Liquidity if an ETF doesn t have it avoid it

Post on: 9 Май, 2015 No Comment

July 29, 2012 at 10:00 am by Richard Rittorno

I want to expand on our investment basics piece concerning volume or stock liquidity. As mentioned, volume is one of the most important factors to look for in any asset. If there is no liquidity there is no one trading shares, and a sell or buy order can sit on the exchange waiting, and waiting, and waiting.

U.S. based traders/investors are spoiled a large percentage of U.S.-based equities have significant liquidity on U.S. exchanges. However, that is not necessarily the case when looking at ADRs, and especially emerging market ETFs.

If you want to invest or trade in low volume, near zero ETFs, do yourself a favor: stay away! But you have to try your luck, and really anyone serious about investing and especially trading emerging markets should be using level II quotes.

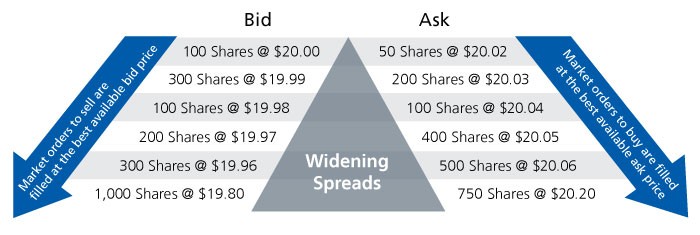

What are level II quotes? They provide much more data about a given ETF or stocks price action. They provide the type and number of order traders are putting in, and whether they are buying or selling the shares. Level II quotes help determine the near term direction, can even allow you to size up your position against the other side, and more.

Below is a level II quote for the iShares MSCI Emerging Markets Index Fund (EEM. quote ). Notice how it provides the usual bid and ask, but also the size of each bid and ask, as well as every other order waiting to be filled at all the exchanges in which traders have placed orders. Try it for your self. Place an order for a price so low that it will not get filled, say $1.00, and you will see your order appear. You may need to make sure your broker sends the order directly; some online brokers will hold the order until the price is within x many pennies of the actual price. There should be an option to route direct.

Look at the EEM level II quote to determine if you will have a hard time selling 300 EEM shares at $38.80. The answer is no they should be sucked up right away because there are 483 buyers willing to pay $38.80 at that moment in time.

Now if you needed to unload 600 shares at $38.80 you could be waiting for the entire order to fill, and if you instructed your broker to fill on full orders then you could also be waiting for a period of time. Notice that even if you dropped your price to $38.75 you still would not unload all your shares unless more buyers stepped in. At this point in time EEM is unbalanced with more sellers (ASK) than buyers.

Now let’s look at the iShares MSCI Emerging Markets Financials Sector Index Fund ETF (EMFN. quote ). As of Friday July 27th 2012 at 10:53 a.m. EDT it had zero liquidity. Why? First notice the size of the orders on each side of the trade are all in single digits. Basically they are all waiting for someone to flinch and change their order.

Looking at the level II quote you’ll see buy orders for four shares at $22.45, and sell orders for seven shares at $23.23 a $0.78 spread. Until either a new buyer or seller closes the gap on the spread, or one of the current orders changes price, those orders will sit there forever.

This is also a great illustration of why it’s so important to use limit orders. If you were to use a market order to buy 12 shares, your order would be filled at $23.23 and not $22.45

Bottom line: It’s extremely important that the product you are investing in has liquidity, even if you are going to hold it for long time.