Like Index Funds S&p 500 Is Less Diversified Than You Think

Post on: 23 Июнь, 2015 No Comment

Your Money — Mutual Funds

July 11, 2001 | By Charles Jaffe, Boston Globe

If you like index funds, you probably think you know what goes into a Standard & Poor’s 500 version.

In the June issue of Money magazine, columnist Jason Zweig asked the question, Is the S&P 500 rigged? While his analysis came to the conclusion that it wasn’t, it also highlighted some trends in the index that deserve some scrutiny.

What the article (it’s listed among Zweig’s recent columns at www.money.com/money/depts/investing/fundamentalist) didn’t answer for fund investors is the question of which index is the best to use if you want to add a represent-the-market centerpiece to a portfolio.

Zweig is quick to point out that the S&P doesn’t represent the nation’s 500 largest stocks. Instead, it’s simply a listing put together by a committee to represent an economic benchmark on the overall market.

Truth be told, if committee members started their own fund, they would have a mighty impressive track record as managers and many people would want to own their fund, but that’s not what the S&P is about.

Their mandate isn’t managing a fund, it’s building a portfolio that reflects the entire stock market and the economy.

Unlike other indexes such as the Russell 2000, which regularly changes component companies as they grow or shrink, membership in the S&P 500 has been stable over the years.

In general, most companies that got on the list stayed on, barring merger, acquisition or bankruptcy.

Occasionally, a stock that had shrunk would be dropped.

Such moves were rare until recently, which is where Zweig’s analysis comes in.

He noted that last year, the S&P committee threw out 18 stocks — more than 1 in 30 of the index holdings and the highest total in its 75-year history — because of fallen market value. Activity of that kind has picked up since 1995.

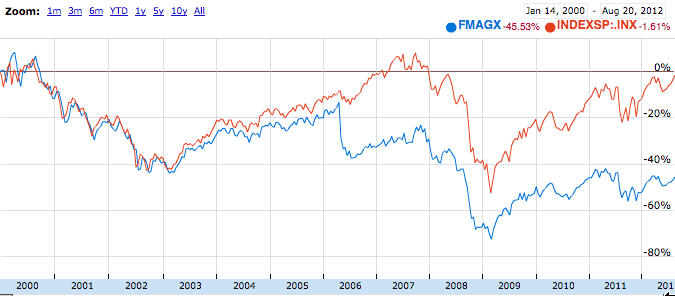

As a result of the changes, Zweig argues the S&P 500 has become more weighted toward technology and skewed toward growth companies.

What’s more, he contends the current S&P 500 shouldn’t be compared with the version of just a few years ago because, statistically speaking, the characteristics of the index have changed dramatically.

For their part, Standard & Poor’s officials reject the contention that anything unseemly is going on, noting correctly that the market as a whole has seen a tilt toward technology and that their index remains underweight in tech stocks relative to the market.

Moreover, they contend the benchmark index remains a solid indicator, filled with all of the leading companies from all of the leading industries.

The crucial thing for a fund investor to recognize is that the S&P 500 has, by the nature of these changes, become more growth-oriented.

And if the trend toward more changes in the index continues, it’ll be fair to say that the S&P 500 is an actively managed index, something which might not appeal to the traditional fans of passive indexing.

It’s fair to compare S&P performance today with what it did in the past, just as it’s fair to compare an active manager’s recent history with his olden days, regardless of the intervening changes in the portfolio.

But investors need to recognize the style drift here. For a better diversified, more broadly situated investment choice, a total market fund based on the Wilshire 5000 (an index that actually has far more than 5,000 stocks in it) would seem to be a better choice.

Most indexing zealots — and Zweig is in this group, although it is led by Vanguard Group founder Jack Bogle — prefer a total market index to the S&P 500.

In spite of all of this, don’t go out and dump your S&P 500 funds. They’re a little less than ideal compared with the total market index funds, but they still represent a good-but-growthy view of the market.

If you’re in the market for an index fund, however, shop the total market variety rather than the less-diversified 500 type. There’s a lot more human judgment involved in putting the S&P together than I had realized, Zweig said during an interview at the recent Morningstar Investors Conference in Chicago.

Personally, it doesn’t bother me and it wouldn’t convince me to sell my S&P funds, but it might make me think twice about what I was actually buying the next time I wanted to add an index fund to my portfolio, he said.