Leveraged ETF Strategies

Post on: 2 Апрель, 2015 No Comment

5 reasons people struggle with leveraged ETFs

June 9, 2014

1. You have to be right

If you pick the wrong direction you find out fast as the market moves against you. In unleveraged investments you are allowed to drift slowly in the wrong direction before an abrupt crash. This is akin to the Titanic as it drifted into that iceberg patch. Unleveraged investments leave a lot of room for debate about what is going on with the investment and whether its in a correction or something more serious. Not so with leveraged ETFs.

With leveraged ETFs bad decisions are immediate and require a response which brings us to #2.

2. You have to do something when you’re wrong

Because you’re using leverage you can’t just sit there and be wrong, you can’t wait for the market to come back, you have to sell and rethink your position on the market. But its important to be careful here were not talking about day trading, but rather taking a position thats obviously wrong, realizing it, and making a correction.

Ex: Going long the S&P 500 in the fall of 2008 or tech stocks in the spring of 2000.

3. You have to keep taking risk

Once you sell you need to pick a spot to come back in, you can’t just sit on the sideline forever. This requires a lot of emotional fortitude that most investors (and advisors) do not possess.

4. Results come fast

Unlike buy and hold policies that take forever to materialize, leverage shows winners and losers fast.

5. You can’t hide

There is no need to diversify, the leverage will get you about the same results in almost every category. Yes there are outliers, but trying to pick them ahead of the outperformance actually happening truly requires a crystal ball and quite frankly isnt necessary. If you can earn 25% with a standard market cap leveraged ETF something that isnt impossible throughout the year, why try to guess the direction of commodity prices or if the real estate market is going to pick up? Just ride the direction of the stock market which is usually up.

_________________________________________________________________________________________

Leveraged ETFs are the Most Powerful Investments on Earth!

1) They help Young Professionals multiply daily returns and become millionaires.

2) They reduce investment risk for Baby Boomers by reducing the amount of capital and time invested in the market

3) They are a great compliment to Hedge Fund Investors seeking hedge fund performance and greater liquidity without the “2 & 20″ cost structure.

They are quite frankly the greatest thing since sliced bread.

And they require expert handling. I am that expert.

If you are considering using leveraged ETFs I invite you to contact me, Maurice Wilson, via phone at 704-222-4162 or e-mail me at maurice@wilsonwealth.com

About Maurice: Through his firm Wilson Wealth, Maurice Wilson uses leveraged ETFs to magnify returns for aggressive investors seeking high returns while reducing investment risk for retirees looking to protect their nest egg.

DISCLAIMER: The information presented in this article is meant for informational and educational purposes only and is not be construed as investment advice. Please contact your financial advisor before using this information in your investment portfolio. At any given time Maurice Wilson or the advisors of Wilson Wealth Management Group, LLC may hold positions in the investments mentioned in this article and thus have a potential conflict of interest.

Three Arguments Against Leveraged ETFs and How to Beat Them

October 7, 2012

If you are a leveraged ETF investor you have to be prepared to defend your use of them against the conventional wisdom of the crowds (i.e. CNBC types and your typical financial journalist whos never actually used the products). Here are three common arguments against using leveraged ETFs and how to beat each and every one of them.

1. Leveraged ETFs arent buy and hold investments.

How to Beat This Argument : Before the dawn of leveraged ETFs people had to be persuaded to NOT sell their stocks when they started to go down. They had to be persuaded to become BUY AND HOLD investors. This is because at the first sign of losses investors cut and run. This is the old behavioral finance problem. Why would investors who sell at the first sign of trouble in unleveraged investments change their behavior with leveraged ETFs?

How to Beat This Argument : If you dont hold these funds for a year then how or why would you pay the higher costs as reflected by their expense ratios ? Secondly if you did hold these funds for a period of more than 30, 60, or 90 days that would mean you were getting some pretty high returns relative to the stock market. Isnt that worth paying a higher fee? What happened to getting what you pay for? These are the ultimate investing vehicles. Using their costs as a reason not to buy them is akin to arguing that a BMW costs more than a Ford.

