Light Up Your Portfolio With These Solar ETFs

Post on: 8 Июнь, 2015 No Comment

Remember how big solar used to be ?

I live in New Jersey. and for a while the state government was massively subsidizing the cost of installing solar panels on residential homes and businesses.

But once the subsidies faded, many solar companies closed up shop and moved on to greener pastures elsewhere in the country.

And, of course, there’s the famous case of the federal government giving money to eventually bankrupt companies like Solyndra.

Add to that the poor economic environment of the last five years, and it’s no surprise that some solar stocks have taken a beating.

Nevertheless, things are looking sunny again for solar…

It Was a Long Way Down

Even the good stocks paid the price as solar companies fell out of favor.

Case in point: First Solar (FSLR) dropped from more than $300 per share in 2008 to less than $12 per share last summer.

Fast forward one year, and it’s recovered a lot, up 150% from last year’s low, but still far lower than it was before the financial crisis.

And it’s a similar story with Sunpower Corporation (SPWR). At $19 per share, it’s still a far cry from its old high above $160 – but a heck of a lot better than its 2012 lows of less than $4.

By the looks of it, both stocks are on the mend, and the industry at large seems to be on the upswing, as well.

And, accordingly, solar company ETFs mostly follow the same storyline.

Solar-Generated Cash Flow

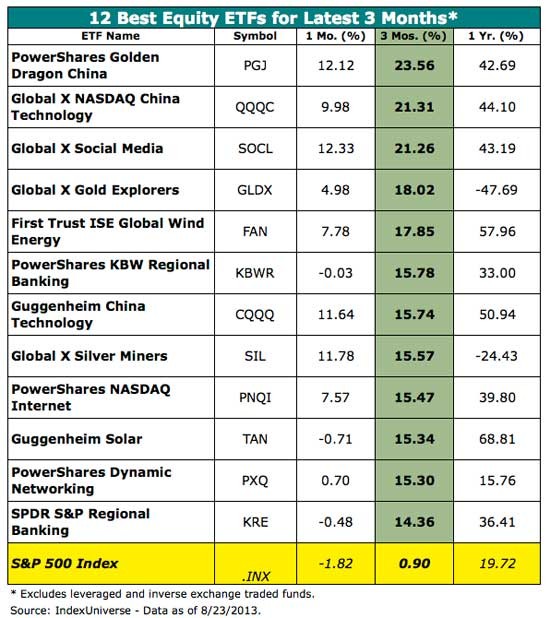

The most popular solar company ETF, Guggenheim Solar ETF (TAN ), was launched at the onset of the financial crisis, quickly peaked, then plummeted in value.

It peaked at more than $300 per share and now trades at about $24 per share. Just as with the previously mentioned stocks, that’s a respectable recovery from its bottom, but it still has a long way to go.

The good news is that with the industry recovering, TAN’s share price appreciation should continue – and it pays a fat dividend, to boot.

Its current yield is just a shade under 6%, which is hard to overlook.

Another solar ETF, Market Vectors Solar Energy ETF (KWT ), is in a similar situation. It peaked at almost $700 per share, fell to less than $28, and is now trading at about $50.

Less attractive, however, is its dividend yield of 2.7%, which isn’t quite half of TAN’s. (Nevertheless, it still pays more than the average stock on the S&P 500.)

Lastly, the First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN). Although worth a mention, it isn’t exclusively solar, and its yield of 1.22% isn’t nearly as compelling.

Bottom line: As the world continues its hunt for alternative forms of energy and attempts to work the kinks out of the solar energy market, all three ETFs will likely continue their steady climb.

But, in the end, with its exclusive focus, superior yield and higher liquidity – which will come in handy should the sector take another deep hit – TAN has the most to offer any investor looking to gain solar exposure.