Leveraged buyouts Know the risks

Post on: 19 Июнь, 2015 No Comment

Leveraged Buyouts have been a topic of interest since their inception in 1960s. The phenomena gained popularity in 1980s with the takeover of large-scale companies such as RJR Nabisco. Most of the experts agree that the heyday of leveraged buyouts is over, but the immense profit margins are still luring investors into it.

According to Investopedia.com, Leveraged Buyout is,

“The acquisition of another company using a significant amount of borrowed money (bonds or loans) to meet the cost of acquisition. Often, the assets of the company being acquired are used as collateral for the loans in addition to the assets of the acquiring company. The purpose of leveraged buyouts is to allow companies to make large acquisitions without having to commit a lot of capital.”

Know the Risks in Leveraged Buyouts

In most of the leveraged buyouts, buyers invest a smaller amount and borrow the remaining money from the market. Most of the financing institutions don’t mind throwing cash at these deals because of the ample cash opportunities in such deals.

Leveraged buyouts are often used in corporate acquisitions through different approaches. There are three basic models used in leveraged buyouts:

- Turning a public company into private

- Financial spin-offs

- Private Deals

Overtaking a public company and turning it into a private enterprise

When an Investment Group or Investor plans to overtake a public company by purchasing all of its outstanding stocks and convert it into a private enterprise. In some cases, these deals are considered friendly and allow the company to move towards a brighter future. Management tends to make maximum purchases to run the company as a private enterprise. On the contrary, hostile takeovers often include takeover of the company and then selling it to a third company or offer its stocks to the public for a higher return.

Financial Spin-Offs

Financial spin-offs are often common in cases where companies wish to sell some of its elements for cash. In some cases, the element up for sale might be purchased by the management of the element itself or might even be purchased by a third party. Most of the companies tend to sell their questionable subsidies through these financial spin-offs.

Private LBO Deals

Private deals are common in small-scale businesses where the owner might want to lay off the company to an investment group. The buyer can be an investment group, management of the company, and even a former partner. The availability of limited equity makes it mandatory to organize a LBO.

LBO has always been considered lucrative and a recipe for success. However, very few people are aware of the risks involved in leveraged buyouts. Leveraged buyouts face several risks and the chances of their failure are comparatively higher. Some important factors of concern are:

- Poor gross margins

- Lower equity levels

- Excessive debt proportion

- High debt servicing demands

A company processed through an LBO often has comparatively poor gross margins. Considering the higher debt ratios and interest rates, the gross margins are bound to fall in near future. In addition to it, the LBO process tends to use most of the equity funds of the company. On an average, equity levels stand at ten percent or even less, this makes it extremely difficult to get sufficient credit for new projects.

Most of the investors in LBOs use massive amounts of debts to overtake the company. The debt ratio may go as high as 70 percent in some cases. These debts are expensive and come with high servicing demands. Most of the company’s gross margins decline because of these debt requirements. On top of all of these factors, the firm doesn’t have the equity to borrow additional money and might even miss multiple profitable opportunities.

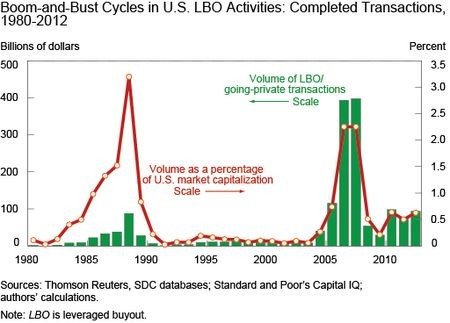

It is not certain to say that LBOs are always a failure because the first half of 1980 was a golden period for LBOs. Most of the LBOs were successful during that period. However, the rate of success fell terribly in the second half of 1980 and first half of 1990. There is no doubt that LBOs offer a significant profit margin, but the investors should always consider the risks involved in the transactions. The key to gain profits through LBOs is to understand the fundamentals of the acquisition and the acquired company, invest in it afterwards.