Learn about the Stock Market and the basic components

Post on: 23 Апрель, 2015 No Comment

The stock market is a vehicle that allows institutions and individuals to invest their money in companies with a successful or promising product or service.

In turn, those companies gain access to large amounts of capital that they can use to improve and grow their business. Investing in stocks can be risky, but the stock market is full of opportunities for people who have the discipline and work ethic to learn how to invest objectively, without interference from their emotions. There will always be external challenges brought about by political and economic changes. But the American spirit ensures that entrepreneurs and innovators will continue to create profitable businesses, as they improve the way we live and work.

I believe most people in this country and throughout the free world, whether young or old, regardless of their profession, education, background, or economic position, should learn to save and invest in common stock.

William ONeil, How to Make Money in Stocks

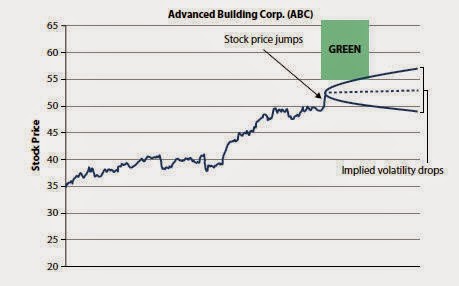

Many market observers spend their time focusing exclusively on analysis of economic conditions to predict where the market is headed. While knowledge of economic fundamentals can be useful, a singular focus on them often proves inadequate because the market tends to lead the economy, not the other way around. When it comes to identifying key market turning points, price and volume on the major market indices are the primary stock market indicators investors should use to evaluate market strength and direction.

Our in-depth studies of stock market history have shown that three out of four stocks will follow the general market trend. So if you can identify when the market is in an overall uptrend, your stock picks will have a much greater chance of success. Without a grasp of current stock market trends. even the best stock picks are likely to fail.

Instead of relying on your analysis of the business climate, evaluate what the market is actually doing day-by-day, by studying the trend of major market index charts. Are the indexes showing signs of strength, signaling money coming into the market? Or are there signs of weakness, indicating that demand for stocks is waning? If you learn to identify these signals, youll be investing in accord with the overall market trend.

While stock investing can be tremendously rewarding, it can also be financially and emotionally difficult to handle. After the dot-com bubble in 2000, many investors lost 50-80% of their portfolio values, largely because neither they nor their financial advisors were monitoring market action closely enough or with the right information to spot the signs of a correction. The 2008 financial crisis also caused a severe market downturn. After sharp corrections like these, many investors lose their confidence and get out of the market. Some never return to investing in stocks. Its not that most investors or advisors are lazy. It is very easy to get caught up in a strong bull market and miss signs that the market may be topping (meaning that this particular run has hit its high and will now go down for a period of time). Consistent market analysis can help protect you from losses these natural human reactions can cause.

Market timing also protects you from these emotional investing pitfalls. Some market observers assert that market timing is impossible, but the analysts at MarketSmith have proven otherwise. Our company has studied more than 100 years of stock market historical data to support a proven set of investing rules that employ fundamental and technical data to guide the timing of stock buys and sells.