Leveraged Exchange Traded Funds

Post on: 21 Апрель, 2015 No Comment

ETFs vs. Traditional Mutual Funds or Stocks

It is important to consider the differences between an exchange-traded fund (ETF) investment and traditional mutual funds or stock investment when considering the advantages and disadvantages of each. Further, when making the choice to invest in an ETF, it is important to consider the differences between an ETF and a leveraged ETF.

ETFs are typically registered investment companies whose shares represent an interest in a portfolio of securities that track an underlying benchmark or index. Some of these ETF investments are not even registered as investment companies. Unlike traditional mutual funds, shares of ETFs typically trade throughout the day on a securities exchange at prices established by the market. ETFs combine features and potential benefits of stocks, mutual funds, or bonds. Like traditional mutual funds, ETF shares represent partial ownership of a portfolio that is assembled by professional managers

An ETF is created when an institutional investor deposits securities into the fund in return for creation units. In return for the deposit, the institutional investor receives a fixed amount of shares, some or all of which may be traded and priced throughout the day on a stock exchange. Retail investors who wish to buy or sell funds do not purchase or redeem directly from the fund — rather, they buy or sell fund shares on the stock exchange in a process identical to the purchase or sale of any other listed stock.

An ETF uses a variety of investment strategies within its portfolio including swaps, futures contracts, and other instruments including limit orders, stop orders, short sales, and margin buying. An important and easy way to learn about an ETFs investment objectives is to look at its prospectus, which also provides detailed information related to the ETFs risks and costs. You can find an ETFs prospectus on the SECs EDGAR system or can conduct a search engine search, visit the website of a firm that issues a particular ETF or can ask your broker.

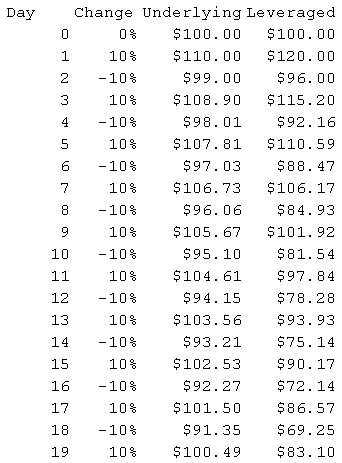

About Leveraged ETFs

Leveraged ETFs seek to achieve a return that is a multiple of the performance of the index that the ETF tracks. A leveraged ETFs prospectus will explicitly state the time period in which the ETF is aiming to multiply the benchmark that tracks the commodities, currencies, or various stock indexes the ETF is associated with. Currently, all leveraged ETFs are designed to generate daily returns that are a positive or negative multiple of the daily return of the specified index. ETFs are not designed to match the return for a holding period that is longer than the objective stated.

Therefore, the daily compounded return of a leveraged ETF over one year, one month, one week, or even a two-day period may be significantly different from the returns produced by simply applying the stated multiple to the indexs total holding period return. As a result, daily leveraged ETFs may be unsuitable for investors who seek an intermediate-term or long-term holding period. Instead, the leveraged ETF investment may be better suited to traders who wish to increase or hedge their market exposure over a short period of time. Even if the long-term performance of the index shows a gain, it is possible for an investor with an intermediate or long-term investment objective, who holds these investments for longer than a day, to suffer significant losses.

Help from an Investment Fraud Attorney

ETF investments have tax advantages over other non-ETF investments because they realize fewer capital gains. Leveraged ETFs, however, may not enjoy this tax-efficiency because daily resets can cause the ETF to realize significant capital gains that may not be offset by a loss. As with any potential investment, an investor should consult with his or her tax advisor and carefully read the prospectus to understand the tax consequences of the specific leveraged ETF investment. Moreover, many leveraged ETFs reliance on the use of futures, swaps, and other derivative securities, to achieve their target returns, run the risk of a swaps or other counterpartys default.

If you believe you were improperly advised or that your broker improperly handled your ETF or leveraged ETF investments, now is the time to contact an investment fraud attorney at Napoli Bern Ripka Shkolnik, LLP. Your initial consultation is free and confidential.