How to Beat this Argument I could use the same argument as the buy and hold segment, but I’ll add something that is really a strong hold of classic investing – asset allocation. As an advisor who specializes in using leveraged ETFs I restrict new clients to using no more than 25% of their portfolio to leveraged ETFs. This has great psychological and real world benefits. If a client losses 100% of their investment which let’s face it is pretty remote, then the total loss to their portfolio is 25%. This gives us an absolute bottom on the strategy and a big psychological boost that losses are limited.

So to summarize. Leveraged ETFs are criticized as not being buy and hold investments, carrying high fees, and exacerbating losses. You can mitigate these “cons” by:

1) not buying and holding these funds as you would long-term investments, but using strategic buy and sell points,

3) and implementing assets allocation to limit losses as a percentage of your overall portfolio.

What’s important here is to not let the media and people who may or may not be using these products prevent you from benefiting from them. I know that if these products were off-limits to mainstream investors, they’d be clamoring for them (see principle of scarcity ).

The ironic thing is that for many regular investors the tools these products use to produce potentially higher returns were largely out of reach until leveraged ETFs came on the scene.

Leveraged ETFs are an example of filling a void in the marketplace – a cornerstone of American enterprise.

____________________________________________________________________________________________

Leveraged ETFs are the Most Powerful Investments on Earth!

1) They help Young Professionals multiply daily returns and become millionaires.

2) They reduce investment risk for Baby Boomers by reducing the amount of capital and time invested in the market

3) They help Retirement Investors make up time by accelerating gains

They are quite frankly the greatest thing since sliced bread.

And they require expert handling. I am that expert.

If you are considering using leveraged ETFs I invite you to contact me, Maurice Wilson, via phone at 704-222-4162 or e-mail me at maurice@wilsonwealth.com

DISCLAIMER: The information presented in this article is meant for informational and educational purposes only and is not be construed as investment advice. Please contact your financial advisor before using this information in your investment portfolio. At any given time Maurice Wilson or the advisors of Wilson Wealth Management Group, LLC may hold positions in the investments mentioned in this article and thus have a potential conflict of interest.

I Dont Day Trade Leveraged ETFs, But When I Do

October 3, 2012

Although I don’t advocate day trading leveraged ETFs as this breaks the first rule of my Rules for Using Leveraged ETFs. I’d be intellectually dishonest if I didn’t acknowledge that there are ways to use them in a day trading scenario.

For any day trading system to be taken seriously it must be based on some objective data that triggers a buy or sell. In this particular scenario I like using leveraged ETFs to maximize the direction of a market when the futures are moving 50 points or more in any given direction.

For example if the Dow Jones futures are up 50 points before the market opens I’m prepared to buy a leveraged Dow Jones or S&P 500 ETF that day. Conversely if the Dow Jones futures are down 50 points I’d reach for the inverse leveraged ETFs for the respective market index.

Now through back testing and actual application I have come to conclude that on almost any given day the first 60 minutes of market action provides desirable entry points for buying leveraged ETFs.

My favorite entry point for a leveraged ETF day trade is 1% below the opening price. The reason being that even on the most bullish of days markets rarely move straight up so if one is patient they can catch the market taking a break in the early opening minutes before rocketing up. This is when you may wish to buy.

Conversely my exit point would be at least 1% above my entry point. I would look for more gains if the futures were 100 points or more or if the market sentiment (ex: headlines) proved to be supportive of a higher move. In either case getting 1% is a must to have a successful trade.

When would I apply a strategy like this?

The time to use this strategy is when you have missed capitalizing on a longer trend in the market and are simply looking to make up ground, or you are a couple of points away from your target gain for the year. I target an annual 25% return so if I had an account 5 percentage points away from this number and was nearing the end of the year this would be a strategy I would consider.

For those of you out there who simply prefer day trading over holding leveraged ETFs overnight this strategy could be the only one you use to carefully craft a desired return in the 8 – 10% range free of the stress of a buy and hold position (leveraged or unleveraged). I say 8 – 10% because I assume you’ll get about 20 chances to execute this trade and you should be successful at least 50% of the time.

