Leveraged ETF

Post on: 10 Май, 2015 No Comment

When to Run It

- Strongly bullish

- Degree of sentiment: +3

Broader Market Outlook

You’re expecting strong short-term bullish action. If your outlook is incorrect and the target index decreases, you will incur a loss.

Potential Risks

An investment in a leveraged ETF could lose money over short or long periods of time. A leveraged ETF’s performance could be hurt by:

- Stock market risk. which is the chance that stock prices overall will decline.

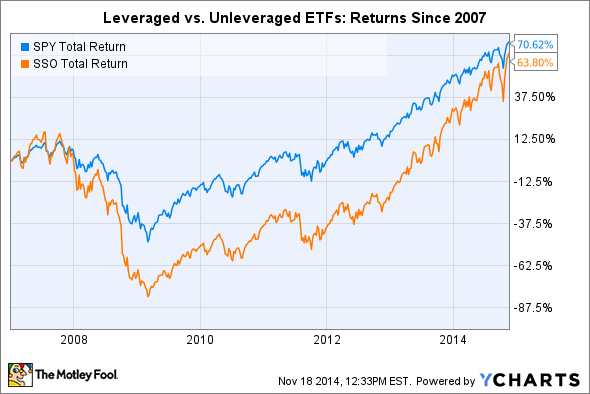

- Risk of beta slippage or compounding risk. which means returns may suffer if positions are held for longer than a single day.

- Risk of market value and NAV may not be equal. which means you might pay more or less than NAV when you buy leveraged ETF shares on the secondary market. It also means you might receive more or less than NAV when you sell those shares.

- Risk of using leverage. which means the ETF you select may use aggressive investment techniques, including derivatives. Losses might exceed the amounts invested in those instruments.

- Correlation risk. which is when the ETF may not track its target index as planned.

- Counterparty risk. which means if the fund manager enters into a transaction with a counterparty, and this party becomes bankrupt or otherwise fails to perform its obligations due to financial difficulties, the value of the ETF may decline.

- Nondiversification risk. which is the chance that the ETF’s performance may be hurt disproportionately by the poor performance of relatively few stocks or even a single stock. If the ETF you select invests a greater percentage of its assets in the securities of a small number of issuers as compared with other ETFs, your nondiversifcation risk will be high.

- Portfolio turnover risk. which is due to the daily rebalancing of ETF holdings. This will cause a higher level of portfolio transactions than compared to most ETFs.

- Gain limitation risk. which means if the ETF’s target index increases more than a certain amount in a given day, your return would be less than that amount. This is due to similar limitations imposed on the downside so that you would not lose all of your investment in a single day if the target index declined by a certain amount.

- Tax and distribution risk. which means because the ETF may have high portfolio turnover, it may cause the ETF to generate significant amounts of taxable income and generate larger and/or more frequent distributions than traditional unleveraged ETFs. Consult a tax advisor prior to investing.

- Other risks specific to your ETF. so be sure to read the prospectus carefully before investing.

About the Security

“ETF” stands for “exchange-traded fund.” Its value is based on a portfolio of investments, often referred to as a basket. In general, the basket consists of different stocks, but may also contain hard commodities, derivatives or other investments. ETFs trade throughout the day just like a stock and the value will fluctuate throughout the trading session.

Before investing in any exchange-traded fund, carefully consider information contained in the prospectus, including investment objectives, risks, charges and expenses. For copies, email service@tradeking.com. Read the prospectus carefully before investing. Investment returns will fluctuate and are subject to market volatility so that an investor’s shares, when redeemed or sold, may be worth more or less than their original cost. Shares of ETFs are not individually redeemable directly with the ETF. Some specialized exchange-traded funds can be subject to additional market risks.

The basket of stocks consists of the companies comprising a target index, sector, or industry, such as the S&P 500, but they can also just be a group of stocks chosen by the ETF manager to suit a particular objective. In general, ETFs are passively managed, but there are a growing number of actively managed ETFs.

There are fees investors and traders pay when buying, selling or holding ETFs. Since ETFs trade like stocks, they are traded through a broker like TradeKing, who charges a commission. Likewise, ETFs employ a manager who adjusts the holdings of the fund, and there will be transaction costs anytime the fund manager changes the ETF’s portfolio. In order to compensate the fund manager and cover the transaction costs of the fund, a fee is passed along to investors, known as the expense ratio. This is charged on an annual basis, and the percentage charged will vary based on the ETF. To learn more, check out ETFs: An Investor’s Guide and Leveraged & Inverse ETFs: A Word of Caution.

