LiabilityAdjusted Cash Flow Yield

Post on: 16 Март, 2015 No Comment

The Origins of LACFY

Liability-Adjusted Cash Flow Yield

10-Year Average Free Cash Flow / (((Outstanding Shares + Options + Warrants) x (Per Share Price) + (Liabilities)) — (Current Assets — Inventory))

And so, LACFY was born.

Of course, the formula isn’t perfect — it won’t protect you from overvaluing a company with a large cash hoard overseas or an artificially-low tax rate (two accounting anomalies that often run hand-in-hand). Nor will it give you a fair valuation for a fledgling company with dramatic earnings growth (although, you can always modify the numerator to a best-guess cash flow figure).

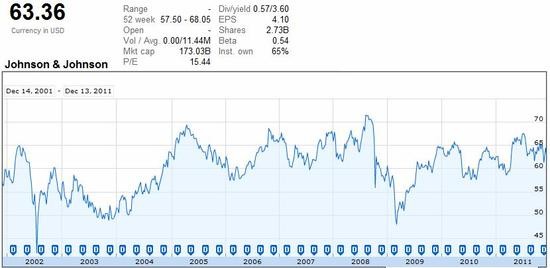

But for established companies with a long earnings record, liability-adjusted cash flow yield shows a more complete picture than a company’s earnings yield alone (the inverse of the price/earnings ratio).

A Corollary Formula, Inspired by the Crash

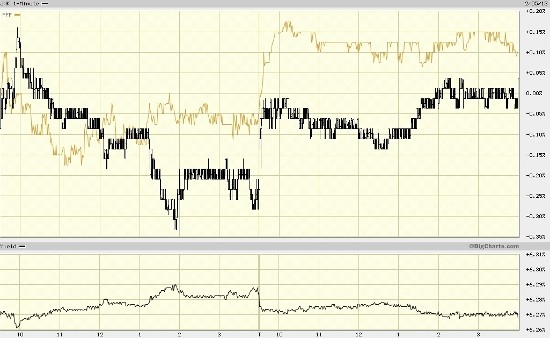

When the financial crisis came to a boil in 2009, I noticed a funny thing — companies that paid a dividend yielding more than their LACFY were cutting their dividends with greater regularity than those that did not (notable examples include General Electric and Pfizer ). It made perfect sense; debt-laden companies had little recourse if they could not support their dividend with free cash flow and/or couldn’t roll-over debt in a drying credit market.

Based on this observation, I created a corollary pass/fail formula:

Dividend Acid Test

Pass = Dividend yield less than LACFY

Fail = Dividend yield greater than LACFY

Again, no formula is perfect — but for any income investor that salivated at BP’s yield following the Macondo disaster — the ultimate dividend cut would have seemed a foregone conclusion.

Practical Use for Fixed-Income Investors

I fear that today’s manipulated bond market will leave many retired investors in the uncomfortable position of watching their real-return eroded by inflation (we’ve kicked the can for a long time, but the day of reckoning will come upon us ‘gradually and then suddenly,’ as Hemingway would say).

In my opinion (please note that this should not be construed as personal investment advice), retirees would be wise to allocate a portion of their investments to conservatively financed dividend-paying stocks that meet the following criteria:

LACFY is greater than Dividend Yield is greater than 10-Year Treasury Yield

This will provide the investor with a high level of current income, and hopefully, better protection against a rise in interest rates.