlook – Your outlook on the underlying stock is neutral, but the stock can move slightly higher or lower for this trade to still be profitable.

Rationale – You would enter a Long Iron Condor option strategy hoping that the underlying will have little price movement. You would not want to enter this trade right before an earnings announcement for example.

Maximum Profit – Limited to the net credit received.

Maximum Loss – Limited to the difference between the adjacent strike prices less the net credit received.

Time Decay – Time decay works against for you in this strategy.

Time Period – Time decay will be at its best the closer to expiry the options is. For this strategy you should be looking to trade options with 1 month or less to expiry. Make sure you check to see if there are any major upcoming news events such as an earnings report.

Strike Price – Try to identify areas of support and resistance and place the trades just below (support) and above (resistance) these levels.

XYZ is trading at $27.50 on February 12, 2011.

Buy the March 2011 $20 puts for $0.25

Sell the March 2011 $25 puts for $1.25

Sell the March 2011 $30 calls for $1.25

Buy the March 2011 $35 calls for $0.25

Net Credit – Premiums sold less premiums bought = $2.00

Maximum Risk Difference in adjacent strikes less net credit = $3.00

Maximum Reward – Net credit = $2.00