The Strategy

A leveraged ETF’s price is designed to move in multiples of two, three or more times the price movement of its target index. The target index may be broad-based, like the S&P 500, or it could be a basket chosen to follow a specific area of the economy, such as the financial sector. For example, if an index ETF based on the S&P 500 increases in price by $1, a 2x ETF based on the S&P 500 would likely increase by $2, a 3x ETF would likely increase by $3, and so on. Conversely, if an ETF based on the financial sector decreases in price by $1, a 2x financial sector ETF would likely decrease by $2, a 3x ETF would likely decrease by $3, etc.

Leveraged ETFs are a way to capitalize on intra-day strong bullish movements. Many investors actively trade ETFs because they think they are better able to estimate the overall direction of the market or a sector, instead of trying to do the same for an individual stock, which is more subject to unexpected news events. Leveraged ETFs kick things up a notch, due to the different degrees of leverage they provide.

Regardless of your expectations, the market can always behave counter to what you intend. Owning a leveraged ETF can result in magnified losses if the ETF’s target index decreases in value. The sharper the decrease, the greater the loss will be.

The correct way to use leveraged ETFs is for an intra-day trade (also known as a “day trade”) when you are strongly bullish. The reason we say strongly bullish is because if you’re wrong, your losses will be magnified due to the leverage this strategy affords you. So this is not a play for the faint of heart. Bear in mind, the more frequently you trade, the more transaction costs you will incur.

Leveraged ETFs aren’t designed to be held overnight

The concept of leveraged ETFs may seem very straightforward at first glance. However, this is actually a very tricky trade because leveraged ETFs “rebalance” daily. In other words, all price movements are calculated on a percentage basis for that day and that day only. The next day you start all over from scratch.

Here’s an example of how daily rebalancing causes something called “beta slippage”, which can wreak havoc with your expected profit and loss calculations and leave you with worse-than-expected returns.

Imagine you pay $100 for one share of a 2x leveraged ETF based on an index that’s currently at 10,000. That same day, the index goes up 10% and closes at 11,000. As a result, your share will increase 20% to $120. So far so good, right?

Here’s the catch: now imagine you hold onto the leveraged ETF overnight, and continue to hold it all through the next day’s trading session. If the index goes back down from 11,000 to 10,000, that’s a decrease of 9.09%, so your 2x leveraged ETF will go down 18.18% for the day.

That probably doesn’t sound so bad, since the price was up 20% the previous day. However, 18.18% of $120 is $21.82, so your share price will end up at $98.18. Even though the index wound up exactly where it started, your trade is down 1.82% because you held onto it for multiple trading sessions.

Failure to understand how daily rebalancing affects leveraged ETFs can cause very bad results for traders who try to hold them over longer periods of time. Although TradeKing doesn’t promote day trading, leveraged ETFs are intended as an intra-day trade. Trading on a daily basis can lead to more transaction costs.

If you decide to hold a position in a leveraged ETF for longer than one day, at a minimum you should monitor your holdings daily. You must recognize if you hold a leveraged ETF over multiple trading sessions, one reversal day could not just annihilate any gains you’ve accumulated, you could find yourself suddenly (and unexpectedly) facing a loss.

Don’t get creative

Using these complicated ETFs for any purpose other than the primary intent can be far too difficult to manage, let alone understand. Here are some scenarios you might have erroneously considered, paired with the appropriate alternatives.

Trading options on leveraged ETFs may be best left to the pros. These ETFs are already more complicated than your average strategy due to their leverage, daily rebalancing and the risk of beta slippage. Throw options into the mix, and you add another layer of difficulty and more variables you have to manage for this trade.

If you understand the risks and want leverage over a longer time frame, there are two main alternatives. One is to own a traditional index ETF on margin if you have a margin account; however, special restrictions may apply. Another is to trade bullish options strategies on a traditional ETF, like an index ETF or a sector ETF. You can find many such strategies in the online version of The Options Playbook.

It may be tempting to run this strategy if you are mildly bullish, because leveraged ETFs multiply your possible gains (or losses). Don’t give in to this temptation. After all, being mildly bullish, instead of extremely bullish, is one step closer to being bearish. To add to that, if your extremely bullish outlook changes to a strongly bearish opinion, don’t take a short position in a leveraged ETF, either.

Set realistic expectations due to increased costs

Because you’ll generally be trading leveraged ETFs as an intra-day trade, you must be prepared for an uphill battle when trying to turn a profit. You have a very short period of time to cover your expenses, namely two commissions (one to enter and one to exit the position), plus the gap between the bid and offer prices on each trade. Add in the difficulty of estimating the market’s direction and any possible taxes on gains, and you have your work cut out for you. Only enter this trade with a clear goal, and don’t get greedy once you’ve met it.

Please note: If you use a leveraged ETF in a market timing strategy, this may involve frequent trading, higher transaction costs, and the possibility of increased capital gains that will generally be taxable to you as ordinary income. Market timing is an inexact science and a complex investment strategy.

