Leveraged ETF Price Decay Explained » Right Side of the Chart

Post on: 26 Июнь, 2015 No Comment

Jan 06 2015

Tonight I received the following inquiry on the UCO short-term trade idea posted earlier today:

Q: I understand the price deterioration on a leverage ETF. does same apply for Non-leveraged ones? I think USO would be an example of this?

My reply below speaks generically to the use of leveraged vs. non-leverage ETPs in general. USO and other ETPs (Exchange Traded Products such as ETFs, ETNs. click here to learn more about ETPs) that track a single commodity or basket of commodities typically do so via futures contracts, which have their own unique issues that can lead to variations in the return of the underlying commodity (spot price) and the actual performance of the tracking ETP. Those issues are an entirely different & complex conversation by themselves and not mentioned below.

A: Not really. The price decay on leveraged ETFs is due to simple math and for the most part, does not affect the non-leveraged ETFs. Most non-leveraged tracking ETFs are pretty much efficient, less the small operating costs that they all must occur. You could Google some articles that explain why the leveraged ETFs decay but essentially, it’s something like this:

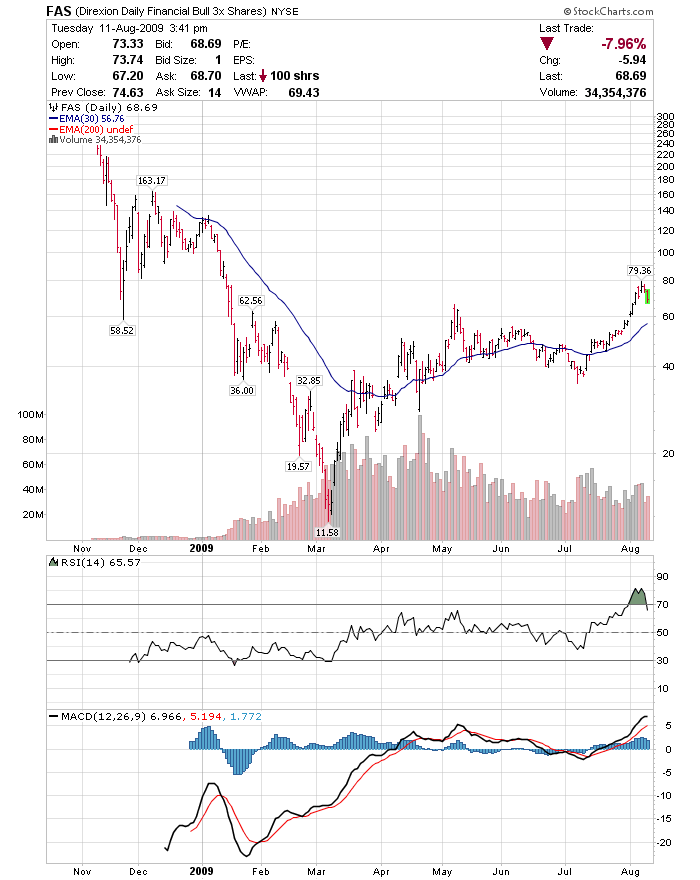

If XYZ is a 2x ETF that tracks the ABC index and the index goes up 3% today, then XYZ goes up 6%. $100k in ABC is now worth $103k & XYZ is worth $106k. Tomorrow the index drops by 3%. ABC is now worth $99.91 (103 x 97%) while XYZ is worth $99.64 (106 x 94%). Essentially, the longer a leveraged ETF is held, the larger the decay, or under-performance of the actual underlying index or sector that the leveraged ETF is tracking as the math works against it. Obviously, the more leverage employed (e.g. 3x vs. 2x), the more pronounced and rapid is the decay. This phenomenon holds true equally for both long (bullish) and short (bearish) leveraged ETFs.

One important factor to be aware of is that the more volatile the underlying (index, commodity or sector), the more pronounced and accelerated the decay will be. For example, in a perfect world, if the underlying were to go straight up every day without any down days, the leverage ETF would actually perform BETTER than expected. For example, if you put $100 in a 3x leverage long ETF and the underlying index went up 3% every day for 5 days straight, you would have nearly $116, not just $115. ($100 X 1.03 x 1.03 x 1.03 x 1.03 x 1.03 = $115.93). Of course, the markets aren’t perfect (even when lifted by the heavy hand of the Fed) so even in an decent uptrend, there are plenty of down days. Essentially, the more down days (or UP days when using leveraged short/bearish ETFs) and the larger the magnitude of these down days, the worse the decay will be over time.

When you take a very volatile index, such as the gold miners or shipping stocks, the day to day percentage swings are often quite large and at times, extremely large. Therefore, NUGT (3x long gold mining ETF) will experience extensive decay or tracking error (when compared to 3x the gold miners index). On the flip-side, an investment in a 2x leverage ETF for a relatively low volatility index during a fairly stable trend will still have some decay but quite minimal, at least over a relatively short period of time (weeks or even a few months).

Bottom line is that the leverage ETFs, especially the 3x long & short and especially those tracking a commodity, sector or index experiencing high volatility such as crude oil as well as gold & silver mining stocks have been lately, are prone to the highest degree of price decay due to the combination of the leverage employed and the large back & forth price swings. As such, the leveraged ETFs are best used for intraday (in & out before the close) trades. If one were bullish on, say, small cap stocks and wanted to take a large position with an expected holding period of 3-6+ months, they would be much better off buying $20k or $30k of IWM (1x Russell 2000) versus $10k of UWM (2x Russell 2000) or TNA (3x Russell 2000), even if they have to incur the (relatively low) cost of leverage in a margin account to do so.