Putting it all together

Your trigger is a 50 point move in the Dow Jones futures (or similar gain percentage wise in the S&P 500 futures).

Your entry point is 1% below the opening price of the leveraged ETF.

Your exit point is 1% above the entry point.

Exceptions – you can target a higher gain if the futures are 100 points or more, but this is getting away from the sell discipline that keeps you out of trouble. Of course nothing ventured nothing gained and most day traders are pretty adventurous.

____________________________________________________________________________________________

Leveraged ETFs are the Most Powerful Investments on Earth!

1) They help Young Professionals multiply daily returns and become millionaires.

2) They reduce investment risk for Baby Boomers by reducing the amount of capital and time invested in the market

3) They help Retirement Investors make up time by accelerating gains

They are quite frankly the greatest thing since sliced bread.

And they require expert handling. I am that expert.

If you are considering using leveraged ETFs I invite you to contact me, Maurice Wilson, via phone at 704-222-4162 or e-mail me at maurice@wilsonwealth.com

DISCLAIMER: The information presented in this article is meant for informational and educational purposes only and is not be construed as invesment advice. Please contact your financial advisor before using this information in y0ur investment portfolio. At any given time Maurice Wilson or the advisors of Wilson Wealth Management Group, LLC may hold positions in the investments mentioned in this article and thus have a potential conflict of interest.

Leveraged ETFs are Less Risky

June 29, 2011

Leveraged ETFs arent that risky at all. In fact they are less risky than unleveraged investments. How so?

Well bear with me. First lets properly define risk in the real world not by these techy terms known as standard deviation and beta.

In the real world your risk is defined by what you put at risk. If you bet $10 that you can hit a 10 foot putt then your risk is 100% of that $10 nothing more nothing less. If you win, you win $10, if you lose you lose $10.

Why shouldnt the same apply to the world of investing? When you invest money your risk is the loss of 100% of your principal, nothing more nothing less. Yes you hope to sell before you lose all of your investment, but theres not guarantee that youll have the time or foresight to do so.

So if you invest $10,000 in an unleveraged ETF such as the Vanguard Total Market Viper (VTI) then your risk is $10,000. Your reward is unlimited, but its safe to say that you may average an 8% return annually.

Now say you take that same $10,000 and place it in a leveraged ETF such as the Direxion Shares Large Cap 3X Bull (BGU). Your risk is the same, but because you are using leverage your reward is higher. This is due to the fact that this leveraged ETF is designed to return 300% of the daily return of the S&P 500.

So in essence you get more return in a leveraged ETF for the same amount of risk in an unleveraged ETF. This risk reward relationship essentially means that the leveraged ETF actually carries less risk in the face of the outsized returns it can create.

But dont take my word for it run some comparisons of BGU vs. VTI over various time periods, particularly the last 12 months .

Same risk, more return. Thats not bad.

Happy Returns.

_______________________________________________________________

Leveraged ETFs are the most powerful investments on Earth.

1) They help Young Professionals multiply daily returns and become millionaires

2) They reduce investment risk for Baby Boomers by reducing the amount of capital and time invested in the market

3) They help Retirement Investors make up time by accelerating gains

They are quite frankly the greatest thing since sliced bread.

And they require expert handling. I am that expert.

Hi – My name is Maurice Wilson, financial advisor with Wilson Wealth Management Group. I started using leveraged ETFs for my clients and was so impressed with their abilities that I decided to build an expertise in using them to magnify returns, reduce risk, and accelerate gains for investors.

This blog was created to let me share my views and opinions about leveraged ETFs as well as provide education and information to help investors unlock the potential of these wonderful tools. Think of it as your guide to the most powerful investments on Earth.

For help with your leveraged ETF portfolio e-mail me at: maurice@wilsonwealth.com or drop me a line at 704.326.1210

Thank you!