Time Horizon

Since leveraged ETFs rebalance daily, up and down price movements across multiple trading sessions can have an adverse effect on expected gains or return worse than expected losses. As a result, this strategy is best suited as an intra-day trade. If you hold the position longer, be sure to check your holdings daily, at a minimum. As always, the more frequently you trade, the more transaction costs you will incur. Placing intra-day trades may result in restrictions on your account if you are identified as a “pattern day trader.” TradeKing does not promote day trading. To learn more, access our day trading disclosures.

When to Get In

You might consider going long a leveraged ETF if:

- There are bullish technical indicators setting up for the leveraged ETF.

- There are bullish technical indicators setting up for the leveraged ETF’s target index.

- Positive news broke overnight which may cause the overall market to rally, such as economic data that is much better than the Wall Street consensus had anticipated.

- The futures market indicates possible bullish strength in the broader market for the opening.

- Strength in foreign markets overnight may carry momentum into the U.S. market.

Keep in mind, any pre-market activity may fizzle out during the regular session and not follow through according to your estimates.

When to Get Out

Due to all the hurdles involved with this strategy, you need to have realistic objectives for potential profits. By trying to milk a trade for every last percentage point, time and again investors have given back too much of their gains. Don’t be one of them.

This is one of those trades where you need to be willing to cut your losses very quickly. If you were wrong about the direction of the market, be ready to jump ship at a moment’s notice, and be extremely disciplined about sticking to your predetermined stop-loss. Get out fast when your trade first starts going south. Don’t rationalize or make excuses; sell the ETF. If it turns around and goes on a bullish run later, don’t kick yourself. Just stop getting quotes on it and move on to the next trade. Of course it’s important to consider transaction costs when trading. But don’t let them sway you to stay with a losing trade that is no longer in your comfort zone.

Long leveraged ETF holders might sell their positions based on any of the following:

- There are bearish technical indicators setting up for the leveraged ETF.

- There are bearish technical indicators setting up for the leveraged ETF’s target index.

- Have an eye out for breaking news throughout the trading session. At the first whiff of a downturn, it’s time to bail on the trade.

- Keep an ear to the ground for upcoming events that might generate negative news. For example, if there’s a Fed meeting happening halfway through the trading session, you need to seriously consider getting out of your position before the meeting unless you’re certain the resulting news will be good for the market. Remember: the markets don’t always respond to events in an entirely rational way. Even a random, seemingly inconsequential remark by a Fed official can tank the market and wipe out your gains.

- This bears repeating: it’s usually a good idea to get out before the market closes to avoid issues with daily rebalancing and negative news coming out overnight.

Trade Management

Any time you enter a trade, you are obviously expecting the results to be outstanding. But as you know, that will not always be the case. Even the most carefully chosen leveraged ETF position can result in losses if the target index decreases in value.

You need to keep a very tight leash on this strategy. Don’t run it on a day when you may not have internet access for an extended period of time. Don’t run errands during the trading session. Avoid long walks in the woods or on the beach if you’re not carrying your smartphone with a signal-boosting case.

You must watch price movements very carefully throughout the day, stay tuned to your favorite financial channel, and keep on top of potential news reports. Keep your trading screen up with your finger on the trigger, ready to get in or out at a moment’s notice. Remember: agility is the name of the game with this strategy.

Volatility Factor

Because this play will typically be run as an intra-day trade, you need to expect some volatility in the market. Even if you’re right about your bullish sentiment, and in spite of the leveraged return, if the market only moves a little you might not make enough profit to cover commissions and the bid-ask spread, much less make the strategy worth your time and effort. However, since this play is leveraged, you might not need as significant a move as if you were trading a standard ETF.

On the other hand, don’t let that volatility work against you. Beware of strong bearish movements and reversals in the market—even when the early trading is working in your favor. Get out at the first sign of trouble, since any losses you will incur will be multiplied by a factor of two or three or more depending on the degree of leverage provided by your ETF.

Although it is possible that an ETF may have lesser volatility than another investment, it does not mean it is low risk.

TradeKing Margin Requirements

After the trade is paid for, no additional margin is required. If you understand the risks, long leveraged ETFs with a multiplier of 2x can be purchased on margin as long as you have a margin account which meets the minimum equity requirement of $2,000. The initial and maintenance margin requirements are usually 75% of the purchase price or current value. These requirements could increase due to market volatility, fluctuations in the ETF’s value, concentrated positions, trading illiquid or low-priced securities and other factors. Leveraged ETFs with a multiplier greater than 2x cannot be traded on margin. Margin trading involves risks and is not suitable for all accounts.

Tax Ramifications

Investments in leveraged exchange-traded funds may impact your tax liability, sometimes in ways you may not expect. Read Basic Strategies with ETFs and consult your tax advisor for the low-down on this important topic.