Lognormal and Normal Distribution

Post on: 27 Июнь, 2015 No Comment

The mathematics behind finance can be a bit confusing and tedious, but luckily most computer programs do the hard calculations. Even though calculating each step in a complicated equation is probably more than most investors care to do, understanding the various statistical terms, their meaning and which makes the most sense when analyzing investments is crucial to picking the appropriate security and getting the desired impact on a portfolio. An example of this is choosing between normal vs. lognormal distributions. These distributions are often referred to in research literature, but the key questions are: what do they mean, what are the differences between the two, and how do they impact investment decisions? (For more, see: Find the Right Fit with Probability Distributions .)

Normal versus Lognormal

Both normal and lognormal distributions are used in statistical mathematics to describe the probability of an event occurring. Flipping a coin is an easily understood example of probability. If you flip a coin 1000 times, what is the distribution of results? That is, how many times will it land on heads or tails? (Answer: half the time heads, the other half tails.) This is a very simplified example to describe probability and the distribution of results. There are many types of distributions, one of which is the normal or bell curve distribution. (See figure 1.)

In a normal distribution 68% (34%+34%) of the results fall within one standard deviation and 95% (68%+13.5%+13.5%) fall within 2 standard deviations. At the center (the 0 point in the image above), the median. or the middle value in the set, the mode. the value that occurs most often, and the mean, the arithmetic average. are all the same.

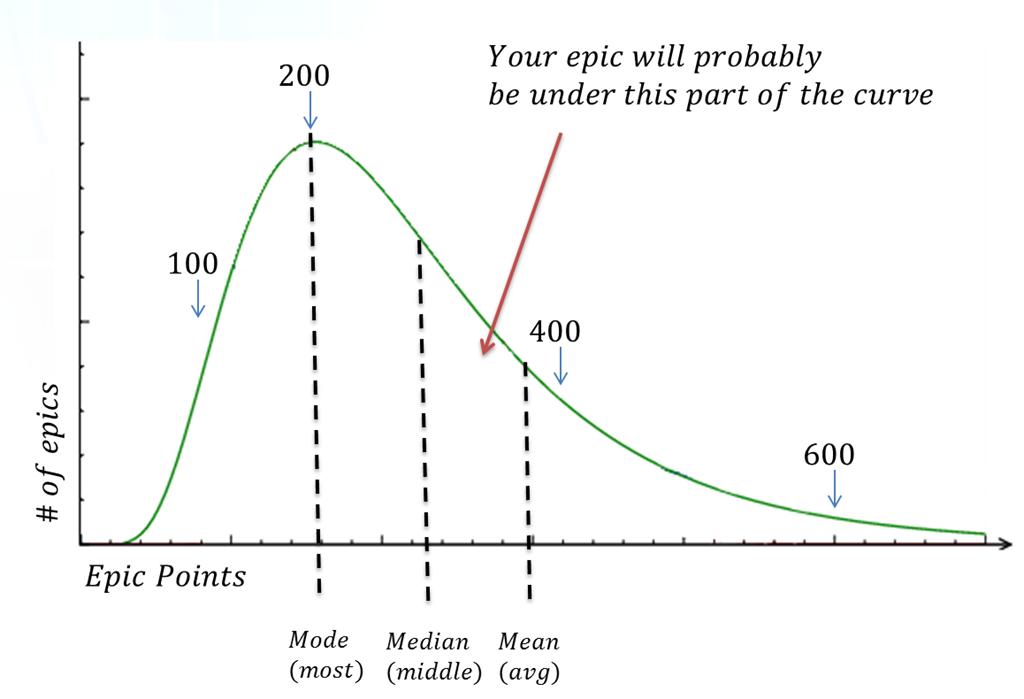

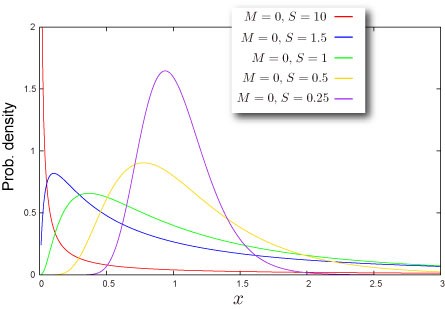

The lognormal distribution differs from the normal distribution in several ways. A major difference is in its shape: where the normal distribution is symmetrical, a lognormal one is not. Because the values in a lognormal distribution are positive, they create a right skewed curve. (See Fig 2)

This skewedness is important to determining which distribution is appropriate to use in investment decision making. A further distinction is an underlying assumption that the values used to derive a lognormal distribution are normally distributed. Let me clarify with an example. An investor wants to know an expected future stock price. Since stocks grow at a compounded rate, she needs to use a growth factor. To calculate possible expected prices, she will take the current stock price and multiply it by various rates of return (which are mathematically derived exponential factors based on compounding ) and which are assumed to be normally distributed. When the investor continuously compounds the returns, she creates a lognormal distribution which is always positive, even if some of the rates of return are negative, which will happen 50% of the time in a normal distribution. The future stock price will always be positive because stock prices cannot fall below $0!

When to Use Normal versus Lognormal Distribution

The preceding description, although slightly complicated, was provided to help us arrive at what really matters for investors: when to use each method in making decisions. Lognormal, as we discussed, is extremely useful when analyzing stock prices. As long as the growth factor used is assumed to be normally distributed (as we assume with rate of return), then the lognormal distribution makes sense. Normal distribution cannot be used to model stock prices because it has a negative side and stock prices cannot fall below zero.

Another similar use of the lognomal distribution is with the pricing of options. The Black-Scholes model which is used to price options uses the lognormal distribution as its basis to determine option prices. (For more, see: Options Pricing: Black-Scholes Model .)

Conversely, the normal distribution works better when calculating total portfolio returns. The reason normal distribution is used is because the weighted average return (the product of the weight of a security in a portfolio and its rate of return) is more accurate in describing the actual portfolio return (which can be positive or negative), particularly if the weights vary by a large degree. The following is a typical example:

Portfolio Holdings Weights Returns Weighted Return

Stock A 40% 12% 40% * 12% = 4.8%

Stock B 60% 6% 60% * 6% = 3.6%

Total Weighted Average Return = 4.8% + 3.6% = 8.4%

Using lognormal return for total portfolio performance, even though it may be quicker to calculate over a longer time period, will fail to capture the individual stock weights, and that may distort the return tremendously. Also, portfolio returns can be positive or negative, and a lognormal distribution will fail to capture the negative aspects.

Although the nuances that differentiate normal and lognormal distributions may escape us most of the time, knowledge of the appearance and characteristics of each distribution will provide insight into how to model portfolio returns and future stock prices.