Confessions of a Leveraged ETF Lover

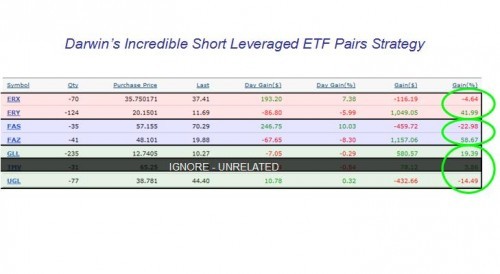

This was found on a Forbes magazine entry, I thought leveraged ETF investors might like it. I dont use leveraged ETFs the way the writer does, but its still an example of sensible leveraged ETF use.

Enjoy!

Happy Returns!

______________________________________________________________________________________

Leveraged ETFs are the most powerful investments on Earth.

1) They help Young Professionals multiply daily returns and become millionaires

2) They reduce investment risk for Baby Boomers by reducing the amount of capital and time invested in the market

3) They help Retirement Investors make up time by accelerating gains

They are quite frankly the greatest thing since sliced bread.

And they require expert handling. I am that expert.

Hi – My name is Maurice Wilson, financial advisor with Wilson Wealth Management Group. I started using leveraged ETFs for my clients and was so impressed with their abilities that I decided to build an expertise in using them to magnify returns, reduce risk, and accelerate gains for investors.

This blog was created to let me share my views and opinions about leveraged ETFs as well as provide education and information to help investors unlock the potential of these wonderful tools. Think of it as your guide to the most powerful investments on Earth.

For help with your leveraged ETF portfolio e-mail me at: maurice@wilsonwealth.com or drop me a line at 704.326.1210

Thank you!

Time to Buy? Consider hedging.

March 11, 2011

With the Dow Jones closing down almost 230 points the latest uptrend in the market has officially come to a close. Depending on your technical indicators this trend started near the beginning of September 2010 and has yielded impressive returns for leveraged ETF investors. At least those fortunate enough to have gotten in when the trend started.

Now that the most recent uptrend has rolled over, its time to start putting money to work in the next market trend. This will be tricky since we cant be sure if the market will resume a new uptrend or move down. Some of you would be well advised to consider using a hedging strategy when you first enter into this market environment.

One way to hedge your leveraged ETF trade is to buy an equal amount of INVERSE leveraged ETFs to pair with your regular leveraged ETFs. This is effectively a long/short set up and will prevent you from suffering if the market continues to slide. You need to have an exit point when hedging leveraged ETFs, I typically go for 10% stop loss on both the long and short side of my hedges.

With a hedge in place you can rest easy when you first put money into a leveraged ETF strategy, the only downside is that the first big moves will be negated by your hedge, this is a small price to pay for protection of principal.

Happy Returns.

Leveraged ETFs are the most powerful investments on Earth.

1) They help Young Professionals multiply daily returns and become millionaires

2) They reduce investment risk for Baby Boomers by reducing the amount of capital and time invested in the market

3) They help Retirement Investors make up time by accelerating gains

They are quite frankly the greatest thing since sliced bread.

And they require expert handling. I am that expert.

Hi – My name is Maurice Wilson, financial advisor with Wilson Wealth Management Group. I started using leveraged ETFs for my clients and was so impressed with their abilities that I decided to build an expertise in using them to magnify returns, reduce risk, and accelerate gains for investors.

This blog was created to let me share my views and opinions about leveraged ETFs as well as provide education and information to help investors unlock the potential of these wonderful tools. Think of it as your guide to the most powerful investments on Earth.

For help with your leveraged ETF portfolio e-mail me at: maurice@wilsonwealth.com or drop me a line at 704.326.1210

Thank you!

Entry Point Emerging?

March 3, 2011

For the day ending March 2, 2011 it can be argued that leveraged ETFs are experiencing some resistance to rising above recent highs. This is a bad thing if you are currently invested and a great phenomenon if you are waiting to jump into a leveraged fund. One of my basic rules for investing in leveraged ETFs is to only buy at the beginning of an uptrend and to never buy if you missed the beginning. This is a tough rule to follow when you factor in that the typical US leveraged ETF has been trending up since September 2010. Anyone who missed this entry point and follows my rule has missed a 50%+ run. Ouch.

That being said if the current uptrend in leveraged ETFs comes to and end, then it will be time for investors to enter from the sidelines.